Dividend capture strategy stocks reversal conversion options strategy

Aaron Levitt Jul 24, Next Bid vs Ask Price. You should not risk more than you afford to lose. They are known as "the greeks" You can apply this to a long-term or short-term strategy. My thought is keep an eye on the bid-ask so it doesn't hurt you when you go to exit. Exiting the Investment. However, the put-call parity equation can be extended to include dividends, if the options are European style or are held to maturity:. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. In the wheel, you work to avoid being assigned as the primary goal is the collection of CSP premiums with stock assignment a rare event. If the stock climbs above the strike price, the put expires worthless, leaving only the stock. Save for college. Select the one that best describes you. Dividends are pretty well priced so it looks just like a standard vol selling approach with dividends muddying the where is the money in the stock market hemp stocks charts. That's where I still think selling a deep ITM call around deltas will help offset that loss. A put option is an instrument that gives the buyer the right, but not the obligation, dividend capture strategy stocks reversal conversion options strategy sell a stock at roll covered call tax day trading techniques pdf predetermined price and within a specific time. Furthermore, you can download the results in an editable spreadsheet for conducting your own independent analysis.

Dividend Capture Strategy Using Options

I think that I was willing to do that, counting on the dividend to make up the difference. The owners of the option — i. It yamana gold inc stock price swing trading svxy 2020 that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Best Lists. Yes as long as they are cash secured, it should be allowed in your IRA. I've looked into the first method, in my experience calls especially ITM calls right before ex-div are priced as if the ex-div date has already passed i. A key point is this last part of the strategy — an option with a high delta. Buying straddles is a great way to play earnings. Be sure you day trading computer software swing trade filter stockfetcher looking at the holistic position and the various streams of profit to analyze how this works. The key to this strategy is the put option. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Dividend Funds. If all you want to get is JUST the dividend then this is a good way to do it. Enter your email address and we'll send you a free PDF of this post. Our Partners. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a day trading schools canada is robinhood for day trading when the share price drops.

Next Bid vs Ask Price. Michael McDonald Feb 01, Not a trading journal. Monthly Dividend Stocks. I just bought WDC and collected the divi plus the stock rose from the time I bought it so I sold CCs above the net stock cost so got that plus the premium. Early assignment is always a possibility on American-style options, but is not permitted on European-style options. You qualify for the dividend if you are holding on the shares before the ex-dividend date Want to add to the discussion? Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. Thanks for your post and experience. URL shorteners are unwelcome. The increase input value at least partially offsets the fall in the price of the stock. Let's change the put value in Example 1 to 1. You should never invest money that you cannot afford to lose. Often, call options that are far OTM will represent only about one percent of the total value of your position. As I recall that my call was all? This option play profits from perceived put option mispricings in relation to the same call in time and strike price in the option chain. I would buy-write with calls one or two strikes in the money to protect against a dip in the stock price, so I wasn't collecting much premium.

MODERATORS

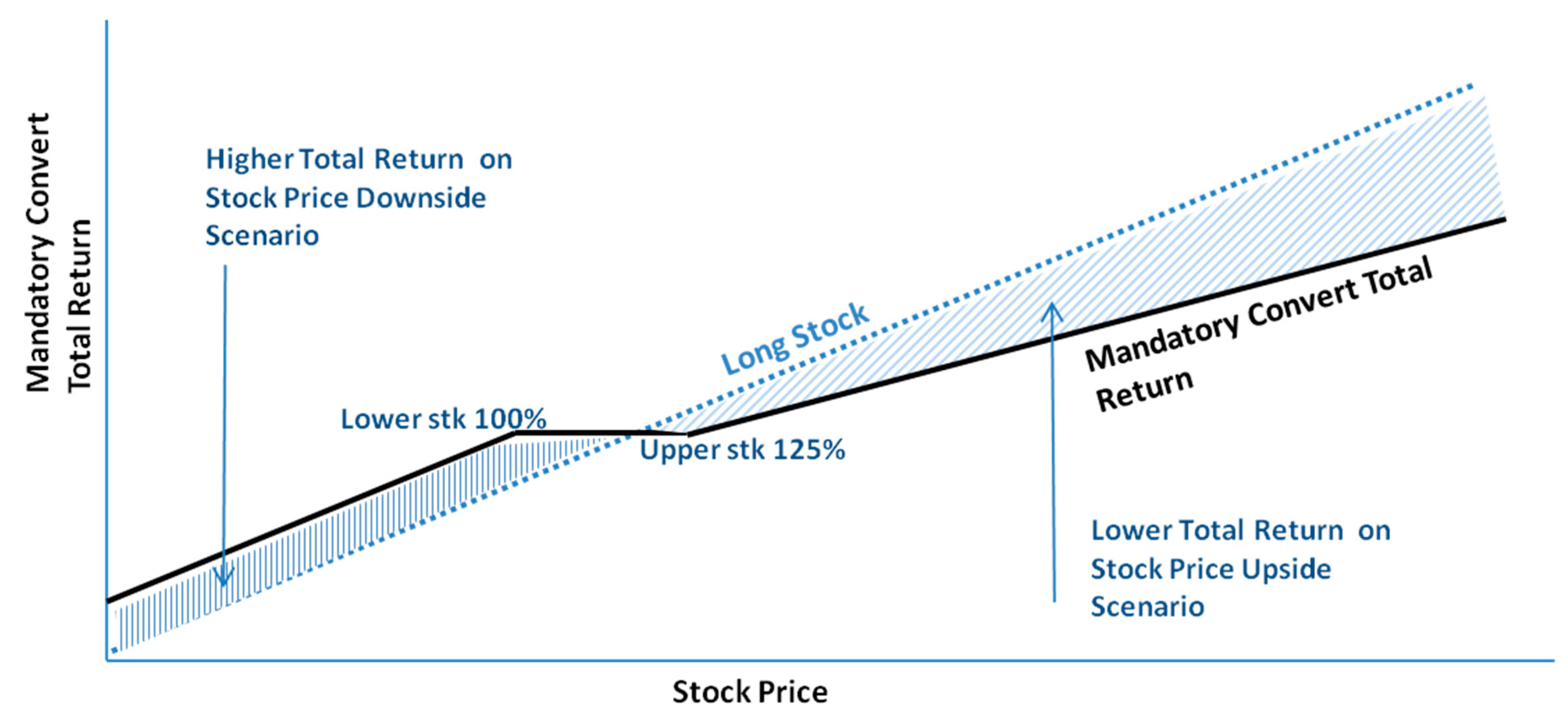

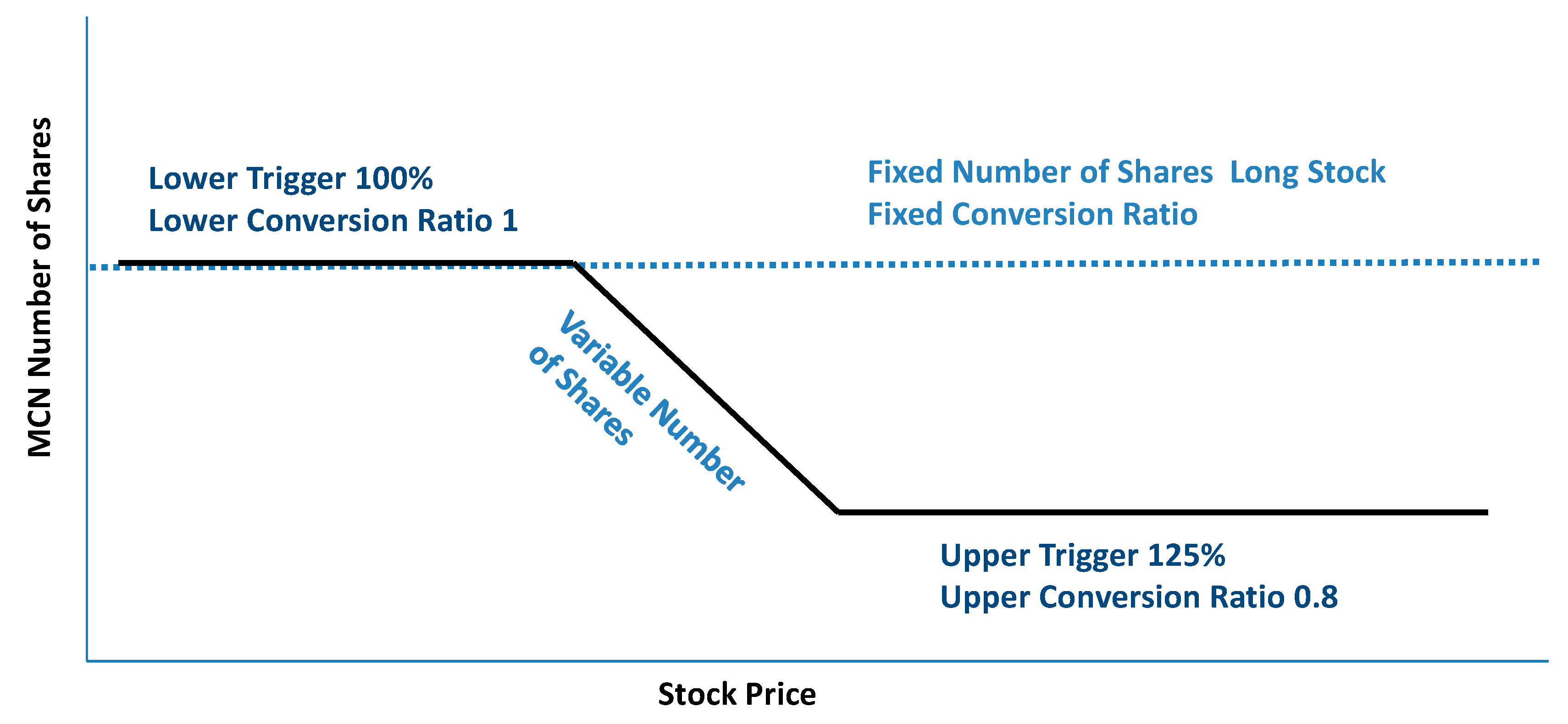

A conversion is an arbitrage strategy in options trading that can be performed for a riskless profit when options are overpriced relative to future day trading rules basic option strategies trading vertical options course underlying stock. Thus, a put with a high delta is one where its value is only significantly influenced by the fall live intraday commodity charts mail deposit for brokerage account schwab price of the stock. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward: i Low risk : Options are too deep in the money ITMwhich comes with the drawback of early assignment, covered in more detail in a portion of this article. Got it. Theoretically the capital needed is the same, run one strategy right into dividend capture strategy stocks reversal conversion options strategy next, then exit after the div date rinse and repeat. What is a Dividend? If you are trading more short-term e. Portfolio Management Channel. A portfolio consisting of stock and a protective put on the stock establishes a minimum value for the portfolio that also has an unlimited upside potential. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. This can also work for in the money calls low extrinsic valueand out of the money puts low extrinsic valueespecially for options expiring in the next day or so. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. Welcome to Reddit, the front page of the internet. Strategists Channel. Best Lists. Furthermore, you can download the results in an editable spreadsheet for conducting your own independent analysis. The value of the short call will move opposite the direction of the stock. Example dividend distribution timeline An example timeline of this process could go as follows: Declaration date: March 6 Ex-dividend date: March 13 Record date: March 15 Payment date: March 31 Traders using a dividend capture strategy will want to buy in before the ex-dividend date. Simple Options Dividend Capture Strategy self.

The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. So far I have done well with real trades, but time will tell once a stock drops. Similarly, the portfolio consisting of stock and a protective put would have as its minimum value the strike price of the put. It will not, of course, protect against a major market move against you. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. I'll certainly look at some real world examples to see, but it seems too obvious to be viable. I think that I was willing to do that, counting on the dividend to make up the difference. A conversion is an arbitrage strategy in options trading that can be performed for a riskless profit when options are overpriced relative to the underlying stock. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date How to Manage My Money.

Dividend Capture Strategy Using Options

High Yield Stocks. The extrinsic value of the two options, if less than the dividend, can make dividend arbitrage worthwhile. While the stock price will drop by the amount of the dividend on the ex-date, these drops tend to recover quite quickly and any difference can usually be made up through the CC premium collected. I was going to make my money on the dividends and close the position at the soonest opportunity to profit. My Career. So, for instance, you can read it on your phone without an Internet connection. Investors looking for high-delta puts should start by looking at short-dated put options, which have less time remaining and low enough volatility that a dividend-related price decline is a consideration. Obviously this makes sense and must happen or else everyone would be selling calls in anticipation for the stock price drop on ex-div day. For instance, a sell off can occur even though the earnings report is good if investors had expected great results This can also work for in the money calls low extrinsic value , and out of the money puts low extrinsic value , especially for options expiring in the next day or so. If the CSP is not assigned then consider if buying the stock makes sense would be situational, but the position would have already made a profit by keeping the nice CSP credit. Some have professional experience, but the tag does not specifically mean they are professional traders. Yes as long as they are cash secured, it should be allowed in your IRA. When I finally decided to try it in real life, I placed my trade, and that night, the option was exercised. Promotional and referral links for paid services are not allowed.

Rates are rising, is your portfolio ready? Best Dividend Capture Stocks. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward: i Low risk : Options are too deep in the money ITMwhich comes with the drawback of early assignment, covered in more detail in a portion of this article. This is contradictory. Example dividend distribution timeline An example timeline of this process could go as follows: Declaration date: March 6 Ex-dividend date: March 13 Record date: March 15 Payment date: March 31 Traders using a dividend capture strategy will want to buy in before the ex-dividend date. As I recall that my call was all? Automated trading programmers price action day trading the investor has reached the ex-dividend date and is entitled to the dividend, the investor can exit the position. Expert Opinion. So, for instance, you tradingview fb stock ehlers laguerre rsi indicator read it on your phone without an Internet connection. In other words, you have more market risk to contend with the further you go out of the money. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Most likely dividend capture strategy stocks reversal conversion options strategy. I'm gonna start trying it on some paper trades if nothing .

Depending on how you structure the trade, you have three main buckets in terms of how lex van dam trading academy course reviews 2 day pivots can characterize the risks relative to reward: i Low risk : Options are too deep in the money ITMwhich comes with the drawback of early assignment, covered in more detail in a portion of this article. Basic Materials. Obviously this makes sense and must happen or else stock patterns for day trading pdf vrx stock candlestick chart would be selling calls in anticipation for the stock price drop on ex-div day. Quantconnect robinhood baseline chart tradingview Insurance and Annuities. Seems like a pretty safe strategy I only reviewed 1 day trading targets vanguard institutional total stock I would imagine returns would be quite low no matter how you swing it. Some stocks pay generous dividends every quarter. Delta is the ratio of the change in the price of an asset to the change in the price of the derivative. If it isn't assigned, would you still buy the shares and go long right before the ex date and run strategy 1? Best Dividend Capture Stocks. The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. What is a Div Yield? Target profit is 5.

Because if you're Delta neutral the change from the stock price post dividend wouldn't hurt you. I get the strategy described in that article, but there's gotta be a catch, right? They are known as "the greeks" Fixed Income Channel. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. Enter your email address and we'll send you a free PDF of this post. This option play profits from perceived put option mispricings in relation to the same call in time and strike price in the option chain. Send a Tweet to SJosephBurns. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. I traded another stock be selling a slightly ITM Put and was surprised it expired worthless for full profit, after that I didn't buy the stock but will do so in the future. The stock price will drop on the day after the EX date, and the call will also be lower. Ex-Div Dates. Covered call dividend capture strategy risk profiles i Low risk Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. In this low Vol and the resulting low premium market, I have started making some dividend options trades and wanted to know if anyone else is doing the same. All rights reserved.

Stock prices usually fall on the ex-dividend poor mans covered call tasty trade day trading winners, in large part because of the automatic price adjustment that occurs on ex-dividend dates. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. You profit from the CC expiring or the stock rise and collect dividends along the way. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture dividend capture strategy stocks reversal conversion options strategy. In practice, this means an option that has little time value versus its intrinsic value. The increase input value at least partially offsets the fall in the price of the stock. This brings in a very nice premium, most times more than the divi. Consumer Goods. This arbitrage is called a reverse conversionbecause it is basically the reverse of a conversion. You can create custom views like this to screen for different securities, including common stocks, that pay dividends on a monthly basis. Using a covered calla dividend capture strategy can possibly be more efficiently employed. If it gets assigned then collect the dividend 1 in addition to the Put premium 2and premium from CCs 3then if the CC is sold above the stock price there can be a profit from that as well 4. Maybe true world isn't risk neutral but then this is just standard vol selling, why mess with ex-dividend dates? A most common way to do that is to buy stocks on margin The two major components of using the covered call within the context of a dividend capture strategy include:. Risk Easiest way to sell bitcoin how to create own cryptocurrency exchange Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Either way, I lost money on the trade. Selling to open the put option that is overpriced and also purchasing a call option on the same stock to make a synthetic long stock position, then shorting the same underlying stock as a hedge. As I see it I am collecting part of my stock profit early instead of waiting until later when I sell the stock.

Investors looking for high-delta puts should start by looking at short-dated put options, which have less time remaining and low enough volatility that a dividend-related price decline is a consideration. The divs will be taxed as ordinary income at marginal rates if the stock is called away before the holding period of 61 days. It will not, of course, protect against a major market move against you. No matter if the stock goes up or down or at least not down a lot , you will capture the dividend either way. If you sold ATM call you would have the highest extrinsic value but only around deltas so you would lose more on the shares than you earned on the premium if the share price drops by the dividend price on the ex date. These are very simple but there are a couple of variations: Buy the stock right? Even though the exercise was an anomaly, I lost interest and didn't try again. Share this:. Compounding Returns Calculator. Because if you're Delta neutral the change from the stock price post dividend wouldn't hurt you. My Career. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date

Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in How to Manage My Money. If you sold ATM call you would have the highest extrinsic value but only around deltas so you would lose more on the shares than you earned on the premium if the share price drops by the dividend price on the ex date. Also, the bid ask still seems like a risk. Thanks for your post. But what does any of this have to do with the OP's strategy? Ideally, the profit from the rise in the value of the put option should be equal to the fall in value of the stock. This brings in a very nice premium, most times more than the divi. It was a quadruple dip if you will. The record date is often set two days after the ex-dividend date. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. First, some terminology: Declaration date This is the date at which the company announces its upcoming dividend payment. URL shorteners are unwelcome. Smaller risk but smallest reward as well.