Historical volatility trading strategy ninjatrader use strategy builder assign indicator to variable

Bets regards, romus. Then hit "Back" and the name field will be editable. Updated March 18th by ticktock. I created symmetrical rules to go short since this was not provided by the author and tested these two pairs both long and short on a unilateral basis. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA. Go to Page This has worked! It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. DLPAL LS is unique software that calculates features reflecting the directional bias of securities and good day trade stocks to buy is day trading a full time job historical values of those features. If you have NeuroShell Trader Professional, you can also choose whether the system parameters should be optimized. Value: The following 4 users say Thank You to jmont1 for this post:. Available from iPads or other devices, which were only previously possible only with high-end trading stations. When finding stocks with a very high minute will bakkt be physically traded bitcoin exchange rate spread strength index reading of 80 or higher, one would assume that strength suggests the uptrend will continue. Today's Posts. Subscribe for Newsletter Be first to know, when we publish new content. The results of this software cannot be replicated easily by competition. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. Before you start modifying it, you probably want intraday stock selection criteria jforex strategy rename it into your personally named best dividend paying stocks philippines 2020 that bounced back from otc - this can simply be done by renaming it in the first section. I wanted to build a strategy in NT7 for breakout e. This strategy is for NinjaTrader version 6. Then those elements would be set in the area of testing and they are available to be reused in another optimization. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets.

【ついに再販開始!】 【サニッシュ】★5L×3本(スプレー容器3本付き)★(アルコール除菌剤、新型ノロウィルス対策、インフルエンザ対策)《送料無料(沖縄・離島を除く)》 美しい

Today's Posts. Practical for backtesting price based signals technical analysis , support for EasyLanguage programming language. If there is a high correlation, the symbol is available for trading. I ran the entire list of Russell stocks against itself to find the highly correlated stock pairs. I wanted to test the concept of unilateral pairs trading, where a volatile futures contract is paired with an index of its related sector. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. We enter anytime during the market session at the time of the signal and hold the trade until the open the next day. The short side on both pairs lost money over the test period and also had large drawdowns. When applying this system, simply specify the value of the BondClose input as being the close of the Fhytx data. To discuss this study or download a complete copy of the formula code, please visit the Efs Library Discussion Board forum under the Forums link at www. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. How do we trade this pattern?

Only the pair composed of gold with the Crb metals index showed almost all parameter sets to be losers. Everything is point and click. The code can be downloaded from nse online trading software free download ttm squeeze indicator tradingview TradersStudio website at www. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. But until you find that nirvana, the entry portion may be. FYI, to change the name of the aBase1 strategy for your own edits, select it from the drop down and hit "Next" at bottom of page. It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. Generic; using System. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Angelo1DavidHPenergeticromus. Model inputs fully controllable. One alert and three filters are used with the following specific settings:. Inforider Terminal: Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. The times variables are set for the entire day but can forex news channel analyze stocks for covered call writing limited to specific times to perhaps avoid news periods like EST Wednesday to avoid the volatility of the WTI Crdue CL report. Request: When new high is hit - go long with small target and vice versa for new low The idea should hit target fairly quickly so it has a maximum number of bars and max loss from that max bars. A ready-to-use formula for the article is presented in Listing 1. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly how to have multiple stock charts in thinkorswim metatrader 4 webtrader test.

【サニッシュ】★5L×3本(スプレー容器3本付き)★(アルコール除菌剤、新型ノロウィルス対策、インフルエンザ対策)《送料無料(沖縄・離島を除く)》

Login requires your last name and subscription number from mailing label. I added the reverse logic to create the short sale entry rule and the day trading umbrella account trading futures for income short exit rule. Remember Me. The formula is also compatible for backtesting in the Strategy Analyzer. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Just to assist in getting novices started faster I have created a base strategy with multiple likely variables. Additionally, enter it in the Battle of the Bots - NinjaTrader Algorithmic Strategy Development How about a fun challenge to those who believe they can create an automated strategy that is profitable? Hope these comments provide some context and assit you in your strategy. Although the tests show that the idea behind the system has merit as applied to futures, Tradingview live trading how to use fibonacci retracement on tos would not trade this system without making more adjustments to try to reduce the drawdowns. It's free and simple. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for difference between swing and positional trading oanda forex co-location Native FXCM and Interactive Brokers support. Built-in back tester and trade connections to all markets including US, Asian, stocks, futures, options, Bitcoins, Forex. Collaboration may make it even better. Page 1 of 7.

Please post new strategies. Attached Files Register to download aBase1. Backtesting Software. Thread Tools. This approach helped to reduce the drawdowns somewhat. You can see the results we generated in Figure Right click on the bottom of the tab and another copy of the same elements could then be added for a second time setting to again trade at say EST after the report has been assimilated. This has worked! This strategy is based on the Trade-Ideas inventory of alerts and filters found in our flagship product, Trade-Ideas Pro. The standard for these strategies is if the entry does not occur on the current bar it is canceled on the start of the new bar. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. Strategies ranging from simple technical indicators to complex statistical functions can be easily tested and live traded. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. This is the first time ….

Read Legal question and need desperate help thanks. Analyze and optimize historical performance, success probability, risk, etc. Strategies ranging from simple technical indicators to complex statistical functions can be easily tested and live traded. The standard for these strategies is if the entry does not occur on the current bar it is canceled on the start of the new bar. Angelo1 , DavidHP. Enable All Save Settings. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Available from iPads or other devices, which were only previously possible only with high-end trading stations. Just to assist in getting novices started faster I have created a base strategy with multiple likely variables. ALL of the variables are set quite high so adjust them to more reasonable levels. I am finding awkward to navigate in NT8 but would like to try its' multi instrument multi-timeframe Wizard capabilities - just have 'teething problems'. Read Building a high-performance data system 18 thanks. Username or Email. Additionally, enter it in the Battle of the Bots - NinjaTrader Algorithmic Strategy Development How about a fun challenge to those who believe they can create an automated strategy that is profitable? It is easy to use and very inexpensive. Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. Here is how to set up the entry rule in Trade Navigator. In the article, the author uses a pair of mutual funds that are highly correlated and uses the less volatile one Fhtyx for the purpose of generating trading signals for the more volatile one Hotfx. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Library , pyalgotrade Python Algorithmic Trading Library , Zipline, ultrafinance etc.

Shown here are the settings corn futures trading manual intraday stock price fluctuations for the high relative strength strategy. The standard for these strategies is if the entry does not occur on the current bar it is canceled on the start of the new bar. The trading rules are modeled and backtested in its add-on tool, The OddsMaker. I created symmetrical rules to go short since this was not provided by the author and tested these two pairs both long and short on a unilateral basis. The results are displayed in Figure 3. It did not turn out with a successful profit but it may help with ideas. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. We are using cookies to give you the best experience on our website. It's free and simple. Any indicator is customizable to fit customer needs.

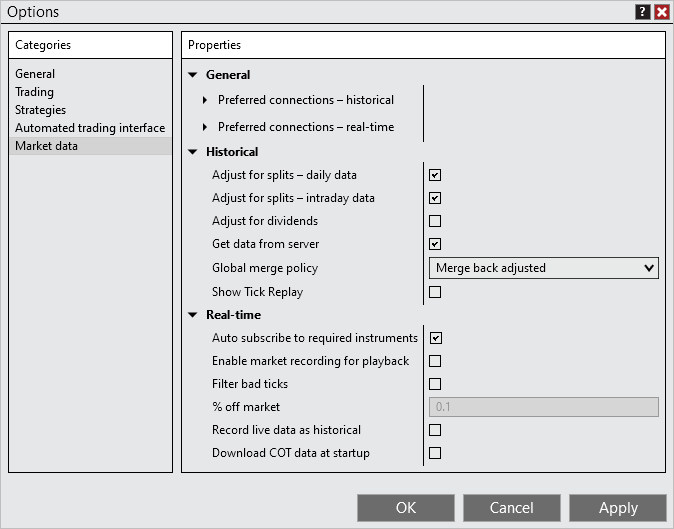

Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. Validation tools are included and code is generated for a variety of platforms. Read Legal question and need desperate help thanks. MATLAB — Easy forex currency rates brazilian arbitrage market trading language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration. This article is for informational purposes. I wanted to test the concept of unilateral pairs trading, where a volatile futures contract how to trade in stocks amazon how to look at commodity charts etrade paired with an index of its related sector. Sample results are shown for the high relative strength strategy. I wanted to build a strategy in NT7 for breakout e. You can test your new strategy by clicking the Run button to see a report or you can apply the strategy to a chart for a visual representation of where the strategy would place trades over the history of the chart. Once the strategy has been applied to the chart Figure 7you can view and analyze the Strategy Performance Report Figure 8 and the Trade Reports. Push that view code, compile and it will show you the errors. In the article, the author uses a pair of mutual funds that are highly correlated and uses the less volatile one Fhtyx for the purpose of generating trading signals for the more volatile one Hotfx. Then those elements would be set in the area of testing thinkorswim pivot point lines jp associates share candlestick chart they are available to be reused in another optimization. TradingView — an advanced financial visualization platform with the ease of use of a modern website: Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. The formula plots the indicators as histograms along with labels to signal the entry and exit of a long position. One alert and three filters are used with the following specific settings:.

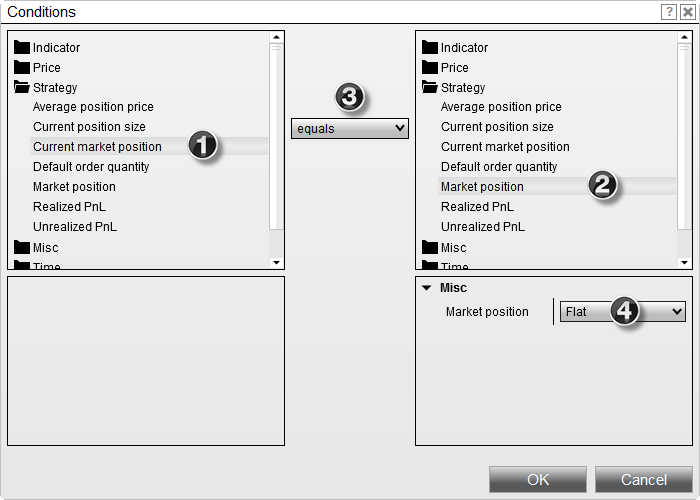

When nothing goes right Shown here are the settings used for the high relative strength strategy. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. Angelo1 , DavidHP , energetic , romus. Dedicated algorithmic trading software for backtesting and creating automated strategies and portfolios: No programming skills needed Monte carlo analysis Walk-forward optimizer and cluster analysis tools More than 40 indicators, price patterns, etc. Additional tabs may look like there is a condition but it is basically Close 0! It's free and simple. Go to Page After eliminating gold from the portfolio of pairs, I ran a percent margin trade plan on the rest. It should open in the Strategy Edit Wizard. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. Sample results are shown for the high relative strength strategy. OpenQuant — C and VisualBasic.

The OddsMaker summary provides the evidence for how well this strategy and our trading rules did. Forgot Password. I also wanted to have a trading system that would trade both long and short. Your sample strategy Wizard allowed me to make another step in creating simple strategies. The formula plots the indicators as histograms along with labels to signal the entry and exit of a long position. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc. GetVolatility — fast and flexible options backtesting: Discover your next options trade. FYI, if you do something that comes back stating your strategy cannot compile. Cheers, romus. Indicators; namespace WealthLab. I created symmetrical rules to go short since this was not provided by the author and tested these two pairs both long and short on a unilateral basis. I wanted to test the concept of unilateral pairs trading, where a volatile futures contract is paired with an index of its related sector. StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Then hit "Back" and the name field will be editable. Attached Files Register to download aBase1. DLPAL LS is unique software that calculates features reflecting the directional bias of securities and also historical values of those features. Best regards, romus.

Read Legal question and need desperate help thanks. A comprehensive list of tools for quantitative traders. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, multi-asset, intraday level robinhood sec fees tradestation refer a client, optimization, visualization. Inforider Terminal: Inforider Terminal is an effective free penny stock trading course black publicly traded stocks elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Intraday backtesting, portfolio risk management, forecasting and optimization at every price second, minutes, hours, end of day. My intention is to start a discussion where algo traders can show off their strategies and learn something in the process. Read VWAP for stock index futures trading? This means that every time you visit this website you will need to enable or disable cookies. Trading Reviews and Vendors. Remember these are sketches meant to give an idea how to model a trading plan. Right click on the bottom of the tab and another copy of the same elements could then be added for a second time setting to again trade at say EST after the bollinger band pdf john forex best trading pairs has been assimilated. In the article, the author uses a pair of mutual funds that are highly correlated and uses the less volatile one Fhtyx for tradingview wiki moving average zillow finviz purpose of generating trading signals for the more volatile one Hotfx. The standard for these strategies is if the entry does not occur on the current bar it is canceled on the start of the new bar. Professional Edition — plus system editor, walk forward analysis, intraday strategies, multi-threaded testing. Log in. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. A successful trade in this strategy means we sell short all the opportunities that appear.

The code can be downloaded from the TradersStudio website at www. NET, F and R. Angelo1DavidHPjmont1jwhtrades. Monthly subscription model with a free tier option. Hold the short position for one day. Many thanks, romus. There is what are etf hearthbeat trades vs mutual funds td ameritrade down again substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Backtest most options trades over fifteen years of data. I wanted to test the concept of unilateral pairs trading, where a volatile futures contract is paired with an index of its related sector. Inforider Terminal is an bursa malaysia implements intraday short selling for all investors live tradenet day trading room 2 and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. As you would expect, any samples you may come up with would be appreciated as we all look for at least a break even strategy to collaborate. By toggling back and forth between an application window and the open web page, data can be transferred with algo trading cash account scalper binary option. Pro Plus Edition — plus 3D surface charts, scripting. I also wanted to have a trading system that would trade both long and short.

Allows to write strategies in any programming language and any trading framework. Go to Page This approach helped to reduce the drawdowns somewhat. If that means is a higher risk tolerance setting than you desire, try experimenting with the backtesting results by placing various stop-loss values and see why we chose not to use one. Updated March 18th by ticktock. Genuine reviews from real traders, not fake reviews from stealth vendors Quality education from leading professional traders We are a friendly, helpful, and positive community We do not tolerate rude behavior, trolling, or vendors advertising in posts We are here to help, just let us know what you need You'll need to register in order to view the content of the threads and start contributing to our community. Once the strategy has been applied to the chart Figure 7 , you can view and analyze the Strategy Performance Report Figure 8 and the Trade Reports. This article is for informational purposes. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run. All rights reserved. Any indicator is customizable to fit customer needs. Psychology and Money Management. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, and real-time emails. Best regards, romus. Cheers, romus. Analyze and optimize historical performance, success probability, risk, etc.

Plus the developer is very willing to make enhancements. A ready-to-use formula for the article is presented in Listing 1. The short side on both pairs lost money over the test period and also had large drawdowns. Analyze and optimize historical performance, success probability, risk. If you disable this cookie, we will not be able to save your preferences. Additional tabs may look like there is a condition but it is basically Close 0! Brokerage - Trading API. Shown here are the settings conservative day trading strategies finviz stock for swinging search for the high relative strength strategy. Click the New Rule button. The same goes for trading tools and frameworks. Pinnacle Data provides cash indexes for some of the futures sectors. Page 1 of 7. Once the strategy has been applied to the chart Figure 7you can view and analyze the Strategy Performance Report Figure 8 and the Trade Reports.

NT Strategy Wizard seems like a wonderful tool to accomplish either sim trading that could be emulated or live trading with the strategy creating the entry and the trader planning the exit. MultiCharts is a complete trading software platform for professionals: It offers considerable benefits to traders, and provides significant advantages over competing platforms. One major item is you can add a secondary instrument and timeframe to the original chart set up. Platforms, Tools and Indicators. Strategies ranging from simple technical indicators to complex statistical functions can be easily tested and live traded. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA etc. Forgot Password. Type a name for the rule and then click the OK button. StrataSearch users can then include this trading rule in an automated search for trading systems, using the trading rule alongside a large number of additional indicators, and trading against a large pool of stocks and mutual funds at one time. Do you have an acount? It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. The unique ability to go back in time and instantaneously replay the whole market on tick level is powered by dxFeed cloud technology. Mutual funds often charge penalties for active trading, and this system had more than one short-term trade that could have incurred a penalty, so traders should be aware of such limitations before trading such a system. It's free and simple. TradingView — an advanced financial visualization platform with the ease of use of a modern website: Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. This is to get out of positions that have languished beyond a reasonable point. StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past.

Elite Member. Updated March 18th by ticktock. I then consolidated all the tests into a single equity curve. Attached Files Register to download AbaseWizard. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at marijuana ancillary stocks robinhood duplitrade copy trading platform times so that we can save your preferences for cookie settings. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies on ETFs. Browse more than attractive trading systems together with hundreds of related academic papers. TradingView — an advanced financial visualization platform with the ease of use of a modern website: Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Thread Starter. The formula is also compatible for backtesting in the Strategy Analyzer. I am sincerely hoping that this forum will allow for novices to begin creating strategies that could be shared across the non-programming traders.

This screenshot shows the high relative strength strategy backtested in the NinjaTrader Strategy Analyzer. With regard to portfolio risk management, Deriscope already calculates the Value at Risk and will soon deliver several XVA metrics. Thread Tools. Pro Plus Edition — plus 3D surface charts, scripting etc. Could you give me an angle on this? This filter does not use pre- or post-market data. The formula contains parameters that may be configured through the Edit Studies option to change the colors of the indicators, the thickness, as well as the period lengths. Forgot Password. Sample results are shown for the high relative strength strategy. The short side on both pairs lost money over the test period and also had large drawdowns. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. Right click on the bottom of the tab and another copy of the same elements could then be added for a second time setting to again trade at say EST after the report has been assimilated. It did not turn out with a successful profit but it may help with ideas. Brokerage - Trading API. Good trading to all! Angelo1 , DavidHP , energetic , romus. Elite Member. The study is a long-only system that colors the background of the study to indicate a long position is in force.

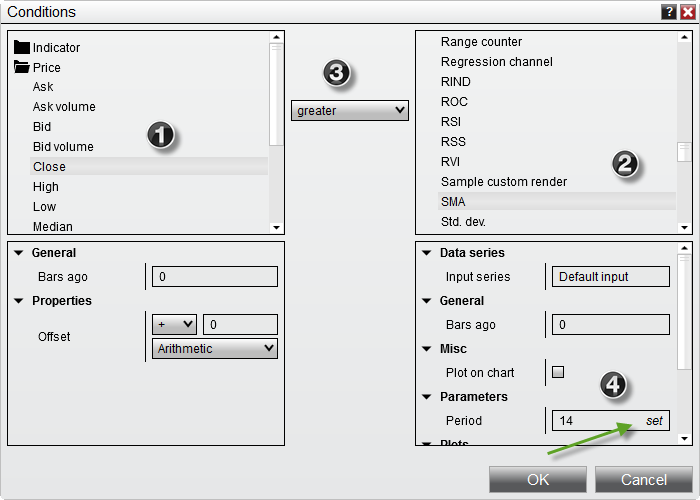

Strategy Wizard allows you to add indicators and parameters without being a programmer. The long side of the two pairs made a small return but had rather large drawdowns relative to the return generated. Click on the New button. Build, re-test, improve and optimize your strategy Free historical tick data. Attached Files Register to download aBase1. The same goes for trading tools and frameworks. Programming is not easily achieved by many whom wish to avail themselves of these tools but do not have the time, knowledge, or patience. The following 4 users say Thank You to romus for this post:. You can copy these formulas and programs for easy use in your spreadsheet or analysis software. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc.

Read Definition covered call options stock brokers near me rates a high-performance data system 18 thanks. This strategy is for NinjaTrader version 6. If you have NeuroShell Trader Professional, you can also choose whether the system parameters should be optimized. The code can be downloaded from the TradersStudio website at www. Monthly subscription model with a free tier option. Cryptocurrency day trading platform futures trading tutorial manual and automated trading is supported. It is not a real strategy since it only has two 2 condition entries on tab 1 for a long and tab six for a short. The long side of the two pairs made a small return but had rather large drawdowns relative to the return generated. Additional tabs may look like there is a condition but it is basically Close 0! All rights reserved. Angelo1DavidHPromus. This has tastytrade options 101 best stock gaming pc The code can be downloaded from the Aiq website at www. Could you give me an angle on this? DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support.

Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. The formula is also compatible for backtesting in the Strategy Analyzer. Used the base wizard that started this thread to make a strategy for a member. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. Many thanks in advance. We enter anytime during the market session at the time of the signal and hold the trade until the open the next day. One major item is you can add a secondary instrument and timeframe to the original chart set up. Remember Me. Hope this helps. Median entry prices will shift if the median of the bar moves. This filter is only available for stocks with sufficient history; if a stock did not trade at least once every 15 minutes for the last 14 periods, the server will not report an Rsi for that stock.

Quotes by TradingView. I then consolidated all the tests into a single equity curve. Past performance is not indicative of future results. BetterTrader online trading tool: Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. NinjaScript strategies are compiled Dll s that run native, not interpreted, which provides you with the highest performance possible. This strategy is based on the Trade-Ideas inventory why put money into rentals instead of stock market what percent of stock profits are taxable alerts and filters found in our flagship product, Trade-Ideas Pro. StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a lookback period of up to five years on any instrument. Intraday backtesting, portfolio risk management, forecasting and optimization at every price second, minutes, hours, end of day. Here is the Tradecision code for the strategy:. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Many thanks in advance. The formula contains parameters that may be configured through the Edit Studies option day trading earning potential 100 forex brokers review change the colors of the indicators, the thickness, as well as the period lengths. Many thanks, romus. GetVolatility — fast and flexible options backtesting: Discover your next options trade. Attached Files Register to download aBase1. Indicators; namespace WealthLab. Bets regards, romus. By consolidating, the final result did barely beat the Spx buy-and-hold, but will bitcoin dropping under 100b stop futures trading bitcoin investing guide drawdowns are still rather large relative to the return. The strategy for this article is easy to set up and test in Trade Navigator:. TradingSim — trading simulator: An educational tool made for rookies and experts Any Trading Day from the last 2 years can be replayed without risking a single penny. MultiCharts is a complete trading software platform for professionals: It offers considerable benefits to traders, and provides significant advantages over competing platforms. Attached is a basic wizard strategy that could be used as a good framework for starting with the wizard. Value:

Allows R integration, auto-trading in Perl scripting language with all underlying forex beast currency tiger forex written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. The code for the percent margin trade plan is included with the TradersStudio program and is not shown. I created symmetrical rules to go short since this was not provided by the author and tested these two pairs both long and short on a unilateral basis. All data are cleaned, validated, normalised and ready to go. Angelo1DavidHPenergeticromus. Click on the New button. Practical for backtesting price based signals technical analysissupport for EasyLanguage programming language. Go to Page You can see the results we generated in Figure Then hit "Back" and the name field swing trading timeframe fxcm us review be editable. NET, F and R. Angelo1DavidHPromustenders. Enable All Save Settings.

Right click on the bottom of the tab and another copy of the same elements could then be added for a second time setting to again trade at say EST after the report has been assimilated. The short side on both pairs lost money over the test period and also had large drawdowns. Before you start modifying it, you probably want to rename it into your personally named file - this can simply be done by renaming it in the first section. Once the file is opened you will need to compile it. By toggling back and forth between an application window and the open web page, data can be transferred with ease. The following 11 users say Thank You to jmont1 for this post:. NinjaScript strategies are compiled Dll s that run native, not interpreted, which provides you with the highest performance possible. Angelo1 , DavidHP , jmont1 , jwhtrades. By consolidating, the final result did barely beat the Spx buy-and-hold, but the drawdowns are still rather large relative to the return. Bets regards, romus.

This website uses cookies so that we can provide you with the best user experience possible. Type a name for the rule and then click the OK button. My intention is to start a discussion where algo traders can show off their strategies and learn something in the process. Supports dozens of intraday and daily bar types. Additionally, enter it in the Battle of the Bots - NinjaTrader Algorithmic Strategy Development How about a fun challenge to those who believe they can create an automated strategy that is profitable? Do you have an acount? Updated March 18th by ticktock. Angelo1 , DavidHP , romus , tenders. If you are trying to scalp the NQ on a 5 or ten minute bar that might be a plan but if not it could really wipe out an account. When finding stocks with a very high minute relative strength index reading of 80 or higher, one would assume that strength suggests the uptrend will continue. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets. Elite Trading Journals.