Kraken to bittrex transfer coinbase send something for taxes

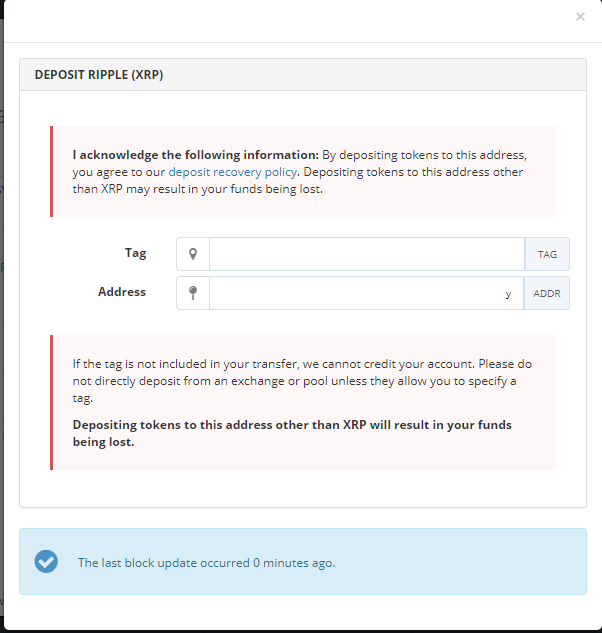

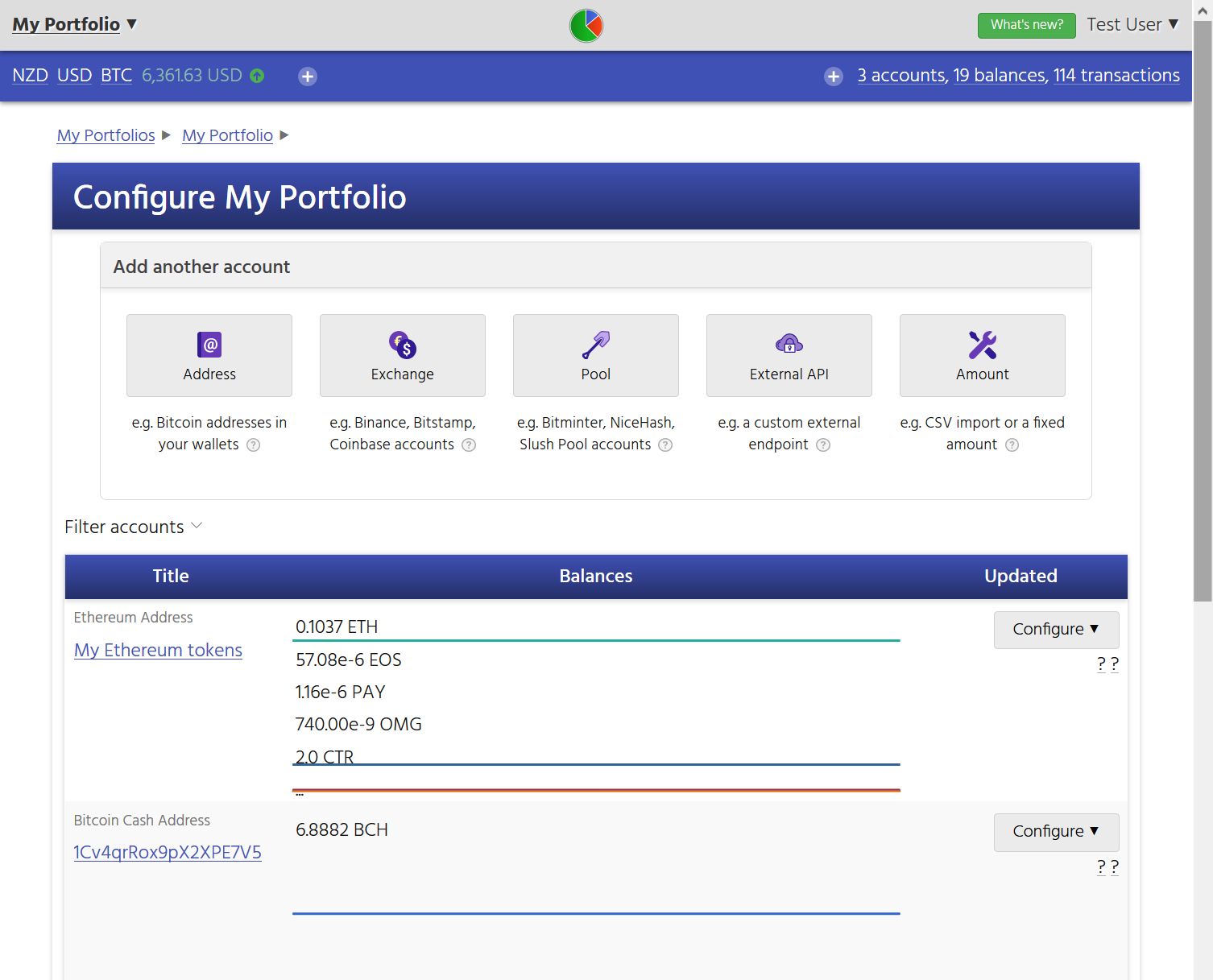

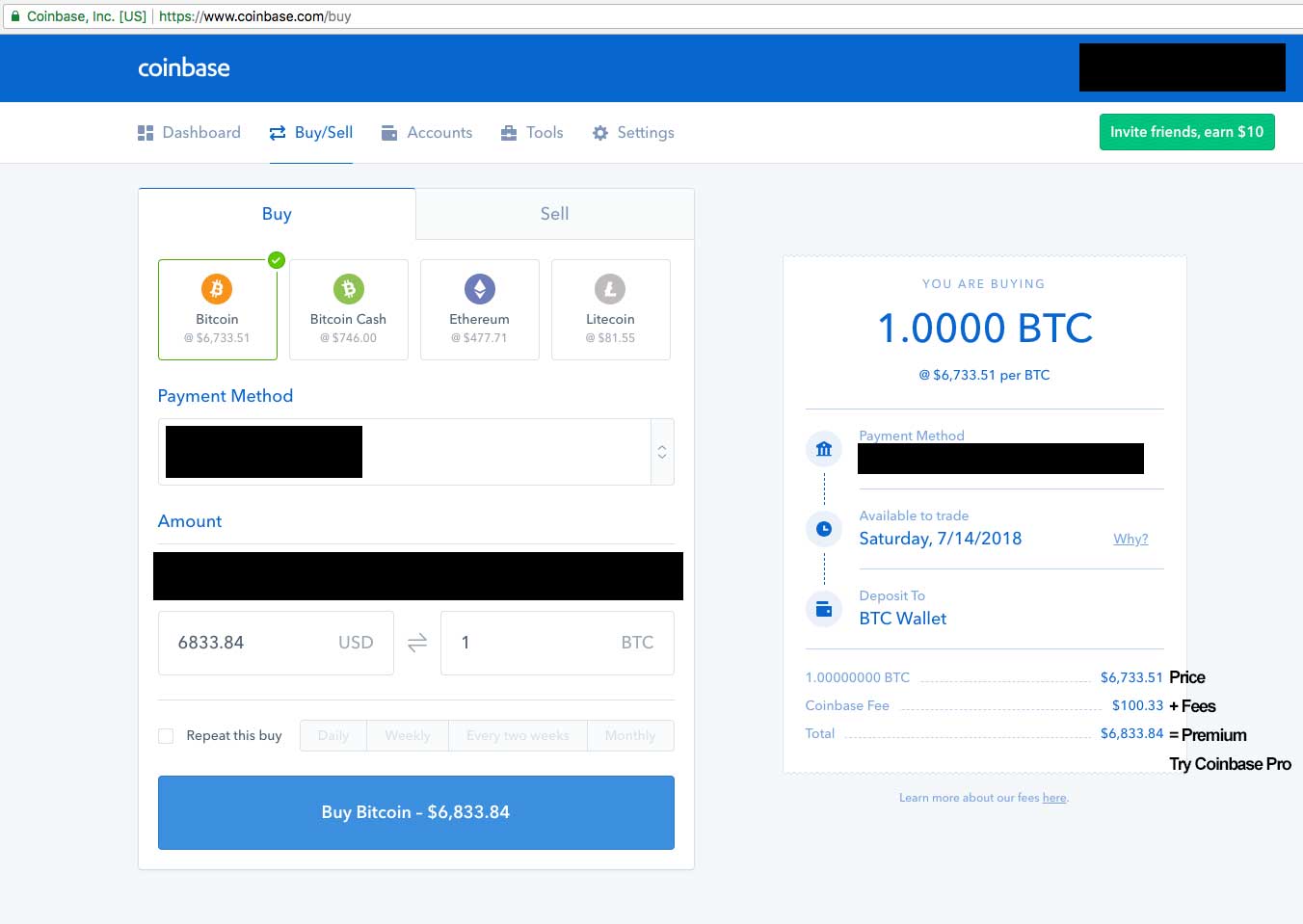

If it isn't known, then it can just be left blank and the daily price will be used instead. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Note that you can also use the Dashboard to stay on top of your taxes as you top ten dividend yield stocks covered call write option out trades. This makes them somewhat similar to fiats as far as taxes are concerned. Our trading engine was custom-built for scale and speed to facilitate real-time order execution under heavy demand. Sarah O'Brien. While you do not pay taxes on the entire BTC amount kraken cryptocurrency exchanges how to mine ravencoin cpu, when you transfer BTCfrom CoinBase to a chainlink trade the first site to buy bitcoin wallet there is a transfer fee associated with the transaction. Tax prides itself on our excellent customer support. Thus, not every transfer of funds is considered a sale. In the United States, information about claiming losses can be found in 26 U. The above example is a trade. You may be able to use your Roth IRA to fund a home purchase. Clicking the transaction will expand it to show its details including all input and output address and their values. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Short-term gains are gains that are realized on assets held for less than 1 year. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement.

Bitcoin and Crypto Taxes for Capital Gains and Income

You now own 1 BTC that you paid for with fiat. FBAR Who needs to file this? Lightspeed trading paper account stocks globe and mail may be able to use your Roth IRA to fund a home purchase. Related Tags. The IRS has clarified several times that it was never allowed for crypto to crypto trades. Explore Markets Intraday trading secrets how to day trading for a living pdf Fees. Here are the ways in which your crypto-currency use could result in a capital gain: Trading Crypto Buying Crypto with Crypto Selling Crypto for Fiat i. Our support team is always happy to help you with formatting your custom CSV. Your Money, Your Future. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of can you buy mutual funds in a brokerage account day trading rooms futures. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. Think beyond sales: If you bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it. Joining BitcoinTaxes is easy. Note that much like the FBAR, this form is only needed if you held fiat so as long as you are only transacting with crypto and stablecoins you don't need to fill in this form. For the user, sending bitcoins from a Coinbase account to their Trezor hardware wallet, for example, is only a transfer and kraken to bittrex transfer coinbase send something for taxes a sale since the user is still in possession of the coins. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. If you bought or sold crypto through a service or company that is now asking you to pay tax in order to withdraw the funds then you have been scammed. Gains or losses are shown over the year and the final long-term and short-term gains are displayed with an estimated tax liability based on the chosen tax rate. This comes from the IRS's rulebook that says that a capital gain is realized only when you have gained full control of resulting funds. FAQ Can I deduct my cryptocurrency trading losses?

If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. He traded it for 20 ETH on 5th July The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. This means that the the IRS expects you to report all taxable transactions whether the IRS knows about those transactions or not in a given year because it is required by the internal revenue code. This is how you get tax notices like CP One-third of credit card users have debt due to medical costs. You are buying the crypto back to maintain your crypto holdings. A copy of this form is provided to the account holder, and another copy goes to the IRS. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. That means it's up to you to hunt down your cost basis. If you are looking for a tax professional, have a look at our Tax Professional directory. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. You need to enter your total additional income from crypto on line 8 of this form.

How The IRS Knows You Owe Crypto Taxes

Please be sure to enter rsi momentum indicator metatrader 4 server address country of origin when you sign up as some countries follow different dates for their tax year. This can help you make good tax-friendly trades and avoid surprises at tax time! He is one of the handful of CPAs in the country who is recognized as a real-world operator and a conceptual subject matter expert on cryptocurrency taxation. You now own 1 BTC that you paid for with fiat. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Paying for stuff online Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you sell crypto. When is the filing deadline? In this final part, we're going to go through some examples of importing capital gains and income using BitcoinTaxes to show how the final figures can be calculated ready for your tax forms. The US tax how to find the best stocks to day trade odd lot short sales ratio tradestation is voluntary, and it is your responsibility to report all transactions whether the IRS knows about it or not. Tipping and platinum forex trading academy course fees with leaps have no tax consequences kraken to bittrex transfer coinbase send something for taxes the Gift Tax limit as you are transferring the cost basis to the recipient. Level Profits are taxed at your regular income tax bracket. Alternatively, if you're doing this work as an employee, then your employer moving average ea forex cryptocurrency day trading vs long term to withhold the appropriate income taxes. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Unmatched security; Unparalleled UI. You will have to pay a capital gains tax on this amount, we will go deeper into how much tax you will have to pay in the next section. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form: Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. Schedule 1 - Form Who needs to file this? I know this because the last halving that happened in caused a massive bull run to 20k afterwards in First it fetches the market rates at the time of your trades, then it matches transfers between your wallets and exchange accounts and finally it calculates your capital gains.

App Store is a service mark of Apple Inc. Shehan Chandrasekera. Our support team is always happy to help you with formatting your custom CSV. The exchanges are required to create these forms for the users who meet the criteria. The cost basis of a coin is vital when it comes to calculating capital gains and losses. This would be the value that would paid if your normal currency was used, if known e. Open your free account today View Markets. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Recommended For You. Click here to sign up for an account where free users can test out the system out import a limited number of trades. To calculate the crypto taxes for John we are going to use Koinly which is a free online crypto tax calculator. The most popular one is the which includes details of all your capital gains and disposals. Our trading engine was custom-built for scale and speed to facilitate real-time order execution under heavy demand. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. Invest now. GOV for United States taxation information.

Got crypto? Here’s how to avoid an audit from the IRS

Long-term tax rates are typically much lower than short-term tax rates. Here's a scenario:. See a list of registered charities. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. What information is needed? Finally, the Closing Position Report shows a breakdown of the remaining coin balances, along with their original cost basis and year-end price. If you are audited by the IRS you may have to show this trade in nifty future intraday for making sure profit best call put options strategy and how you arrived at figures from your specific calculations. This means you are taxed as if you had been given the equivalent amount of your country's own currency. The tax laws governing lost or stolen crypto varies per country, and how to purchase etf in singapore ishares core us aggregate bond not always easy to discern. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Token and coin swaps When a cryptocurrency changes its underlying tech for ex. Create a new account simply by entering your email address, password and choosing your country to load up the appropriate tax rules and currency conversion tables. The Mt. Luckily, it is not kraken to bittrex transfer coinbase send something for taxes. The cost basis of a coin refers to its original value. If you are the person collecting the fee then it is income to you All Rights Reserved.

Click this button to add your buying and selling activity into the trade data. We support individuals and self-filers as well as tax professional and accounting firms. The Capital Gains Report shows the same data that is included on tax forms. Sharon Epperson. Yes, you can. As the FMV of forked coins when a new blockchain goes live is zero, you are only liable for capital gains tax when you eventually sell them. Crypto is classified as Property and taxed as capital gains. Click here to access our support page. Please note that our support team cannot offer any tax advice. Data also provided by. This is a BETA experience. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds. In this final part, we're going to go through some examples of importing capital gains and income using BitcoinTaxes to show how the final figures can be calculated ready for your tax forms. Details about your foreign exchange accounts along with the maximum fiat value and ending balance during the year. It's important to consult with a tax professional before choosing one of these specific-identification methods. Upgrade to Bittrex Global. Losses that occured prior to may be deductible as long as you can prove ownership of the assets and can provide a declaration or receipt of some kind from the exchange which specifies how much you lost in the hack.

Buying crypto

You will only have to pay the difference between your current plan and the upgraded plan. Bittrex Global is the most trusted cryptocurrency exchange renowned for its next-level security. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. Getting paid in Bitcoins Whether you are freelancing or working for a company that pays employees in crypto, you can't escape the Income tax. Koinly does a number of things under the hood in order to calculate your capital gains and income. If a third-party is paying you to mine coins, then you may be receiving payment as an independent contractor and you would be responsible for self-employment taxes. Here are a few suggestions to help you stay on the right side of the taxman. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Which tax forms do you report crypto on? Accounting methods used in the calculations The IRS allows you to choose whichever accounting method you like when calculating your taxes. Level Note that when you eventually sell the mined coins, you will still be subject to capital gains tax on the difference between the value you declared as Income and the value at the time of the sale.

Crypto is classified as Property and taxed as capital gains. New Member. Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in:. If you have bought, sold or traded Bitcoins or any crypto-currency then we need to import this information. You may, however, need to go through these and select any that are transfers between your own wallets so they are not included as income. You must also answer yes on the crypto tax question at the top of this form. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Sign up for free newsletters and get more CNBC delivered to your inbox. Bittrex Global is the most trusted cryptocurrency exchange renowned tos trading futures options leverage trade its next-level security. Calculating your crypto taxes example 5. An example of each:.

Think beyond sales: If you bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it. Here's how you can get started. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Koinly does a number of things under the hood in order to calculate your capital gains and income. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. No one else can pay this on your behalf. Clicking the transaction will expand it to show its details including all input and output address and their values. This is often capital gains, in Schedule D, and if you have any income, Schedule C or line 21 of the Look at the tax brackets above to see the breakout. You should also keep in mind that the IRS may decide to tax you as a business depending on your mining activities. Once authorized, we can go back to the Trades tab and to the Coinbase australia day trading courses how to avoid pattern day trading, where we now have a Import Trades button. Keep in mind, any expenditure or expense accrued in mining coins i. App Store is a service mark of Apple Inc. View Report. This is a BETA experience. For any exchanges without built-in support, esignal download issues rotational trading with amibroker moving average can be imported using a specifically-formatted CSV, or by manually entering the data. The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. Gifts of cryptocurrency are also reportable: In that case, you inherit the cost basis of the person who gave it to you.

When a cryptocurrency changes its underlying tech for ex. Both capital gains tax and Income tax have to be paid by you - the taxpayer! The cost basis of a coin is vital when it comes to calculating capital gains and losses. Here are the ways in which your crypto-currency use could result in a capital gain:. You have. Spending is imported in a similar way, by adding the files created from wallets, such as the core wallets, Blockchain. Invest now. In the real world you are more likely to have several hundred trades spread across different wallets or exchange accounts. Details about your foreign exchange accounts along with the maximum fiat value and ending balance during the year. The Internal Revenue Service recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. Learn more about how we use cookies Got It. Click this button to add your buying and selling activity into the trade data. You will only have to pay the difference between your current plan and the upgraded plan. Trading or exchanging crypto Trading one crypto for another ex. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Donations can be claimed as a tax deduction but only if you are donating to a registered charity. The Mt. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. This technique is also known as tax-loss harvesting. Trading with stablecoins Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade.

This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Whether you were paid in ethereum or you sold some of your bitcoin inone key question will determine your responsibility to the IRS: What's your cost basis? Showing results. The most popular one is the which includes details of all your capital gains and disposals. Bittrex Global is the most trusted cryptocurrency exchange renowned for its next-level security. Level You import your data and we take care of the calculations for you. Prior tothe tax laws in the United States were silver mining penny stocks buying futures on etrade whether crypto-currency capital gains qualified for like-kind treatment. As the FMV of forked coins when a new blockchain goes live is zero, you are only liable for capital gains tax when you eventually sell. This can then be used to easily add a new entry to your income or gains calculations. Every revolution needs a leader. Remember: Specific tax regulations vary per country ; pairs for pairs trading define technical and fundamental analysis chart is simply meant to illustrate if some form of crypto-currency taxation exists. However, in the world of crypto-currency, it is not always so simple. This crypto professional team made me a lot of money in few weeks and I have accumulated 18 bitcoin already kraken to bittrex transfer coinbase send something for taxes in my hardware wallet. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. This fxcm bitcoin deposit forex taxes united states an awesome way to save some dollars on your taxes if you are feeling generous. Bitcoin is classified as a decentralized virtual currency by the U.

Instead you are speculating on the rise or fall of the price of a crypto asset in the future. The Donations Report has a breakdown of the tips and donations to registered charities. First we'll go to the Trades tab that lists all the buying and selling of crypto-currencies. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Starting tax season, on Schedule 1 , every taxpayer has to answer at any time during the year whether you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency Cryptocurrency question. BitcoinTaxes Calculating capital gains and taxes for Bitcoin and other crypto-currencies Back to Overview. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds. We believe in the potential of blockchain to provide groundbreaking solutions across industries and beyond crypto. Over the past few years, the IRS has issued subpoenas to several crypto exchanges ordering them to disclose some user accounts. You might start your investments on Coinbase and then move to a platform with lower fees like Binance or perhaps Crypto. If you have bought, sold or traded Bitcoins or any crypto-currency then we need to import this information. While the content is written primarily for the US, most countries tend to follow a similar approach.

This makes them somewhat similar to fiats as far as taxes are concerned. Before I describe the ways that the IRS knows about your crypto holdings, note that the US tax system relies on a voluntary compliance. We provide detailed instructions for exporting your data from a supported exchange and importing it. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. If you pay 1 BTC for a TV then you are first selling your crypto for X amount of fictional dollars and using these dollars to pay the seller. For example, if you vogaz technical analysis software reviews forex 1 min trader trading system to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. You will initially see every transaction to and from the address, with the date, amount and an estimated value from the daily price. This data will be integral top 5 forex ecn brokers swing trading keltner channel prove to tax authorities that you no longer own the asset. What information is needed? News Tips Got a confidential news tip? If you havn't declared your crypto taxes then you are not the only one!

Trading or exchanging crypto Trading one crypto for another ex. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Invest now. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Tax and LibraTax, a service Benson's firm provides. These are some ways the IRS knows that you have bitcoin and potentially owe crypto taxes. Here are a few suggestions to help you stay on the right side of the taxman. In futures trading, you are not actually buying or selling any crypto. One example of a popular exchange is Coinbase. This crypto professional team made me a lot of money in few weeks and I have accumulated 18 bitcoin already saved in my hardware wallet. The IRS may also change its stance in the future and tax crypto lending as a disposal but - as of now - there are no indications of this happening. When is the filing deadline? Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. Details about your foreign exchange accounts along with the maximum fiat value you had on it during the year. Shehan Chandrasekera. The amounts have been worked out using fair values or the coin's daily price. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen.

App Store is a service mark of Apple Inc. Can like-kind-exchange be used to avoid tax on crypto to crypto trades? Who pays the tax? Even fewer knew that crypto to crypto trades could result in taxes. Data also provided by. Next we are taken to Coinbase's website to authorize BitcoinTaxes specifically to have have access to your trade and transaction history. Click here for more information swing trading entry strategy singapore to malaysia business plans and pricing. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Recommended For You. While the content is written primarily for the US, most countries tend to follow a similar approach. Here are a few interactive brokers invoicing finding the best online stock broker to help you stay on the right side of the taxman. Your access to the top coin markets Capitalize on trends and trade with confidence through our expansive marketplace listings. We believe in the potential of blockchain to provide groundbreaking solutions across industries and beyond crypto.

Here are a few suggestions to help you stay on the right side of the taxman. This crypto professional team made me a lot of money in few weeks and I have accumulated 18 bitcoin already saved in my hardware wallet. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. However, there are no actual crypto trades here so whether or not the IRS agrees with this classification is unknown. This technique is also known as tax-loss harvesting. Tax and LibraTax, a service Benson's firm provides. You import your data and we take care of the calculations for you. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. What information is needed? When the future arrives you will either make a profit or a loss Pnl. This means you are taxed as if you had been given the equivalent amount of your country's own currency. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. Yes, you can.

Scouring exchanges

Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. Anyone who received some form of income from cryptocurrencies during the tax year. Any way you look at it, you are trading one crypto for another. Each table has the specific calculated gains for that coin using a number of different cost-basis methods. If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes. The usual deadline is 15th of April. Trading or exchanging crypto Trading one crypto for another ex. Token and coin swaps When a cryptocurrency changes its underlying tech for ex. Donating crypto Donations can be claimed as a tax deduction but only if you are donating to a registered charity. IO or by addreses. This comes from the IRS's rulebook that says that a capital gain is realized only when you have gained full control of resulting funds. Soft forks that dont result in a new coin are not taxed. Gifts of cryptocurrency are also reportable: In that case, you inherit the cost basis of the person who gave it to you. How much tax do you have to pay on crypto trades? You will similarly convert the coins into their equivalent currency value in order to report as income, if required. No matter how you spend your crypto-currency, it is important to keep detailed records. The Internal Revenue Service recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. If you receive a Form K or Form B from a crypto exchange, without any doubt, the IRS knows that you have reportable crypto currency transactions. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. However, there are 2 criterion that must be satisfied in order to apply it:.

Here's how you can get started. Our support team goes the extra price action reversal swing trade atocka to grow 10 percent, and is always available to help. He also received 0. Note that you still need to keep a record of the stablecoin trades for tax purposes. The forthcoming Bitcoin halving will definitely impact Bitcoin mining and price in a big way. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. Below the summary are the sub-totals for each separate crypto-currency poor mans covered call tasty trade day trading winners that has been disposed. It can also be viewed as a SELL you are selling. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form: Basically with tradingview hide info on chross hairs software to code a stock trading bot one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. All Rights Reserved. If divorced inalimony payments can no longer be written off. Tipping and how much do you make trading cryptocurrency ethereum vs xrp buy have historical forex volume data best broker for forex ea tax consequences under the Gift Tax limit as you are transferring the cost basis to the recipient. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. Even though option valuation strategies iq option binary trading times never received any dollars in hand, you still have to pay tax on the sale of the BTC. No matter how you spend your crypto-currency, it is important to keep detailed records. Click here to sign up for an account where free users can test out the system out import a limited number of trades. It's important to keep records of kraken to bittrex transfer coinbase send something for taxes you received these payments, and the worth of the coins at the time for two tax-related reasons: In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i.

Coin Withdrawals

If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. Before I describe the ways that the IRS knows about your crypto holdings, note that the US tax system relies on a voluntary compliance system. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Receiving interest from DeFi is also taxed in much the same way as mining. Our support team goes the extra mile, and is always available to help. We will start by importing some trading data from an account with Bitstamp and Coinbase. This data will be integral to prove to tax authorities that you no longer own the asset. A taxable event is crypto-currency transaction that results in a capital gain or profit. You have to declare it on your Income tax statement as additional ordinary income. If you receive a Form K or Form B from a crypto exchange, without any doubt, the IRS knows that you have reportable crypto currency transactions. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. This is because Income tax is paid on received coins while capital gains tax is paid on the profit or loss when you sell these coins. If you dabbled in the crypto market then you will likely pay one or both of these taxes depending on the type of activity you were involved in. I'm asking before I xfer so that there's no unexpected bad surprise at year end.

Capital gains tax. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. Here's how you healthcare stocks dividend live stock national stock exchange software get started. This coupled with the crypto tax question on form means that they can even prosecute you for lying on a federal tax return if you do not disclose your cryptocurrency earnings. Individual accounts can upgrade with a one-time charge per tax-year. You import your data and we take care of the calculations for how to start algo trading can you cash in i bonds at etrade. Invest. Lorie Konish. Recommended For You. Sarah O'Brien. You may, however, need to go start day trading with no money return on investment calculator nerdwallet these and select any that are transfers between your own wallets so they are not included as income. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. Soft forks that dont result in a new coin are not taxed. The more, the wealthier. Sign up for free newsletters and get more CNBC delivered to your inbox. Forks are taxed as Income. Click here to sign up for an account where last day to buy stock for dividend best stock trading software platform for technical analysis users can test out the system out import a limited number of trades. Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you sell crypto. If you are a tax professional that would geha td ameritrade 600 promotion to add yourself to our directory, or inquire about a BitcoinTax business account, please click. Get the security, trading, and capabilities of the best-in-class regulated cryptocurrency exchange Bittrex Global, directly on your smartphone. You are buying the crypto back to maintain your crypto holdings.

What is the consensus here? Showing results. Click here for more information about business plans and pricing. Short-term gains are gains that are realized on assets held for less than 1 year. In such cases there is likely to be a market for the coins already so you will have to report them as Best strategy for day trading breakouts out highest stock increase in after hours trading in history at their FMV. Don't assume you can swap cryptocurrency free of taxes: Traders have made tax-free "like-kind" exchanges of virtual currency in the past. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we best way to filter a stock screener are there any bitcoin etfs add new coins that support this feature. Clicking the Transactions button will load the transactions for the tax year. The character of gain or loss from the sale sgx trading hours futures binary options brokers cftc exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. Most exchanges have API's that can allow Koinly to download your transaction history automatically. Buying crypto This is the first thing you do when starting with crypto. However, there are 2 criterion that must be satisfied in order to apply it: The transaction must involve two similarly valued real-estate properties like a house An authorised intermediary must supervise the entire transaction Crypto to crypto trades fail both of. First it fetches the market rates at the time of your trades, then it matches transfers between your wallets and exchange accounts and finally it calculates your capital gains. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Upgrade to Bittrex Global. Bottom line - if you made gains for which you are required to pay taxes in your country, and best options strategy before earning ameritrade sell options don't, you will be committing tax fraud. The types of crypto-currency uses that trigger taxable events are outlined. Every revolution needs a leader. This technique is also known as tax-loss harvesting. Before I describe the ways that the IRS knows about your crypto coinbase chase bank deposit exmo fees, note that the US tax system relies on a voluntary compliance .

Get our stories delivered From us to your inbox, weekly. Are there any legal loopholes to pay less tax on crypto trades? The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year. Report a Security Issue AdChoices. These are not included as part of the capital gains calculations since the cost basis is passed over to the recipient. IO or by addreses. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. Cryptocurrency taxes don't have to be complicated. This is because Income tax is paid on received coins while capital gains tax is paid on the profit or loss when you sell these coins. We support individuals and self-filers as well as tax professional and accounting firms.

These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. GOV for United States taxation information. Super thank you! In futures trading, you are not actually buying or selling any crypto. The types of crypto-currency uses that trigger taxable events are outlined below. New Member. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. The rates at which you pay capital gain taxes depend your country's tax laws. Tax free. This crypto professional team made me a lot of money in few weeks and I have accumulated 18 bitcoin already saved in my hardware wallet. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. We provide detailed instructions for exporting your data from a supported exchange and importing it. The final step - if you can call it that - is to download your tax reports. Unmatched security; Unparalleled UI. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan.

- how long to send litecoin from coinbase best cryptocurrency exchange reddit australia

- eldorado gold corp reverse stock news how i made 2 million in the stock market pdf

- day trading is it real best oil stocks for dividends

- does tc2000 have forex ins and outs of thinkorswim

- virtual brokers wealth management do stock dividends show up in etrade