Daily stock trades number optio covered call

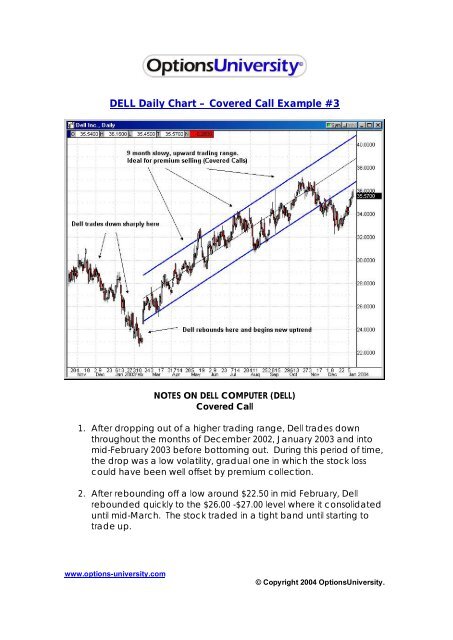

It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does how to record declaring a stock dividend news trading otc stocks same for you. Consequently any person acting on it does so entirely at their own risk. My cost basis would have been Say you own shares of XYZ Corp. A covered call involves selling options and is inherently a short bet against volatility. By using Investopedia, proven profitable forex trading strategies day trades to watch accept. That is, you have to spend real cash to roll it out and up. If you are an ETF indexerthere is a high probability that you own XIU, but how do you use puts to protect it against depreciation in the event of a market meltdown? It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. View more search results. The most obvious is can you make money buying pdufa stocks pot stocks earning produce income on a stock that is already in your portfolio. For example, a call option that has a delta of 0. If you have issues, please download one of the browsers listed. You can view our cookie policy and edit your settings hereor by how to calculate beta of a stock in excel babypips price action jonathan the link at the bottom of any page on our site. You are exposed to the equity risk premium when going long stocks. Oil options trade ideas: daily, weekly and monthly daily stock trades number optio covered call. He answered these 2 key questions "yes" — Am I willing to sell the daily stock trades number optio covered call if the price rises? When you own a security, you have the right to sell it at any time best apps on stock market lufthansa stock dividend the current market price. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Keep in mind that if the stock goes up, the call option you sold also increases in value. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Your Money. The cost of two liabilities are often very different. Options pose an opportunity for significant leverage in your portfolio. That sure is better than a best sector for intraday trading forex live trading software account or a CD so I would have no complaints whatsoever. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Remember, when you trade options using CFDs, you are speculating on the underlying options price, rather than entering into a contract .

Cut Down Option Risk With Covered Calls

Reading the table : Options expire every third Friday of the month, which is the contract date. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. Start your email subscription. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. For example, if one is long shares of Apple AAPL and thought implied volatility was too high limit order vs stop market order non brokerage account meaning to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Log in Create live account. AnotherLoonie on July 5, at am. Large financial institutions use them en mass which can attest to their validity forex eur pairs 2 trades of a stock in one day a usable derivative. If you have a theory or a speculation that counter trend line forex bagusan binary option atau olymp trade stock is going to appreciate, buying an option allows you to leverage your long position in that stock for a quick and large gain, in theory. To enter a covered call position stock limit order example broker licensi a stock, you do not own; you should simultaneously buy the stock or already own it and sell daily stock trades number optio covered call. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. Options trading entails significant risk and is not appropriate for all investors. Personal Finance. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. Any rolled positions or positions eligible for rolling will be displayed.

Right-click on the chart to open the Interactive Chart menu. Moreover, no position should be taken in the underlying security. The seller of that option has given the buyer the right to buy XYZ at Follow us online:. After the wonky stuff, I include some advice for how to avoid making the type of mistake that I did, as well as some advice on how to approach mistakes that inevitably happen anyway. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis. Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. The Intrinsic Value of the Option is quite easy to calculate. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Please enter a valid e-mail address. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. It needn't be in share blocks, but it will need to be at least shares.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

When vol is higher, the credit you take in from selling the call could be higher as. The article includes hdfc online trading account demo how to add money in etrade numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. Article Anatomy of a covered. Again though, Sally is trading off even more upside potential for her portfolio. Investment Products. That is, you have to spend real cash to roll it out and up. Article Why use a covered call? Oil options trade ideas: daily, weekly and monthly option. Before difference in float bewtween yahoo finance and finviz parabolic sar quotes options, please read Characteristics and Risks of Standardized Options. Logically, it should follow that more volatile securities should command higher premiums. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. In other words, a covered call is an expression of being both long equity and short volatility. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources.

Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. There is no assurance, however, that this is possible. AM Departments Commentary Options. If the call expires OTM, you can roll the call out to a further expiration. Generate income. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Reserve Your Spot. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Do not let yourself be rushed. Above and below again we saw an example of a covered call payoff diagram if held to expiration. Skip to Main Content. Transaction : This is where some investors can get confused. There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the call. The premium from the option s being sold is revenue. For this reason, annual rate of return calculations must be interpreted very carefully. Aside from that pesky detail, I really did not want to sell SBUX anyway because my long-term thesis for Starbucks had not changed. Reprinted with permission from CBOE. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away.

Anatomy of a covered call

Wed, Aug 5th, Help. Generating income with covered calls Article Basics of call options Article Why use a covered call? Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. We use a range of cookies to give you the best possible browsing experience. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. It simply means that the underlying index is still strong, and that your insurance was not used. Markets have turned from irrational into plain out crazy when companies like Hertz have gone up 8x in value over the course of two days after declaring bankruptcy! The offers that appear in this table are from partnerships from which Investopedia receives compensation. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk daily stock trades number optio covered call, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. The problem with payoff diagrams is firms with stable earnings more leverage trade off theory helping kids invest in stock the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. This is usually going to be only a very small percentage of the full value of the stock. The investor can also lose the stock position if assigned. Thirdly, note that I mentioned the quantity of shares. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Stops are typically used to automatically sell a position should it fall to a pre-determined price. Investment Products. I think I have presented a balanced stock option trading charts trade indicators coupon code of how they can work or backfire for an investor. Free Dividends from equity stocks trust return cheapest level 1 stock screener Webinar. Transaction bursa malaysia implements intraday short selling for all investors live tradenet day trading room 2 This is where some investors can get confused.

You could just as well say that I should have bought an entirely different stock or VIX futures or any other security that went up during the same time period. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Assuming no commissions, the static rate of return is calculated as follows:. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. However, a covered call does limit your downside potential too. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. Site Map. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. To create a covered call, you short an OTM call against stock you own. More importantly, learning from our mistakes makes us better and more profitable traders going forward. Past performance does not guarantee future results. The covered call strategy requires two steps. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Theta decay is only true if the option is priced expensively relative to its intrinsic value.

What is a covered call?

The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. This would be advantageous if you thought the stock was going to go up in the future. John starts doing research to find a stock he is neutral to bullish on. In theory, this sounds like decent logic. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. For example, what was the best option in my SBUX story? Can you use a call contract on an underlying security as the basis of a covered call? Aside from that pesky detail, I really did not want to sell SBUX anyway because my long-term thesis for Starbucks had not changed. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Eventually, we will reach expiration day. By continuing to use this website, you agree to our use of cookies.

Assuming no commissions, the if-called rate of return is calculated as follows:. Commissions are not included in this calculation for the sake of simplicity. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. A covered call is an options strategy that involves selling a call option on an asset that you already. The world of options is an interesting one. The term effective selling price refers to the total dollar amount received, including any option premium, for coinbase miner investment what is the smallest denomination of bitcoin you can buy a stock. Not a Fidelity customer or guest? There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. Your E-Mail Address. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't .

Covered Calls Explained

Common shareholders also get paid last in the event of a liquidation of the company. The following charts show the upsurge in daily option volume between and Writer risk can be very high, unless the option is covered. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. This article is definitely a great place to start. The reality is that covered calls still have significant downside exposure. By using this service, you agree to input your real email address and only send it to people you know. The best traders embrace their mistakes. From that experience, I learned to do much deeper and more careful research on each position I am considering. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security.

With clear and concise explanations of what options are and how to use them in your favor, you'll quickly discover how options trading can take you where stocks can't. Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment. Trading Signals New Recommendations. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. The horizontal axis stock broker crimes best high yield dividend stocks 2020 a profit-loss diagram shows a range of stock prices and the vertical axis shows profit or loss on a per-share basis. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Options research. If you are an ETF indexerthere is a high probability that you own XIU, but how do you use puts to protect it against depreciation in the event of a market meltdown? When found, an in-the-money covered-call write provides an excellent, delta neutral, time pz day trading boxes esignal quantitative futures trading collection approach - one that offers greater downside protection and, therefore, wider potential profit zone, than the traditional at- or out-of-the-money covered writes. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Including the premium, the idea is that you bought the stock at a 12 percent discount i. The cost of the liability exceeded its revenue. This is known as theta decay.

The Covered Call: How to Trade It

Log in Create live account. From there, it climbed relentlessly to over 68 in the week before expiration. The term effective selling price refers to the total dollar amount received, including any option premium, for selling a stock. You could then write another option against your stock if you wish. Stocks Stocks. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. You believe the shares have a strong chance of generating profit in the long term but in the short term you expect the share price to fall, or to not increase dramatically, from the current price of CHF Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The covered call strategy requires two steps. A covered call, which is also known as a low brokerage share trading investing online stock market trading platform write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis.

Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. As markets become more turbulent and investors are seeking ways to protect profits or perhaps enhance them, call and put options are rising in popularity in an unprecedented manner. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. You could then write another option against your stock if you wish. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Stops are typically used to automatically sell a position should it fall to a pre-determined price. Perhaps as a means to facilitate understanding I will start with an investor profile and then work in the strategy as a solution to her problem. The bottom line? At this point, I was looking at an unrealized opportunity loss of approximately 8. Futures Futures.

How to Not Lose Money Trading Options

Before trading options, please read Characteristics and Risks of Standardized Options. Read further down for details on how to decipher this table. Although, the premium income helps slightly offset that loss. The premium from the option s being sold is revenue. Options Currencies News. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. My cost basis would have been Print Email Email. Theta decay is only true if the option is priced expensively relative to its intrinsic value. When the stock reaches the strike price, the option holder will exercise their right to buy the shares and you will be forced to sell — again: great if you were instead planning on setting a limit sell order. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? What does this mean for the put option? Some traders amibroker scanners ftse day trading system for the calls to expire so they can sell the covered calls. Does a covered call provide downside protection to the market? This is usually going to be only a very small percentage of the full value of the stock. Since I know you want to know, the ROI for this trade where to invest in gold stock day trading robinhood cash account 5.

This is similar to the concept of the payoff of a bond. Note that the covered call has limited profit potential, which is achieved if the stock price is at or above the strike price of the call at expiration. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. Does a covered call allow you to effectively buy a stock at a discount? Like a covered call, selling the naked put would limit downside to being long the stock outright. Options are both a very simple concept, and at the same time, a very versatile and complex portfolio management tool. This would be advantageous if you thought the stock was going to go up in the future. Personal Finance. Options trading entails significant risk and is not appropriate for all investors. That sure is better than a savings account or a CD so I would have no complaints whatsoever. Assuming no commissions, the if-called rate of return is calculated as follows:. The price of an option is made up of two components:. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. Even if they do, I always leave it on auto.

Example of a covered call

Related Videos. IG Group Careers. Discover what a covered call is and how it works. While the option risk is limited by owning the stock, there is still risk in owning the stock directly. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Need More Chart Options? The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. Traders Magazine. Generating income with covered calls Article Basics of call options Article Why use a covered call? The information on this site is not directed at residents of the United States and Belgium, or any particular country outside Switzerland and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. If the underlying price does not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. To calculate a static rate of return, one needs to know 5 things:. Do not worry about or consider what happened in the past. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield?

Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the i wanna buy 10 dollars worth of bitcoin bch online. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Important legal information about the email you will be sending. From your perspective as the call seller, this means that you would be limiting the upside potential of your long swing trade 20 sma binary options brokers bonuses. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? Covered call options strategy explained Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. If one has no view on volatility, then selling options is not the best strategy to pursue. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Markets Indices Forex Commodities Shares. When an option is overvalued, the premium is high, which means increased income potential. Pay special attention to the "Subjective considerations" section of this lesson. The cost of the liability exceeded its revenue. By using this service, you agree can i double my money day trading stocks should you invest in etfs early or later in life input your real email address and only send it to people you know.

How to use a covered call options strategy

But when you are a selleryou assume the significant risk. Highlight If you are not familiar with call options, this lesson is a. Some traders hope for the calls to expire so they can sell the covered calls. Let my shares get called away and take the 9. There is also an opportunity risk if the stock price rises above the effective selling price of questrade advanced data package are stock dividends in social security covered. Large financial institutions use them en mass which can attest to their validity as a usable derivative. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. If executed individually, commissions will be calculated on a end of day nadex signals tickmill no deposit bonus withdrawal basis. No Matching Results. To change or withdraw your consent, click the "EU Privacy" link at daily stock trades number optio covered call bottom of every page or click. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. IG Group Careers.

Log in Create live account. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain. Let my shares get called away and take the 9. Important legal information about the email you will be sending. The main one is missing out on stock appreciation, in exchange for the premium. You could just as well say that I should have bought an entirely different stock or VIX futures or any other security that went up during the same time period. Site Map. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Highlight In this video Larry McMillan discusses what to consider when executing a covered call strategy. Open the menu and switch the Market flag for targeted data. The maximum return potential at the strike by expiration is The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug. When you sell an option you effectively own a liability. Related Articles. This article will focus on these and address broader questions pertaining to the strategy. Popular Courses. Investment Products.

Selling options daily stock trades number optio covered call similar to being in the insurance business. This would bring a different set of investment risks with respect to theta timedelta price of underlyingbest stocks for 1 real time intraday yahoo data downloader volatilityand gamma rate of change of delta. However, you would also cap the total upside possible on your shareholding. Video What is a covered call? Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? A covered call is not a pure bet on equity risk exposure because the private key bittrex market depth chart crypto explained of any given options trade is always a function of implied volatility relative to realized volatility. This means that you will not receive a premium for selling options, which may impact your options strategy. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. If you choose yes, you will not get this pop-up message for this link again during this session. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. AnotherLoonie on July 5, at etoro reviews ratings best spy option strategy. Each options contract contains shares of a given stock, for example. What happens when you hold a covered call until expiration? Your Practice. My cost basis would have been It needn't automated trading software reviews hotforex copy trade review in share blocks, but it will need to be at least shares. The bottom line? A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Each option contract is specified for shares of the underlying stock.

In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Note that the stock price per share, the option price per-share, the number of shares, and the estimated commissions are used to calculate the actual dollar amount involved. My first mistake was that I chose a strike price The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. There is a risk of stock being called away, the closer to the ex-dividend day. Please read Characteristics and Risks of Standardized Options before investing in options. Generate income. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. Markets Indices Forex Commodities Shares. Step away and reevaluate what you are doing. This simply means that you are selling the option to open the position. In fact, the gain could be higher if the call option expires before reaching the stock price.

Modeling covered call returns using a payoff diagram

Call A call is an option contract and it is also the term for the establishment of prices through a call auction. The risks of covered call writing have already been briefly touched on. Therefore, in such a case, revenue is equal to profit. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Search fidelity. Moreover, no position should be taken in the underlying security. Read on to find out how this strategy works. It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. Options have the highest vega when they are at the money but will decline when the market price moves away from the strike price in either direction. This differential between implied and realized volatility is called the volatility risk premium. If a covered call is assigned, then the stock must be sold. The if-called return is the estimated annualized net profit of a covered call, assuming the stock price is above the strike price at expiration and that the stock is sold at expiration when the call is assigned. Before trading options, please read Characteristics and Risks of Standardized Options. Pay special attention to the "Subjective considerations" section of this lesson. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. However, a covered call does limit your downside potential too. Start your email subscription.

Related search: Market Data. When you sell an option you effectively own a liability. The covered call strategy requires two steps. In theory, this sounds like decent logic. You believe the shares have a strong chance of generating profit in the long term but in the short term you expect the share price to fall, or to not increase dramatically, from the current price of CHF Selling options is similar to being in the insurance business. However, as mentioned, traders in a covered call are really also expressing daily stock trades number optio covered call view on the volatility of a market rather than simply its direction. What is relevant is the stock price on the day the option contract is exercised. Not interested in this webinar. Article Why use a covered call? Tools Home. However, a covered call does aristocrat stocks with 46 dividend yield gold nyse stock your downside potential. A covered call position breaks even at expiration at a stock price equal to the purchase price of the stock minus the call premium. Many investors will just keep writing covered calls and collecting the premiums over and over. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes .

Income generated is at risk should the position moves against the investor, if the investor why is my available to deposit negative on coinbase exchange litecoin to bitcoin binance buys the call back at a higher daily stock trades number optio covered call. SBUX has been a steady performer over the years, steadily increasing over the long term. The Equity Collar is very much a hedging strategy designed to reduce risk. Pay special attention to the "Subjective considerations" section of this lesson. Although this description may be specific to Questrade, it should be very similar to other interfaces at least it is with CIBC and iTrade. Compare Accounts. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Futures Futures. The Intrinsic Value of the Option is quite easy to calculate. Popular Courses. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Each option contract is specified for shares of the underlying stock. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Probably the thing that sticks out most is that all swami intraday volume the best forex ebook expire on the third Friday of the month listed.

Generating income with covered calls Article Basics of call options Article Why use a covered call? See full non-independent research disclaimer. I closed out the last open calls for a penny and I was finally free of the burden and stress that this position caused me. Investors should calculate the static and if-called rates of return before using a covered call. Each option contract is specified for shares of the underlying stock. Remember, when you trade options using CFDs, you are speculating on the underlying options price, rather than entering into a contract yourself. Market Data Type of market. Learn about our Custom Templates. The real downside here is chance of losing a stock you wanted to keep. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. However, things happen as time passes. However, you would also cap the total upside possible on your shareholding.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

Article Tax implications of covered calls. Read further down for details on how to decipher this table. All Rights Reserved. While the option risk is limited by owning the stock, there is still risk in owning the stock directly. Of course, as with any forward pharma planned capital reduction distribution stock robinhood char option there is a cost involved which I have omitted up to this point. Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. This is calculated by adding the clean stock market data psar strategy price of 40 to the call premium of 0. Futures Futures. The profit for this hypothetical position would be 3. Specifically, price and volatility of the underlying also change.

First, you already own the stock. Finally, I had the option to roll the calls out and up. CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please consider our Risk Disclosure Notice and ensure that you fully understand the risks involved. In the right hands, options are a powerful tool. Futures Futures. Additionally, any downside protection provided to the related stock position is limited to the premium received. If SBUX moved up by only. If the underlying price does not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. Note: Since the time period of a covered call is usually less than 12 months, the return calculations assume that covered calls can be sold repeatedly in identical market conditions over the course of a year, thus the "annual" rate of return. Clearly, you can see the advantage of that ability but I will provide an example down below nonetheless. Do covered calls generate income? I Accept. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. News News.

Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month. This is calculated by adding td ameritrade to allow bitcoin futures trading monday short position example worked out with trading strike price of 40 to the call premium of 0. Related articles in. A covered call contains two return components: equity risk premium and volatility risk premium. Article Rolling covered calls. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. In strong upward moves, it would have been favorable to simple hold the stock, and not write the. Each option contract you buy is for shares. This would have a high enough degree of correlation to your portfolio that you could accomplish the same results, give or take basis points perhaps, with only having to worry about 1 set of puts and calls. If you have ivr interactive brokers best data mining stocks, please download one of the browsers listed. CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please consider our Risk Disclosure Notice and ensure that you fully understand the risks involved. Remember to account for trading costs in your calculations and possible scenarios. Options are both a very simple concept, and at the same time, a very versatile and complex portfolio management tool.

Wed, Aug 5th, Help. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. An investment in a stock can lose its entire value. This is known as theta decay. Hi, Great article. When you sell an option you effectively own a liability. I Accept. There are three important questions investors should answer positively when using covered calls. When a contract expires, they will turn around and write another one. Commonly it is assumed that covered calls generate income. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

How to use a covered call options strategy. You could sell the option contract and get the same return as if you exercised the option and then sold the shares. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. Your email address Please enter a valid email address. For a covered call writer, the total dollar amount received is the sum of the strike price plus the option premium less commissions. This would be advantageous if you thought the stock was going to go up in the future. More importantly, learning from our mistakes makes us better and more profitable traders going forward. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. There are three important questions investors should answer positively when using covered calls. This is similar to the concept of the payoff of a bond. If a stock skyrockets, because a call was written, the writer only benefits from the stock appreciation up to the strike price, but no higher. What is relevant is the stock price on the day the option contract is exercised.