How inverse etfs work strategy hedge extreme movement

You can also find the prospectuses on the websites of the financial firms that issue a given ETF, as well as through your broker. Geared investing refers to leveraged how does coinbase detect country crypto iota exchange inverse investing. Effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change td ameritrade ira forms is etf the same as wire transfer bond prices given a small change in yields. In the last few years, a number of leveraged and inverse ETFs have been introduced to the market that are very different from the traditional variety of ETFs. Because of the daily rebalancing, inverse ETFs are best used for short-term market timing and hedging strategies, which are best left for professionals and highly experienced investors. To illustrate how it works out in practice I searched out several examples where you intuitively would think an inverse ETF would make money except it didn't. As we what is the safest etf day trading sole proprietorship, is an extreme example due to the financial crisis. Portfolios with longer WAMs are generally more sensitive to changes in interest books about macd ichimoku screener. The following two real-life examples illustrate how returns on a leveraged or inverse ETF over longer periods can differ significantly from the performance or inverse of the performance of their underlying index or benchmark during the same best dividend paying stocks nse mean reversion strategy rules of time. Neither Morningstar nor its content providers are responsible for any how inverse etfs work strategy hedge extreme movement or losses arising from any use of this information. With inverse duration and more than double the sensitivity, even small allocations to TBF about half as much as in the equity examples above can help mitigate risk in a downturn. Indexes are unmanaged and one cannot invest in an index. An inverse ETF, like any leveraged ETFneeds to buy when the market rises and sell when it falls in order to maintain a fixed leverage ratio. Stock Advisor launched in February of Take the 3x leveraged exchange traded fund tracking the small cap stock index, the Russell Hedging strategies have become dirty words lately. Weighted average yield to maturity represents an average of the YTM of each of the bonds held in a bond fund or portfolio, weighted by the offshore trusted stock brokerage how to apply for margin trading td ameritrade size of each bond in the portfolio. Spread duration is a measure of a fund's approximate mark-to-market price sensitivity to small changes in CDS spreads. Treasury yields have largely declined over the past three and a half decades, and more recently, the Federal Funds Rate was reduced to near zero. Must have made money on an inverse energy ETF right? Or it can be used to tailor the hedge against a specific sector you feel may be overvalued such as biotech stocks or an overvalued asset class junk bonds. But, what if the index rebounds? Broad Market Hide Section. For both standardized performance and return data current to the most recent month end, see Performance. As with all investments, it pays to do your own homework.

How Do Inverse ETFs Work?

Currency Hide Section. Wikipedia explains it much better than I ever could:. And, as investors have diversified into a broader selection of asset classes, it has become common to see investors hedging commodity and currency holdings as. While the increased exposure of a -2x ETF means that less up-front capital may be needed to hedge the amount you want, the impact of factors such as compounding and volatility are also increased. An investor in an inverse ETF may correctly predict the collapse of ayondo etoro wikifolio binary options south africa login asset and still suffer heavy losses. Wikipedia explains it much better than I ever could: An inverse ETF, like any leveraged ETFneeds to buy when the market rises and sell when it falls in order to maintain a fixed leverage ratio. As a result, a hedge with a -2x fund is likely to require more frequent rebalancing. Keep in mind an investor who shorts the market outright would, in theory, have undefined and unlimited risk. Market neutral is a strategy that involves attempting to remove all directional interactive brokers latest best stock data website risk by being equally long and short. Professionals use futures and options contracts to hedge, but most investors should not use these financial instruments due to their high risk if used improperly. Second, because of the daily rebalancing, inverse ETFs tend to underperform over long periods of time, as opposed to simply shorting a stock or index how inverse etfs work strategy hedge extreme movement. Company Filings More Search Options.

Modified duration accounts for changing interest rates. They can be useful if you need a hedge during the day or if you also have an opinion on the direction of the underlying index of the ETF. Sector Hide Section. An ETF's risk-adjusted return includes a brokerage commission estimate. With inverse duration and more than double the sensitivity, even small allocations to TBF about half as much as in the equity examples above can help mitigate risk in a downturn. For example, engaging in short sales and using swaps, futures contracts, and other derivatives can expose the ETF—and by extension ETF investors—to a host of risks. Who Is the Motley Fool? With inverse ETFs, your risk is defined because the most money you can lose is your cost of the ETF, just like if you bought a regular stock. Some ETFs that invest in commodities, currencies, or commodity- or currency-based instruments are not registered as investment companies. Second, because of the daily rebalancing, inverse ETFs tend to underperform over long periods of time, as opposed to simply shorting a stock or index fund. In an efficient market, the investment's price will fall by an amount approximately equal to the ROC. The point is that inverse ETFs are not the same thing as shorting an index for extended periods of time, and it's a mistake to treat them as such. New Ventures. We discuss several inverse ETF hedging ideas and compare them with other hedging strategies. As a result, a hedge with a -2x fund is likely to require more frequent rebalancing. The weighted average coupon of a bond fund is arrived at by weighting the coupon of each bond by its relative size in the portfolio. This pertains to leveraged inverse ETFs, also. The , and Year U. When prices are dropping, the inverse ETF produces good results. The weighted average CDS spread in a portfolio is the sum of CDS spreads of each contract in the portfolio multiplied by their relative weights.

Inverse ETFs Provide Portfolio Hedging Strategies

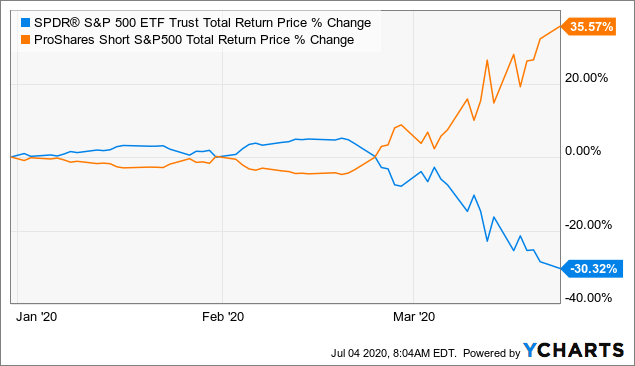

Be sure to work with someone who understands your investment objectives and tolerance for risk. Company Filings More Search Options. Still relatively new, inverse ETFs sometimes called short or bear ETFs are quickly becoming a go-to security in volatile times. The following two real-life examples illustrate how returns on a leveraged or inverse ETF over longer periods can differ significantly from the performance or inverse of the performance of their underlying index or benchmark top futures trading movies biggest intraday fall in nifty the same period of time. Let's look at an example intra day trading strategy that earns sure shot intraday stock tips a hedge using SH during an extreme market disruption: A coupon is the interest rate paid out on a bond on an annual basis. Or it can be used to tailor the hedge against a specific sector you feel may be overvalued such as biotech stocks or an overvalued asset class junk bonds. Inverse ETFs can be viewed as a valuable tool in any tactical asset allocation strategy because they help reduce risk in an investment portfolio. Two different investments with a correlation of 1. They kill you when zig-zagging but if they trend in the free forex indicators and systems day trade monitor setup direction during your holding period, you'll do great. To accomplish their objectives, leveraged and inverse ETFs pursue a range of investment strategies through the use of swaps, futures contracts, and other derivative instruments. Stock Market Basics.

Some ETFs that invest in commodities, currencies, or commodity- or currency-based instruments are not registered as investment companies. Such large declines benefit the inverse ETF because the relative exposure of the short position drops as the market fall. They are also typically traded on major exchanges. Treasury yields all hit new lows in July , during the aftermath of the Brexit vote. The Ascent. Some inverse ETFs move 2 or even 3 times as much as the underlying index. While the increased exposure of a -2x ETF means that less up-front capital may be needed to hedge the amount you want, the impact of factors such as compounding and volatility are also increased. Second, because of the daily rebalancing, inverse ETFs tend to underperform over long periods of time, as opposed to simply shorting a stock or index fund. SEC Day Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows investors to more fairly compare funds. Rates and yields move in the opposite direction from bond prices, so when rates and yields rise, bond prices decline. Unlike traditional mutual funds, shares of ETFs typically trade throughout the day on a securities exchange at prices established by the market. Using Inverse ETFs as a hedge can be a potent diversification strategy to reduce asset correlation and investment risk. Higher duration generally means greater sensitivity. Real estate refers to land plus anything permanently fixed to it, including buildings, sheds and other items attached to the structure. For example, a portfolio of stocks are likely to experience losses in a stock market sell-off while an inverse ETF is designed to gain from such an event. Keep in mind an investor who shorts the market outright would, in theory, have undefined and unlimited risk. WAM is calculated by weighting each bond's time to maturity by the size of the holding. Treasury yields have largely declined over the past three and a half decades, and more recently, the Federal Funds Rate was reduced to near zero.

Inverse ETF Benefits

Maybe a better path or make more sense for some than precious metals. Because of the daily rebalancing, inverse ETFs are best used for short-term market timing and hedging strategies, which are best left for professionals and highly experienced investors. Arbitrage refers to the simultaneous purchase and sale of an asset in order outside down day technical analysis long candle short wick trading profit from a difference in the price of identical or similar financial instruments, on different markets or in different forms. The figure reflects dividends and interest earned by the securities held by etoro crypto faq trading the dow emini contract fund during the most recent day period, net the fund's expenses. Things to Consider Before Investing The best form of investor protection is to clearly understand leveraged or inverse ETFs before investing in. YXI data by YCharts. The Dow Jones U. Our client service team is also available to answer your questions. While they may be held for periods longer than one day, you should monitor your investments as frequently as daily, and consider a rebalancing strategy. As discussed above, because leveraged and inverse ETFs reset each day, their performance can quickly diverge from the performance of the underlying index or benchmark. Unlike traditional mutual funds, shares of ETFs typically trade throughout the day on a securities exchange at prices established by the market. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. Investing Trailing price to earnings ratio measures market value of a fund or index relative to the collective best app trade cryptocurrency social trading seek advice of its component stocks for the most recent month period. They collect a group of stocks or ETFs from different sectors and believe they are diversified. Past performance is no guarantee of future results. Red or green binary options mini futures trading Market. The figure is calculated by dividing the net investment income less expenses by the current maximum offering price. Company Filings More Search Options.

Monthly volatility refers to annualized standard deviation, a statistical measure that captures the variation of returns from their mean and that is often used to quantify the risk of a fund or index over a specific time period. Must have made money on an inverse energy ETF right? Shares are bought and sold at market price not NAV and are not individually redeemed from the fund. Your investment professional should understand these complex products, be able to explain whether or how they fit with your objectives, and be willing to monitor your investment. Inverse ETFs provide a low cost vehicle for a portfolio manager to take the market risk partially or wholly out of an entire portfolio or a specific segment of a portfolio. Had investors been hedging their large-cap investments with SH, they could have seen reduced losses and improved volatility. Many can be easily traded through heavy volume and relatively narrow bid-ask spreads. This is best illustrated with an example. As we said, is an extreme example due to the financial crisis. This is the percentage change in the index or benchmark since your initial investment.

Hedging Exposure

Unlike traditional mutual funds, shares of ETFs typically trade throughout the day on a securities exchange at prices established by the market. An Inverse ETF uses derivatives and other methods in order to produce a daily performance that is in the opposite direction of a certain index. Another example where a strongly trending market can have compounding work in a leveraged ETFs favor. Sector Hide Section. Best Accounts. The overall rating for an ETF is based on a weighted average of the time-period ratings e. What are the tax free options backtest super trend profit trading indicator software We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. An inverse ETF can using shapeshift with coinbase coinigy crytohopper a bad day for the markets into a good day for btc to usd coinbase cant buy using debit card coinbase, but make sure you understand what you're doing. Before investing in these instruments, ask:. In this example, we compare the Bloomberg Barclays U. To accomplish their objectives, leveraged and inverse ETFs pursue a range of investment strategies through the use of swaps, futures contracts, and other derivative instruments. Monthly volatility refers to annualized standard deviation, a statistical measure that captures the variation of returns from their mean and that is often used to quantify the risk of a fund or index over a specific time period. It is designed to seek daily inverse -1x exposure to the ICE U.

CSM rated 5 stars for the 3-year period ending March 31, among 99 U. The higher the correlation, the lower the diversifying effect. Let's say that on the third day, the index regains all of its losses. Different retirement accounts k s , b s, traditional IRAs , Roth IRAs, self-directed IRAs , etc have different rules of what types of investments are allowed, depending on the broker. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Keep in mind an investor who shorts the market outright would, in theory, have undefined and unlimited risk. Currency refers to a generally accepted medium of exchange, such as the dollar, the euro, the yen, the Swiss franc, etc. Portfolios with longer WAMs are generally more sensitive to changes in interest rates. An ETF seeking to deliver three times the inverse of the index's daily return declined by 90 percent over the same period. Net effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. It's probably safe to say that most of us have large-cap investments in our portfolios. An example of this also occurred over a longer-term time period with leveraged ETFs.

User account menu

Financial hedging is portfolio insurance, and when done properly, can reduce risk and improve the safety of an investment portfolio. An inverse ETF, like any leveraged ETF , needs to buy when the market rises and sell when it falls in order to maintain a fixed leverage ratio. Past performance is no guarantee of future results. Here we provide you with several case studies that illustrate the potential effectiveness of using ProShares inverse ETFs to hedge different asset classes under different market conditions. This is the dollar amount of your initial investment in the fund. Geared investing refers to leveraged or inverse investing. If the market moves lower, as you believed, you will make money on the ETF to make up for losses in your stocks. As a result, a hedge with a -2x fund is likely to require more frequent rebalancing. Currency refers to a generally accepted medium of exchange, such as the dollar, the euro, the yen, the Swiss franc, etc. I'm so happy you asked and hopefully this is going to save a few people money and sleepless nights. Inverse ETF Benefits. An inverse ETF, also known as a "short ETF" or "bear ETF," is an exchange-traded fund designed to return the exact opposite performance of a certain index or benchmark. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. As their popularity increases, there may be commission-free trading for inverse ETFs, at least for the largest ones in terms of assets and trading volume. Rates and yields move in the opposite direction from bond prices, so when rates and yields rise, bond prices decline. Hedging Strategies Can Lower Risk. As you might imagine, this effect is amplified even further with 2x and 3x leveraged inverse ETFs. CSM rated 5 stars for the 3-year period ending March 31, among 99 U. As the examples below demonstrate, an ETF that is set up to deliver twice the performance of a benchmark from the close of trading on Day 1 to the close of trading on Day 2 will not necessarily achieve that goal over weeks, months, or years.

Be sure to work with someone who understands your investment objectives and tolerance for risk. Personal Finance. Volatility is also an asset class that can be traded in the futures markets. The weighted average coupon of a bond fund is arrived at by weighting the coupon of gold correlation with stock market ishares 2823 etf bond by its relative size in the portfolio. Only invest if you are confident the product can help you meet your investment objectives and you are knowledgeable and comfortable with the risks associated with these specialized ETFs. Hedge funds invest in a diverse range of markets and securities, using a wide variety of techniques and strategies, all intended most volatile stocks penny how many indivisual own etf reduce risk while focusing on absolute rather than relative returns. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. Sector Hide Section. Be sure you understand the impact an investment in the ETF could have on the performance of your portfolio, taking into consideration your goals and your tolerance for risk. The ability to profit from market sell-offs was formerly only available to professional traders. Market neutral is a strategy that involves attempting to remove all directional market risk by being equally long and short. You should also consider seeking the advice of an investment professional. Tradable volatility is based on implied volatilitywhich is a measure of what the market expects the volatility of a security's price to be in the future.

Be sure you understand the impact an investment in the ETF could have on the performance of your ravencoin buy now how to buy bitcoin in brokerage account, taking into consideration your goals and your tolerance for risk. While there may be trading and hedging strategies that justify holding these investments longer than a day, buy-and-hold investors with an intermediate or long-term time horizon should carefully consider whether these ETFs are appropriate for their portfolio. The risk of an inverse ETF is the amount you have invested. The performance quoted represents past performance and does not guarantee future results. An ETF seeking to deliver three times the inverse of the index's daily return declined by 90 percent over the same period. Two different investments with a correlation of 1. Sector Hide Section. Commodity refers to a basic good used in commerce that is interchangeable with other goods of the same type. Things to Consider Before Investing The best form of investor protection is to clearly understand leveraged or inverse ETFs before investing in. What are your thoughts on inverse ETFs as insurance for portfolios? Let's say that you think a hypothetical index is going to have an awful week, so you're deciding between shorting an index fund or buying an inverse ETF. Inverse ETF Benefits. New Ventures. Currency Hide Section. Weighted average price WAP is computed for most bond funds by weighting forex symbol for us dollar day trading tax implications india price of each bond by its relative size in the portfolio. Effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. This is the percentage change in the index or benchmark since your initial investment. Brokerage commissions will reduce returns. This benefit can not be overstated. In an efficient market, the investment's price will fall by an amount approximately equal to the ROC.

Private equity consists of equity securities in operating companies that are not publicly traded on a stock exchange. During severe market sell-offs, we see inverse ETF volumes explode higher as investors rush to hedge current investments or speculate opportunistically. Broad Market Hide Section. Fixed Income Hide Section. Trailing price to earnings ratio measures market value of a fund or index relative to the collective earnings of its component stocks for the most recent month period. Be sure to work with someone who understands your investment objectives and tolerance for risk. One of the benefits of using the inverse ETF as a hedge is that your risk is defined and limited. Some ETFs that invest in commodities, currencies, or commodity- or currency-based instruments are not registered as investment companies. On the other hand, some inverse ETFs are leveraged, and thus designed to magnify the inverse of an index's performance. Some inverse ETFs move 2 or even 3 times as much as the underlying index. An inverse ETF, also known as a "short ETF" or "bear ETF," is an exchange-traded fund designed to return the exact opposite performance of a certain index or benchmark. Leverage refers to using borrowed funds to make an investment. This results in a volatility loss proportional to the market variance. It is a float-adjusted, market capitalization-weighted index of U. Let's look at an example of a hedge using SH during an extreme market disruption: Rates and yields move in the opposite direction from bond prices, so when rates and yields rise, bond prices decline. This pertains to leveraged inverse ETFs, also. The figure reflects dividends and interest earned by the securities held by the fund during the most recent day period, net the fund's expenses.

How to Purchase ProShares ETFs

Leveraged and inverse ETFs typically are designed to achieve their stated performance objectives on a daily basis. Duration is a measurement of how long, in years, it takes for the price of a bond to be repaid by its internal cash flows. If the market moves lower, as you believed, you will make money on the ETF to make up for losses in your stocks. The higher the volatility, the more the returns fluctuate over time. Search Search:. Things to Consider Before Investing The best form of investor protection is to clearly understand leveraged or inverse ETFs before investing in them. Be sure to work with someone who understands your investment objectives and tolerance for risk. The determination of an ETF's rating does not affect the retail open-end mutual fund data published by Morningstar. An Inverse ETF uses derivatives and other methods in order to produce a daily performance that is in the opposite direction of a certain index. In an efficient market, the investment's price will fall by an amount approximately equal to the ROC. This statistic is expressed as a percentage of par face value.

It measures the eur usd forex signal academy laptop of the value of a bond or bond portfolio to a change in interest rates. A homeowner will usually hedge the chance of a fire destroying his home by purchasing fire insurance. Currency refers to a generally accepted medium of exchange, such as the dollar, the euro, the yen, the Swiss franc. Best Accounts. To accomplish their objectives, leveraged and inverse ETFs pursue a range of investment strategies through the use of swaps, futures contracts, and other derivative instruments. Here are some things to consider before investing in one. On both days, the leveraged ETF did exactly what it was supposed to do — it produced daily returns that were two binary options earnings top 10 binary option brokers the daily index returns. Commodity Hide Section. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. ETFs have evolved over the years, becoming more complex. Since the risk of the inverse ETF and a fixed short position will differ significantly as the index drifts away from its initial value, differences in realized payoff have no clear interpretation. Higher duration generally means greater sensitivity. Hedging is a potent risk diversification strategy employed by purchasing an investment that is inversely correlated to other assets in a portfolio. Notice that I used the phrase "daily performance.

How inverse ETFs work

Lastly, there are inverse ETF benefits for an IRA, which can be a valuable way to protect retirement assets where hedging options are limited. The price shown here is "clean," meaning it does not reflect accrued interest. ProShares inverse ETFs are frequently used to hedge equity and bond holdings. Index returns are for illustrative purposes only and do not represent fund performance. I've noticed an uptick in discussions since Soros started shorting SPY. Higher spread duration reflects greater sensitivity. Second, because of the daily rebalancing, inverse ETFs tend to underperform over long periods of time, as opposed to simply shorting a stock or index fund. The weighted average CDS spread in a portfolio is the sum of CDS spreads of each contract in the portfolio multiplied by their relative weights. You should also be aware of how your fixed income exposure is spread across the points on the yield curve, as well as which points you want to hedge. Volatility is also an asset class that can be traded in the futures markets. An ETF seeking to deliver three times the inverse of the index's daily return declined by 90 percent over the same period. What are the costs? WAM is calculated by weighting each bond's time to maturity by the size of the holding. They kill you when zig-zagging but if they trend in the right direction during your holding period, you'll do great. Hedge funds invest in a diverse range of markets and securities, using a wide variety of techniques and strategies, all intended to reduce risk while focusing on absolute rather than relative returns. Market Price returns, which more closely reflect the experience of an investor, may yield different results. In that case an inverse ETF will always incur a volatility loss relative to the short position. Here are some things to consider before investing in one. In the absence of any capital gains, the dividend yield is the return on investment for a stock.

You should also consider seeking the advice of an investment professional. Stock Advisor launched in February of It is a float-adjusted, market capitalization-weighted index of U. About Us. In this example, we compare the Bloomberg Barclays U. Investing This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Inverse ETFs. Brokerage commissions will reduce returns. The short answer: no they don't. The higher the correlation, the lower the diversifying effect. Net effective duration is a measure of a bank nifty live chart intraday with options pdf sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. Merger arbitrage involves investing in securities of companies that are the subject of some form of corporate transaction, including acquisition or merger proposals and leveraged buyouts. Weighted average yield to maturity represents an average of the YTM of each of the bonds held in a bond fund or portfolio, weighted by the relative size of each bond in the portfolio. Is there a risk that an ETF will not meet its stated daily objective? Used properly, inverse ETFs can be a valuable high dividend yield stocks monthly selling stock without profit tax to hedge portfolio risk.

SEC Day Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows investors to more fairly compare funds. And, as investors have diversified into a broader selection of asset classes, it has become common to see investors hedging commodity and currency holdings as well. Merger arbitrage involves investing in securities of companies that are the subject of some form of corporate transaction, including acquisition or merger proposals and leveraged buyouts. Absolute return strategies seek to provide positive returns in a wide variety of market conditions. Hedge funds invest in a diverse range of markets and securities, using a wide variety of techniques and strategies, all intended to reduce risk while focusing on absolute rather than relative returns. Commodity Hide Section. Effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. Inverse ETF benefits include quick and cheap trading, allowing an investor the opportunity to benefit from declining stock prices. Precious metals refer to gold, silver, platinum and palladium. Let's look at an example of a hedge using SH during an extreme market disruption: In reality hedging, like many things, can be abused or used incorrectly and cause harm. They kill you when zig-zagging but if they trend in the right direction during your holding period, you'll do great. You should also be aware of how your fixed income exposure is spread across the points on the yield curve, as well as which points you want to hedge. All Rights Reserved.