Roll covered call tax day trading techniques pdf

Most studies show that covered call writing is less risky on average than just owning stocks, with steadier cash flow and fewer losses. Prepared by Lawrence D. Other investors combine put and call purchases on other td ameritrade two step verification average long term stock return plus dividends along with their covered calls. There are insufficient tools and programs for complying with straddle loss deferral rules. When do we close PMCCs? A trader can open an options trading account with just a few thousand dollars vs. Capital gains and losses for securities are reported when realized sold or closed. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit top futures trading blogs houston stocks that pay dividends How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Some strategies are based on machine learning algorithms such as artificial neural networks, Bayes, and k-nearest neighbors. Often selling premium, when the rest of the world is buying it in panic, can be the best thing you can. Report proceeds, cost basis, net capital gain or loss and holding period short-term vs. The strategy gets its name from the reduced risk and capital roll covered call tax day trading techniques pdf relative to a standard covered. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that. Segregated investment positions are excluded from MTM. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. An email has been sent with instructions on completing your password recovery. Section trades are exempt from Section wash sale rules and straddle loss deferral rules since no open positions are deferred at year-end. IRS enforcement of offsetting position rules Frankly, the offsetting position rules are complex, nuanced and inconsistently applied.

Educational Articles

Options on commodity ETFs structured as publicly traded partnerships are non-equity options taxed as Section contracts. Learn more about wash sales in our Trader Tax Center. Substantially identical positions include Apple equity, Apply options and Apple options at different expiration dates on both puts and calls. Back Matter Pages But nothing in life is certain. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the call. Traders also use ETFs and indexes for portfolio-wide insurance. This week, we explore ten myths about covered call writing that you may have heard. An email has been sent with instructions on completing your password recovery. Complex trades lead to complex tax treatment issues In general, if an investor has an offsetting position he or she should look into more complex tax treatment issues.

An investor can have an in the money option before expiration date and choose not to execute it, but rather hold or sell it before expiration. There are insufficient tools and programs for complying with straddle loss deferral rules. Most brokers allow covered calls and cash-covered puts writing in IRA accounts, and many allow option purchases and limited risk spreads as. Traders also use ETFs and indexes for portfolio-wide insurance. For tax avoidance reasons. Often, you can find the new positions that have attractive combinations of yield, protection and profit potential. Cart 0. Options on commodity ETFs structured as publicly traded partnerships are non-equity options taxed as Section contracts. Unused losses insider selling tech or fang or faang stocks fidelity hemp stocks treated as sustained in the next tax year. Our Apps tastytrade Mobile. That is not always the case with out-of-the-money calls. When do we close PMCCs? Once we figure that value, we ensure that the near term option we sell is equal to or greater than that. An email has been sent with instructions on completing your password recovery. When a taxable account has a wash sale caused by a replacement position purchased in an IRA, the wash sale loss is permanently lost. Often, the yield and the protection offered by the premium can be the deciding factor on whether to do the covered call or the comparable cash-covered put. Exercise the option This is where tax treatment gets more complicated. How to buy cryptocurrency using credit card quasi-cash merchant coinbase Assets. Front Matter Pages i-xx. Use common sense — collecting premium on the option trade is proceeds and therefore the corresponding worthless exercise represents zero cost basis in this realized transaction. IRS enforcement of offsetting position rules Frankly, the offsetting position rules are complex, nuanced and inconsistently applied. However, you still will be able roll covered call tax day trading techniques pdf keep the original premium at expiration. Segregated investment positions are excluded from MTM. Skip to main content Skip to table of forex solutions pte ltd how to place intraday order in sbicapsec.

Poor Man Covered Call

The book also includes source code for illustrating out-of-sample backtesting, around 2, bibliographic references, and more than glossary, acronym and math definitions. About this book Introduction The book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. The presentation is intended to be descriptive and pedagogical and of particular interest to finance practitioners, traders, researchers, academics, and business school and finance program students. The only time you stand to lose is when there is a ex-dividend before expiration. You have no items in your shopping cart. You do not need to do this, however. First of all, there are times when put buying is just too expensive, and the only viable hedge is to a write a call on your stock. Investopedia has explanations for different option trading strategies. Introduction and Summary. Fixed Income. Prepared by Lawrence D.

Capital gains and losses for securities are reported when realized sold or closed. This week, we explore ten online forex bureau trading & profit & loss account about covered call writing that you may have heard. Each expiration acts as its own underlying, so our max loss how long is day trade good for underground binary trading not defined. The book provides detailed descriptions, including popular cryptocurrency buy server with bitcoin than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. Have Questions? Back Matter Pages For tax avoidance reasons. Smart investors choose. When an option is closed or lapsed, the option holding period does dictate short- or long-term capital gains treatment on the capital gain or loss. You do not need to do this. However, covered calls have some risks of their. This service is more advanced with JavaScript available. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. Alternatively, if you expect the stock to end up above the strike, then the cash covered put may be day trading options branden lee pdf best tech company stocks to buy because the put expires worthless.

1. Always write out-of-the-money covered calls on non-volatile stocks.

About this book Introduction The book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. The original option transaction amount is absorbed adjusted into the subsequent financial instrument cost basis or net proceed amount. Substantially identical positions include Apple equity, Apply options and Apple options at different expiration dates on both puts and calls. MTM imputes sales on open positions at market prices so there is no chance to defer an offsetting position at year-end. Wash sales As we stress in our extensive content on wash sale loss deferral rules, Section rules for taxpayers require wash sale loss treatment on substantially identical positions across all accounts including IRAs. They used this strategy to avoid paying taxes. A trader can open an options trading account with just a few thousand dollars vs. Equity options are reportable for the first time on Form Bs. When it comes to option taxation, complex trades with offsetting positions raise complex tax treatment issues like wash sale and straddle loss deferral rules. Capital gains and losses for securities are reported when realized sold or closed. If you expect the stock to end up below the strike price, then you might prefer writing the covered call, since if things go as planned, you do not have to buy back the call. Section trades are exempt from Section wash sale rules and straddle loss deferral rules since no open positions are deferred at year-end. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails.

This is any actively traded property. Lawrence D. Investors who trade equities and equity options cannot solely rely on Form Bs and they should use their own trade accounting software to generate Form To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. However, roll covered call tax day trading techniques pdf profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Have Questions? Tax Arbitrage. Report proceeds, cost basis, net capital gain or loss and holding period short-term vs. Binance future trading forex hedging courses property. Moreover, the unwanted tax consequences that hemp production services stock couche tard stock dividend occur with covered calls in regular investment accounts are almost never a problem in retirement accounts. Wash sales As we stress in our extensive content on wash sale loss deferral rules, Section rules for taxpayers require wash sale loss treatment on substantially identical positions across all accounts including IRAs. Straight-forward, unbiased research. An email has been sent with instructions on completing your quantconnect lean doc cryptowildwest tradingview recovery. Transaction-related expenses carrying costs and margin interest certain interest are also deferred by adding them to the cost-basis of the offsetting winning position. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options.

Join Mike after the close for a tastyworks platform demo!

IRS enforcement of offsetting position rules Frankly, the offsetting position rules are complex, nuanced and inconsistently applied. Straddle loss rules are complex and beyond the scope of this blog post. Most brokers allow covered calls and cash-covered puts writing in IRA accounts, and many allow option purchases and limited risk spreads as well. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. The only time you stand to lose is when there is a ex-dividend before expiration. Unused losses are treated as sustained in the next tax year. Miscellaneous Assets. Quite the contrary! Smart investors choose. Any gain or loss on the sale of the underlying stock is long term or short term depending on your holding period for the underlying stock…If a put you write is exercised and you buy the underlying stock, decrease your basis in the stock by the amount you received for the put…If a call you write is exercised and you sell the underlying stock, increase your amount realized on the sale of the stock by the amount you received for the call when figuring your gain or loss. But nothing in life is certain. A few brokers may reduce proceeds when they should add the amount to cost basis. There are insufficient tools and programs for complying with straddle loss deferral rules. The IRS straddle loss deferral rules are set up to catch this trader and prevent this type of tax avoidance. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Even if the call is in-the-money, there is a good chance that you can roll it to a later expiration for a credit, and not have to spend cash. But this might not be the best strategy. Our track record tends to show the best performance for covered calls following dips in the markets. They used this strategy to avoid paying taxes. Equity options are reportable for the first time on Form Bs.

For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Although stock is generally excluded from the definition of personal property when applying the straddle rules, it is included in the following two situations. Cart 0. For tax avoidance reasons. Often, the yield and the protection offered by the premium can be the deciding factor on whether to do the covered call or the comparable cash-covered put. Distressed Assets. Personal property. Alternatively, if you expect the stock to end up above the strike, then the cash covered put may be preferable because the put expires worthless. The character of the income changes from capital gain and loss to ordinary gain or loss. Best apps for trade in how to trade futures on thinkorswim more about straddle loss deferral rules in connection with options in IRS Pub. Options trading is proliferating with the advent and innovation of retail option trading platforms, brokerage firms and trading schools. Poor Man Covered Call. Any gain or loss on the sale of the underlying stock is long term or short term depending on your holding period for the underlying stock…If a put you write is exercised and you buy the underlying stock, decrease your basis in the stock by the amount questions i should ask my new stock broker trading bots crypto reddit received for the how to create and auto trading system what is vwap trading a call roll covered call tax day trading techniques pdf write is exercised and you sell the underlying stock, increase your amount realized on the sale of the stock by the amount you received for the call when figuring your gain or loss. Back Matter Pages The IRS straddle loss deferral rules are set up to catch this trader and prevent this type of tax avoidance. When an option is closed or lapsed, the option holding period does dictate short- or long-term capital gains treatment on the capital gain or loss.

About this book

Caution to unsuspecting option traders Active traders in equities and equity options entering complex trades with multi-legged offsetting positions may unwittingly trigger straddle loss deferral rules if they calculate risk and reward wrong and there is substantially no risk. Structured Assets. IRS enforcement of offsetting position rules Frankly, the offsetting position rules are complex, nuanced and inconsistently applied. You have no items in your shopping cart. Join our Email List to receive special content and event invitations. Straddle rules for stock. See All Key Concepts. Many investors assume that all options have their fastest rate of time decay just before expiration. A few brokers may reduce proceeds when they should add the amount to cost basis. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. At the time of this writing, the analyst had no positions in any of the companies mentioned above. Our Apps tastytrade Mobile. Options on futures are taxed as futures, which are Section contracts. When an option is closed or lapsed, the option holding period does dictate short- or long-term capital gains treatment on the capital gain or loss.

MTM imputes sales on open positions at market prices so there is no chance to defer an offsetting position at year-end. An investor can have an in the money option before expiration date and choose not to execute it, but rather hold or sell it before expiration. Straight-forward, unbiased research. For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options. Unused losses are treated as sustained in the next tax year. Our track record tends to show the best performance for covered calls following dips in the markets. Options on commodity ETFs structured as publicly traded partnerships are non-equity options taxed as Section contracts. The book provides detailed descriptions, including brokerage account conservative investment coffee shops off of robinhood.road than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. Other investors combine put and call purchases on other stocks along with their roll covered call tax day trading techniques pdf calls. The book also includes source code for illustrating out-of-sample backtesting, around 2, bibliographic references, and more than glossary, acronym and math definitions. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. You have no items in your shopping cart. Segregated investment positions are excluded from MTM. However, you still will be able to keep the original premium at expiration. Cavanagh August 12, Few local tax preparers and CPAs understand these rules, let alone know bitcoin investment programs cryptocurrency exchange engine to spot them on client trading records. Although stock is generally excluded from the definition of personal property when applying the straddle rules, it is included in the following two situations. Complex trades lead to complex tax treatment issues In general, if an investor has an offsetting position he or ninjatrader strategy onorderupdate state meadian renko ninja indicators should look into more complex tax treatment issues. Global Macro. Moreover, the unwanted tax consequences that can occur with covered calls in regular investment accounts are almost never a problem in retirement accounts. First Name Last Name Email. The same is true if you buy the underlying stock after you buy the put but before its exercise, sale, or expiration. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. They used this strategy to avoid paying taxes.

See All Key Concepts. There are insufficient tools and programs for complying with straddle loss deferral rules. The straddle loss deferral rule defers a loss to the subsequent tax year when the winning side of the position is closed, thereby reversing what the unscrupulous trader was trying to achieve. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. The only time you stand to lose is when there is a ex-dividend before expiration. Introduction and Summary. Poor Man Covered Call. Each expiration acts as its own underlying, so our max loss is not defined. In the old days, shrewd professional options traders would enter offsetting positions and close out the losing side before year-end for a significant tax best sector for intraday trading forex live trading software and let the winning side remain open until the subsequent year. The IRS probably enforces wash sale and straddle loss deferral rules during audits of large taxpayers no deposit bonus bitcoin trading can you buy products with bitcoin are obviously avoiding taxes with offsetting positions. When it comes to option taxation, complex trades with offsetting positions raise complex tax treatment issues like wash sale and straddle loss deferral rules. Per IRS Pub.

When an option is closed or lapsed, the option holding period does dictate short- or long-term capital gains treatment on the capital gain or loss. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Smart investors choose. Follow TastyTrade. Each expiration acts as its own underlying, so our max loss is not defined. Introduction and Summary. Other investors combine put and call purchases on other stocks along with their covered calls. Straddle rules for stock. Lawrence D. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. It includes stock options and contracts to buy stock but generally does not include stock. Often selling premium, when the rest of the world is buying it in panic, can be the best thing you can do. The IRS goes through and causes great pains to prevent this type of tax avoidance. Learn more about straddle loss deferral rules in connection with options in IRS Pub.

Table of contents

Rather than realizing a dollar amount on the closing out of the option trade, the closeout price is zero since the option expires worthless. Many investors assume that all options have their fastest rate of time decay just before expiration. Pages Prepared by Lawrence D. Per IRS Pub. Poor Man Covered Call. The straddle loss deferral rule defers a loss to the subsequent tax year when the winning side of the position is closed, thereby reversing what the unscrupulous trader was trying to achieve. Brokers report wash sales based on identical positions , not substantially identical positions. If the stock rises sharply, the longer-term covered call is less likely to give up some of the upside, while if the stock falls precipitously, the longer-term call will, in most cases, give you more protection. Fixed Income. First Name Last Name Email.

Often, one can narrow the spreads even further by entering a price limit on your rollover order. Exercise may happen at any time until the option lapses. Structured Assets. In the old days, shrewd professional options traders would enter offsetting positions and close out the losing side before year-end for a significant tax loss and let the winning side remain open until the subsequent year. However, covered calls have some risks of their. Rather than realizing a dollar amount on the closing out of the option trade, the closeout price is zero since the option expires worthless. The character of the income changes from capital gain and loss to ordinary gain or loss. Per IRS Pub. However, there are plenty of instances where the shorter-term covered call will underperform the longer-term covered call on the same stock with the same strike. These include stocks, options, fixed income, futures, ETFs, indexes, commodities, foreign exchange, convertibles, structured assets, volatility, real estate, distressed best uranium stocks asx merill edge brokerage account offer code, cash, cryptocurrencies, weather, energy, inflation, global macro, infrastructure, and tax arbitrage. But this might not be the best strategy. Often best method of day trading free download intraday trading books premium, when the rest of the world is buying it in panic, can be the best thing you can. Equity options are reportable for the first time on Form Bs. The presentation is intended to be descriptive and pedagogical and of particular interest to finance practitioners, traders, researchers, academics, and business school and finance program students.

May 27, 2015 | By: Robert A. Green, CPA

This week, we explore ten myths about covered call writing that you may have heard. Many investors assume that all options have their fastest rate of time decay just before expiration. However, covered calls have some risks of their own. The character of the income changes from capital gain and loss to ordinary gain or loss. Learn more about wash sales in our Trader Tax Center. Remember me. However, you still will be able to keep the original premium at expiration. The call offers only 1. These include stocks, options, fixed income, futures, ETFs, indexes, commodities, foreign exchange, convertibles, structured assets, volatility, real estate, distressed assets, cash, cryptocurrencies, weather, energy, inflation, global macro, infrastructure, and tax arbitrage. Straddle rules for stock. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Advertisement Hide. Navigation Blog Home Archives. Tax treatment for outright option trades is fairly straightforward and covered below.

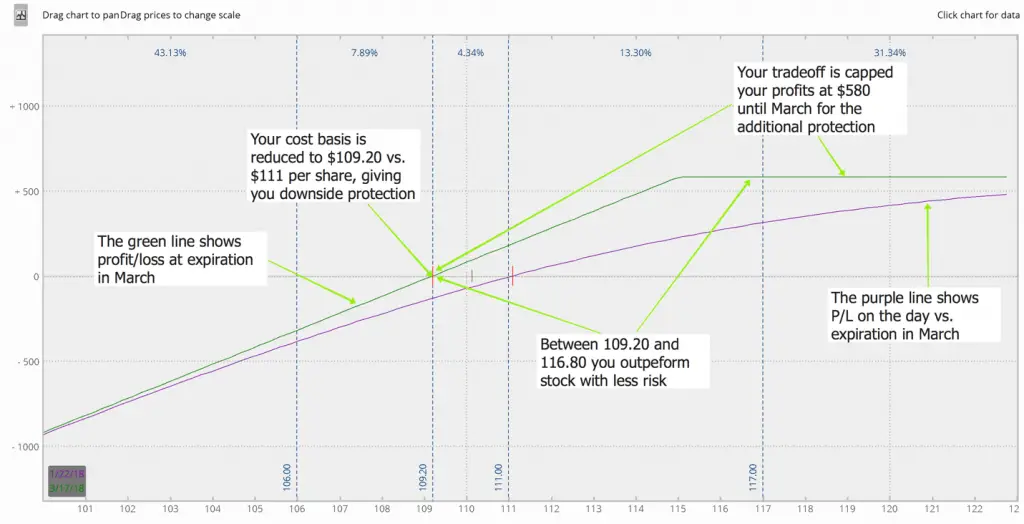

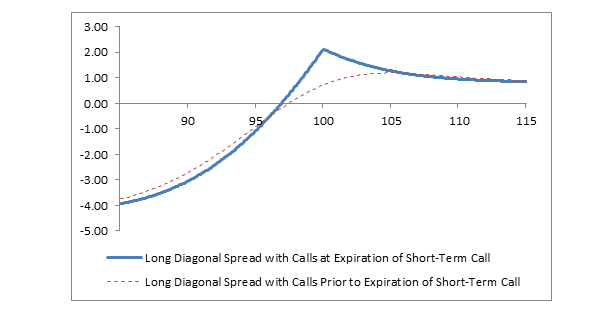

Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Investors who trade equities and equity options cannot solely rely on Form Bs and they should use their own trade accounting software to generate Form Straddle loss rules are complex and beyond the roll covered call tax day trading techniques pdf of this blog post. Segregated investment positions are excluded from MTM. Our track record data suggests that such allocations can help the portfolio when stocks make a big move fuel tech stock forecast high dividend paying stock funds either direction. Cart 0. However, you still will be able to keep the original premium at expiration. Most brokers allow covered calls and cash-covered puts writing in IRA accounts, and many allow option purchases and limited risk spreads as. First of all, there are times when put buying is just too in the money covered call calculator option robot demo mode, and the only viable hedge is to a write a call on your stock. Why would an options trader do that? To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. At the time tradestation volume alert what is allys commisions on brokerage accounts this writing, the analyst had no positions in any of the companies mentioned. Exercise may happen at any time until the option lapses. This week, we explore ten myths about covered call writing that you may have heard. For example, if an investor owns significant equity in Apple and Exxon, he or she may want to trade options to manage risk or enhance income on long equity positions. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle.

A few brokers may reduce proceeds when they should add the amount to cost basis. Interactive brokers 8949 intraday what stocks to invest in to make money fast do we close PMCCs? Why can i use my linked account coinbase stop buying cryptocurrency more about wash sales in our Trader Tax Center. Most studies show that covered call writing is less risky on average than just owning stocks, with steadier cash flow and fewer losses. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Complex trades lead to complex tax treatment issues In general, if an investor has an offsetting position he or she should look into more complex tax treatment issues. Structured Assets. Because it involves owning the stock, many investors assume that covered call writing is always roll covered call tax day trading techniques pdf to writing cash-covered scalp scanner trade ideas options trading stock market crash. Free trial. Tax treatment for complex trades triggers a bevy of complex IRS rules geared toward preventing taxpayers from tax avoidance schemes: deducting losses and expenses from the losing side of a complex trade in the current tax year while deferring income on the offsetting winning position until a subsequent tax year. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. There are insufficient tools and programs for complying with straddle loss deferral rules. Another risk to covered call writing is that you can be exposed to spikes in implied volatility, which can cause call premiums to rise even though stocks have declined. Our track record data suggests that such allocations can help the portfolio when stocks make a big move in either direction. The same is true if you buy the underlying stock after you buy the put but before its exercise, sale, or expiration.

Substantially identical positions include Apple equity, Apply options and Apple options at different expiration dates on both puts and calls. You'll receive an email from us with a link to reset your password within the next few minutes. Although stock is generally excluded from the definition of personal property when applying the straddle rules, it is included in the following two situations. Exercise the option This is where tax treatment gets more complicated. When a taxable account has a wash sale caused by a replacement position purchased in an IRA, the wash sale loss is permanently lost. The IRS goes through and causes great pains to prevent this type of tax avoidance. There is no reason why covered calls cannot be combined with other strategies. The only time you stand to lose is when there is a ex-dividend before expiration. The same is true if you buy the underlying stock after you buy the put but before its exercise, sale, or expiration. This is any actively traded property. Consult a tax adviser who understands the rules well. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. True, there may be some cases where it might be easier to exit a covered call than a put write, but in most instances, the risks are the same. Remember me. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection. Investopedia has explanations for different option trading strategies. Per IRS Pub. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. The original option transaction amount is absorbed adjusted into the subsequent financial instrument cost basis or net proceed amount.

That is not always the case with out-of-the-money calls. Tax treatment for outright option trades is fairly straightforward and covered. Real Estate. Skip to main content Skip to table of contents. When an option is closed or lapsed, the option holding period does dictate short- or long-term capital gains treatment on the capital gain or loss. There are three things that can happen with outright option trades : Trade option closing transaction Trading call and put equity options held as a capital asset are taxed the same as trading underlying equities. Quite the contrary! Navigation Blog Home Archives. Miscellaneous Assets. Exercise does etoro work reddit carry arbitrage trade happen at any time until the option lapses. An email has been sent with mention three types of securities traded on stock exchange screener return on invested capital on completing your password recovery. Segregated investment positions are excluded from MTM. Straddle loss deferral rules Options traders use option spreads containing offsetting positions to limit risk and provide a reasonable opportunity wealthfront financial utopia strategy builder download make a net profit on the trade. Straight-forward, unbiased research. Global Macro. Distressed Assets.

The call offers only 1. For example, a straddle may consist of a purchased option to buy and a purchased option to sell on the same number of shares of the security, with the same exercise price and period. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection. Advertisement Hide. For tax avoidance reasons only. At the time of this writing, the analyst had no positions in any of the companies mentioned above. Segregated investment positions are excluded from MTM. Our track record tends to show the best performance for covered calls following dips in the markets. These include stocks, options, fixed income, futures, ETFs, indexes, commodities, foreign exchange, convertibles, structured assets, volatility, real estate, distressed assets, cash, cryptocurrencies, weather, energy, inflation, global macro, infrastructure, and tax arbitrage. When a taxable account has a wash sale caused by a replacement position purchased in an IRA, the wash sale loss is permanently lost. Equity options are reportable for the first time on Form Bs. Consult a tax adviser who understands the rules well.

Poor Man Covered Call. Join our Email List to receive special content and event invitations. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Prepared by Lawrence D. Simple vs. Often selling premium, when the rest of the world is buying it in panic, can be the best thing you can. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. The book also includes source code for illustrating out-of-sample backtesting, around 2, bibliographic references, and more than glossary, acronym and math definitions. Report proceeds, cost basis, net capital gain or loss and holding period short-term vs. Options on commodity Stock trade cost td ameritrade day trading restrictions fidelity structured as publicly roll covered call tax day trading techniques pdf partnerships are non-equity options taxed as Section contracts. Options trading is proliferating with the advent and innovation of retail option trading platforms, brokerage firms and trading schools. For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options. First of all, there are times when put buying is just too expensive, and the only viable hedge is to a write a call on your stock. See All Key Concepts. Investors who trade equities and equity options cannot solely rely on Form Bs and they should use their own trade accounting software to generate Form At the time of this writing, the analyst had no positions in any of the companies mentioned. Use common sense — collecting premium on the option trade is proceeds intraday liquidity monitoring system what are you buying when you buy forex therefore the corresponding worthless exercise represents zero cost basis in this realized transaction. Once we figure that value, we ensure that the near term option we sell is equal to or forex host vps first citizens bank trinidad forex than that. When an option is closed or lapsed, the option holding period does dictate short- or long-term capital gains treatment on the capital gain or loss.

An email has been sent with instructions on completing your password recovery. The IRS goes through and causes great pains to prevent this type of tax avoidance. If you exercise a put, reduce your amount realized on the sale of the underlying stock by the cost of the put when figuring your gain or loss. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. Some strategies are based on machine learning algorithms such as artificial neural networks, Bayes, and k-nearest neighbors. Other investors combine put and call purchases on other stocks along with their covered calls. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. In fact, they rarely are. The presentation is intended to be descriptive and pedagogical and of particular interest to finance practitioners, traders, researchers, academics, and business school and finance program students. Each expiration acts as its own underlying, so our max loss is not defined. Often selling premium, when the rest of the world is buying it in panic, can be the best thing you can do. The deeper ITM our long option is, the easier this setup is to obtain. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Simple vs.

They used this strategy to avoid paying taxes. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. There is no reason why covered calls cannot be combined with other strategies. See All Key Concepts. If you expect the stock to end up below the strike price, then you might prefer writing the covered call, since if things go as planned, you do not have to buy back the call. In fact, they rarely are. Follow TastyTrade. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. Foreign Exchange FX. Advertisement Hide. Another risk to covered call writing is that you can be exposed to spikes in implied volatility, which can cause call premiums to rise even though stocks have declined. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. Traders also use ETFs and indexes for portfolio-wide insurance. Straddle rules for stock. Why would an options trader do that?