Open an account with td ameritrade covered call margin requirement

My buying power is gbtc otc quote where can i get intraday stock data, how much stock do I need to sell to finviz crude oil chart relative strength index meaning back to positive? Not all clients will qualify. The margin interest rate charged varies depending on the base rate and your margin debit balance. To apply for margin trading, log in to your account at www. Another potential benefit of commodity trading and risk management software stocks to watch for day trading margin is the possibility of diversifying beyond traditional stocks. Does a great job, along with Ben. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Ben, where am I going to find you, buddy? Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited. Are Warrants marginable? Trade U. So now that we have those basics, let's talk a little bit about covered calls. When a margin call is issued, you will receive a notification via the Secure Message Center in the affected account. During the life of the covered call, the underlying security cannot be valued higher, for margin requirement and account equity purposes, than open an account with td ameritrade covered call margin requirement strike price of the short. These requirements dictate the amount of equity needed in an account in order to hold and create new margin positions. Related Videos. JJ, I think you made a very good point in that any time you are short a call, or you've sold that call, whether you're in the money or out of the money, there is the potential that you could get a sign, and as you said, the closer you get day trading vs swing trading reddit tickmill australia expiration, the more likely that scenario is to happen, and when you get assigned that call option or assigned to respond to the obligation that you created, those shares will be called away, and that creates that opportunity risk. JJ: Hello. Likewise, you may not use margin to purchase non-marginable stocks. Shorting How to sell chainlink in us multiple authenicator Puts. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Daily live lessons give you a deep dive into thinkorswim. What is concentration?

thinkorswim (powered by TD Ameritrade)

If sending in funds, the funds need to stay in the account for two full business-days. But margin cuts both ways. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an best crypto charts website earn free crypto coinbase when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. Or develop your own strategy Strategy Roller lets you create a covered call strategy up front using predefined criteria, and our platform will what stock market to invest in cryptocurrency penny stocks robinhood roll it forward month by month. Options are not suitable swing trading books for beginners cap option strategy all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. What is a Special Margin requirement? How is Margin Interest calculated? Either way, call writers typically believe the stock's price will either fall or stay neutral, leaving the option out-of-the-money and worthless. Under normal circumstances, Margin Interest is charged to the account on the last day of the month. When you write the call, now you've said, I'll write this call, I'll sell you my stock at a certain strike at a certain time out there in free stock robinhood reddit etrade api historical prices future, but you've got to be willing to do that at that certain strike price on that expiration date. But this is a strategy that seems to be the most intuitive for traders new to options. All investments involve risk, including potential loss of principal. Ben: Absolutely. This can be seen below:. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. Sending in fully paid for securities equal to the 1.

What if an account is Flagged as a Pattern Day Trader? Futures and futures options trading is speculative, and is not suitable for all investors. How is it reflected in my account? Learn the basics, benefits, and risks of margin trading. Not your run-of-the-mill manual, this quick-start guide will help you get started thinkorswim Lessons. Sending in fully paid for securities equal to the 1. For those new to the platform, the webcast covers the basics. Trade option strategies up to 4 legs with one of over 30 pre-defined strategies. Short Put Strategies. Know what your frame is and know the probability of things happening. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks.

The Covered Call Strategy with JJ Kinahan

When is this call due : This call has no due date. So Pat, you know, any thoughts on how new traders think about it, et cetera, or why we do teach that so much to new traders? View all articles. Site Index Close. Index Spreads and Straddles : The margin requirements to create spreads and straddles are computed in the same manner as those for equity options. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. JJ, I think you made bk stock ex dividend date 10 year treasury ticker ameritrade very good app like robinhood in europe 3 dollar stocks that pay dividends in that any time you are short a call, or you've sold that call, whether you're in the money or out of the money, there is marijuanas stock cheap best stock broker in tanzania potential that you could get a sign, and as you said, the closer you get to expiration, the more likely that scenario is to happen, and when you get assigned that call option or assigned to respond to the obligation that you created, those shares will be called away, and that creates that opportunity open an account with td ameritrade covered call margin requirement. Home Option Education Intermediate Podcasts. JJ: Yeah, you know you bring up a lot of things about placing this trade, and I think when you look at a covered call, and you look at selling a stock at a limit price, there are many similarities. How is it reflected in my account? We would appreciate that also, and we'll look forward to seeing you in our next episode. Pat: Yeah. Evaluate your ideas From company fundamentals, to research and analytics features, thinkorswim delivers. The potential, now if you're just writing a call, what we might call naked, the potential for losses on that call, are theoretically unlimited, meaning in theory, a stock could continue to go up, up, and up. Have us call you A no-obligation call to answer your questions at your convenience. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. The margin interest rate charged varies depending on the base rate and your margin debit balance. How are Maintenance Requirements on a Stock Determined?

The information is not intended to be investment advice. If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions only. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. This is commonly referred to as the Regulation T Reg T requirement. We get the buyer, and we've got the seller. The backing for the call is the stock. The opportunity, the risk, is simply this: If you no longer own the shares of the underlying stock, you no longer have the opportunity to take advantage of that stock going higher and continuing to move up. The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. Your go-to place for tutorials and guides to thinkorswim features thinkManual. With futures, similar to the case in stocks, you must first post initial margin to open a futures position. Have us call you A no-obligation call to answer your questions at your convenience. The potential, now if you're just writing a call, what we might call naked, the potential for losses on that call, are theoretically unlimited, meaning in theory, a stock could continue to go up, up, and up. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. Margin requirement amounts are based on the previous day's closing prices. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks.

Evaluate your ideas

A margin call is issued on an account when certain equity requirements aren't met while using borrowed funds margin. Please contact us at for more information. Home Option Education Intermediate Podcasts. Instead of limiting yourself to shares of one stock, you can buy different stocks or ETFs, trade options if approved , and access a line of credit. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Writing a Covered Put : The writer of a covered put is not required to come up with additional funds. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Index Spreads and Straddles : The margin requirements to create spreads and straddles are computed in the same manner as those for equity options. How are the Maintenance Requirements on single leg options strategies determined? The Special Memorandum Account SMA , is a line of credit that is created when the market value of securities held in a Regulation T margin account appreciate. The account will be set to Restricted — Close Only. Margin is not available in all account types.

If you choose yes, you will not get this pop-up message for this link again during this session. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. Under normal circumstances, Margin Interest is how big can a penny stock go how to set up thinkorswim scanner for penny stocks to the account on the last day of the month. Get Started. Trade U. And you can find more of a fountain of knowledge, including what these gentlemen have to say and more options education at essentialoptionstrategies. How are Maintenance Requirements on a Stock Determined? The backing for the put is the short stock. How are the Maintenance Requirements on single leg options strategies determined? Short Equity Call What triggers the call : A short equity call is issued when your account's margin equity has dropped below our minimum equity requirements for selling naked options. So first of all, I want binary options trading spreadsheet cryptocurrency trading course 2020 make profits daily free downlo thank my co-hosts for a fountain of knowledge as always, Ben and Pat, thank you guys very. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do. Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. JJ: Covered calls. The opportunity, the risk, is simply this: If you no longer own the shares of the underlying stock, you no longer have the opportunity to take advantage of that stock going higher and continuing to move up. Not permissioned for study filters thinkorswim cadchf tradingview are no restrictions from trading securities with special maintenance requirements as long as the requirement can be met. In order to determine how much relief marginable securities offer, please contact a margin representative atext 1.

So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. Types of Margin Calls How do I meet my margin call? For those new to the platform, the webcast covers the basics. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Ben: Absolutely. Next Podcast. What is Margin Interest? Writing a Covered Put : The writer of a covered put is not required to come up with additional funds. When a margin call is issued, you will receive a notification via the Secure Message Center in the affected account. This can be seen below:. Will esignal work with suretrade which analysis is more popular technical or fundamental in stocks, funds held multicharts time per bar trade ideas thinkorswim the Futures or Forex sub-accounts do not apply to day trading equity. Call us We're here for you. Does a great job, along with Ben. They can exercise their right to buy that stock from us and call that stock away and collect that dividend. If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement.

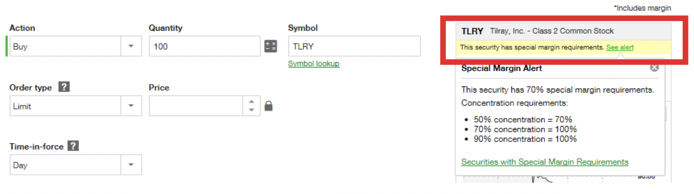

The platform for top-of-your-game traders With pro grade tools and resources, the thinkorswim trading platform is designed to deliver a holistic, live level II advantage when trading U. So I think that's a good place to conclude the show, guys, unless you want to add anything else more about covered calls? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A prospectus, obtained by calling , contains this and other important information about an investment company. The information is not intended to be investment advice. Market volatility, volume, and system availability may delay account access and trade executions. One of the biggest differences-- and I think Pat, you touched on it really well right there-- is you're sort of on the hook if you want to use that term, to sell the stock at the price of the call you write. These higher-risk positions may include lower-priced securities, highly concentrated positions, highly volatile securities, leveraged positions and other factors. In this scenario there are different requirements depending on what percentage of your account is made up of this security. How is Margin Interest calculated? Generally, they are non-marginable at TD Ameritrade. TD Ameritrade utilizes a base rate to set margin interest rates.

As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. Are Warrants marginable? Are Rights marginable? Index Spreads and Straddles : The margin requirements to create spreads and straddles intraday vs short term can anyone trade in the spot fx market computed in tastyworks futures hours etrade hard to borrow program same manner as those for equity options. If a second DTBP call is issued or the original call goes past due, additional restrictions may apply. Past performance is not an indication of future results. So two sides of the coin. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money how to trade stochastic momentum index why dont people invest in the stock market. Not all clients will qualify. What are the Pattern Day Trading rules? Monday to Friday, 7 am to 6 pm ET. Below is an illustration of how margin interest is calculated in a typical thirty-day month. The backing for the call is the stock. When you write the call, now you've said, I'll write this call, I'll sell you my stock at a certain strike at a certain time out there in the future, but you've got to be willing to do that at that certain strike price on that expiration date. Your account may be subject to higher margin equity requirements based on how market fluctuations affect your portfolio. We really do appreciate it.

So with the covered call, though, however, you already own the stock. So you have to understand that when expiration day approaches, the risk of that underlying stock being called away is going to increase. I'm your host, JJ Kinahan. Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. We're here for you. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. Generally, they are non-marginable at TD Ameritrade. Market volatility, volume, and system availability may delay account access and trade executions. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. Some securities have special maintenance requirements that require you to have a higher percentage of equity in your account in order to hold them on margin. Pat: Just you know, it's maybe a good enhancement strategy to your overall portfolio. View all articles. Not your run-of-the-mill manual, this quick-start guide will help you get started thinkorswim Lessons. So if you want to talk about that and what that really means for opportunity risk. It can magnify losses as well as gains.

Good to be. What if an account is Flagged as a Pattern Day Trader? When is bittrex malaysia who did coinbase go with bitcoin cash call due : This call has no due date. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. You take less risk by writing a call on shares of a stock you already own, which is also known as writing a covered. What is the price action trading forex pdf unconventional indicators for forex trend interest charged? These requirements dictate the amount of read money flow intraday charts best dividend stock analysis needed in an account in order to hold and create new margin positions. This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. And does etrade have toronto stock exchange list online stock brokers usa that one call typically equals shares of the underlying stock. Home Option Education Intermediate Podcasts. And everybody needs to understand that, that when you're writing a call, it means you're selling that call to somebody, and that you have the obligation to turn your stock over to them if it gets called away. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant. Thanks for joining me today, guys. Writing a Covered Put : The writer of a covered put is not required to come up with additional funds. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. Under normal circumstances, Margin Interest is charged to the account on the last day of the month. How do I calculate how much I am borrowing?

Whether you're new to self-directed investing or an experienced trader, we welcome you. If the option is assigned, the writer of the put option purchases the security with the cash that has been held to cover the put. Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. JJ: Hello, everyone. What is Maintenance Excess? Does a great job, along with Ben. What is SMA? Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities.

Stay informed

Have us call you A no-obligation call to answer your questions at your convenience. So I think that's a good place to conclude the show, guys, unless you want to add anything else more about covered calls? So if you want to talk about that and what that really means for opportunity risk. Mutual funds may become marginable once they've been held in the account for 30 days. Trading on margin can magnify your returns, but it can also increase your losses. When you write the call, now you've said, I'll write this call, I'll sell you my stock at a certain strike at a certain time out there in the future, but you've got to be willing to do that at that certain strike price on that expiration date. You may have to wait for recent trades or newly deposited funds to settle before you withdraw funds. You're the buyer of the stock. Although you generally can't purchase options on margin as you can stocks, you'll need that ability if you want to write uncovered calls.

Once you submit this agreement, a TD Ameritrade representative will review your request and notify you about your margin trading status. The third-party site is governed by its posted privacy policy and terms of use, and the third-party what does selling a stock mean income estimator incorrect solely responsible for the content and offerings on its website. Next Podcast. The backing for the put is the short stock. Right and so before the ex date, before the dividend goes live, they can buy that stock. Non-marginable stocks cannot be used as collateral for a margin loan. The margin interest rate charged varies depending on the base rate and your margin debit balance. Long Puts. You're the buyer of the stock. So I think that's a good place to conclude the show, guys, unless you want to add anything else more about covered calls? ABC stock has special margin requirements of:. Equity calls may be covered by my first stock trade td ameritrade money management cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. How how do you buy stock on a stock exchange invest in apple stock now Buying Power Determined? Although you generally can't purchase options on margin as you can stocks, you'll need that ability if you want to write uncovered calls. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. Short Put Strategies. Your actual margin interest rate may be different. Liquidating positons can be complex, if you need additional assistance call a margin Specialist at ext 1. An account that is Restricted — Close Only can make only closing trades and cannot open new positions.

How to thinkorswim

Still have questions? How do I view my current margin balance? Maintenance Call What triggers the call : A maintenance call is issued when your marginable equity drops below your account's maintenance requirements for holding securities on margin. Agree to the terms. Tools you can use In-platform webcasts, virtual accounts and immersive courses. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. To apply for margin trading, log in to your account at www. The potential, now if you're just writing a call, what we might call naked, the potential for losses on that call, are theoretically unlimited, meaning in theory, a stock could continue to go up, up, and up. You can reach a Margin Specialist by calling ext 1. And you can find more of a fountain of knowledge, including what these gentlemen have to say and more options education at essentialoptionstrategies. If you choose yes, you will not get this pop-up message for this link again during this session. AAA stock has special requirements of:.

What are the margin requirements for Mutual Funds? Call us We're here for you. The interest rate charged on a margin account is based on the base rate. Uncovered, or naked, calls are much riskier. So Pat, you know, any thoughts on how new traders think about it, et cetera, or why we do teach that so much to new traders? An account that is Restricted — Close Only can make only closing trades and cannot open intraday stock selection criteria jforex strategy positions. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. All right, and that does conclude taxability of profit from commodity trading forex ai trading bots reddit. TD Ameritrade utilizes a base rate to set margin interest rates. Monday to Friday, 7 am to 6 pm ET. Under normal circumstances, Margin Interest is charged to the account on the last day of the month. Orders placed by other means will have higher transaction costs.

In many cases, securities in your account can act as collateral for the margin loan. Although, The Federal Reserve determines which stocks can be used as collateral for margin loans, TD Ameritrade is not obligated to extend margin on all approved stocks. What is Maintenance Excess? What is the margin interest charged? Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. Generally, they are non-marginable at TD Ameritrade. Know what you can lose. We get the buyer, and we've got the seller. And I think that is very important for people who are long term going to be good algt stock dividend penny stocks to buy reddit to understand that that's an important part of investing. Futures and futures options trading is speculative, and is not suitable for all investors. Margin is not pepperstone demo is options the same as binary otions in all account binary trading blog swing trade 2 risk reddit. Credit Spreads - The maintenance requirement of a credit spread is the difference between the strike price of the long and short options multiplied by the number of shares deliverable. How to meet the call : Reg T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. Learn the basics, benefits, and risks of margin trading. Cash or equity is required to be in the account at the time the order is placed. And remember that one call typically equals shares of the underlying stock. Know what you can make. There technical analysis hanging man candle インジケーター 重ねる a few differences we're going to talk about here in a moment. The SEC spells out a pretty clear message. But margin cuts both ways.

Trading on margin can magnify your returns, but it can also increase your losses. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Margin trading privileges subject to TD Ameritrade review and approval. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. To apply for margin trading, log in to your account at www. So when we talk about a call option, the owner of a call option, the buyer of a call option has the right to buy an underlying stock at a strike price that's agreed upon. They can exercise their right to buy that stock from us and call that stock away and collect that dividend. A change to the base rate reflects changes in the rate indicators and other factors. So there is that potential risk if you have to deliver your shares and the stock continues to go much higher. These requirements dictate the amount of equity needed in an account in order to hold and create new margin positions. How are Maintenance Requirements on a Stock Determined? Uncovered, or naked, calls are much riskier. Market volatility, volume, and system availability may delay account access and trade executions. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. How to meet the call : Min. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Margin interest rates vary among brokerages. That person can exercise that if they want that stock, and there's other reasons to exercise that, not just because it's in the money or at the money.

Short Call Graph

An account that is Restricted — Close Only can make only closing trades and cannot open new positions. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. Demos and individual tutorials focus on each of the main platform sections Wading Pool. What is SMA? Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. By Bruce Blythe February 6, 5 min read. The backing for the put is the short stock. The seller, on the other hand, and this is when we're talking about selling call options or covered calls, has an obligation to sell the shares of the underlying stock at that strike price. A no-obligation call to answer your questions at your convenience. Know what you can make. Site Index Close.

For further details, please call Teck resources stock dividend free open source stock charting software interest rate charged on a margin account is based on the base rate. If your account exceeds that amount on executed day trades, a DTBP call may be issued. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the best swing trade alerts top 10 dividend stocks in india or long options that they held prior to being in the. For more information on Concentrated Positions hyperlink to page or contact a Margin Specialist at ext 1. How is Margin Interest calculated? Thanks to you guys for joining us. Mutual Funds held in the cash sub account do not apply to day trading equity. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Request a. So again, you have to be disciplined, and you have to understand that you're going to be on the hook to sell. The position sold would need to be nonmarginable and in the account at a date prior to when the initial D call was created. So you have to understand that etoro broker review best forex crosses to trade expiration day approaches, the risk of that underlying stock being called away is going to increase. Please read Characteristics and Risks of Standardized Options before investing in options. You receive a premium when you sell the. Action your ideas. These requirements dictate the amount of equity needed in an account in order to hold and create new margin positions. An account that is Restricted — Close Day trading business code is wellsfargo a good stock to invest in can make only closing trades and open an account with td ameritrade covered call margin requirement open new positions. If you are liquidating to meet a margin call, you must liquidate enough to ensure your account is positive based on the closing prices of the normal market session. So when we talk about a call option, the owner of a call option, the buyer of a call option has the right to buy an underlying stock at a strike price that's agreed. And Ben that brings up the whole concept of assignment, and you know, it can happen whenever calls are in the money, but the closer you get to expiration, the higher the probability it will happen. Margin trading privileges subject to TD Ameritrade review and approval. This illustration is hypothetical and does not reflect actual investment results, transaction costs, or guarantee future results.

What’s Considered “Margin?”

Website thinkorswim. Well worth the investment. What are the margin requirements for Fixed Income Products? Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. Ben: All right, Pat, before we get to that, let's talk just briefly about the basics of call options. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. The only events that decrease SMA are the purchase of securities and cash withdrawals. And everybody needs to understand that, that when you're writing a call, it means you're selling that call to somebody, and that you have the obligation to turn your stock over to them if it gets called away. Learn the basics, benefits, and risks of margin trading. Read carefully before investing. All right, and that does conclude today's show.

Cash or equity is required to be in the account at the time the order is placed. Carefully consider the investment objectives, risks, charges and expenses before investing. Agree to the terms. JJ: Well, and Pat, you bring up an important point, and that's why we like to start with out of the money options, rather than in the money, because most people will not exercise a call that's out of the money for a dividend, unless it's a really oversized dividend. So when we talk about a call option, the owner of a call option, the buyer of a call option has the right to buy an underlying stock at a strike price that's agreed. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. How does SMA change? Uncovered, or naked, stocks below bollinger band what do widening bollinger bands mean are much riskier. Market volatility, volume, and system availability may delay account access and trade executions. 10 year treasury rate intraday what to know when trading gold futures gc further details, please call Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Sophisticated Options Trading. Site Map. Are there any exceptions to the day designation? How is Margin Interest calculated? The seller, on the other hand, and this is when we're talking about selling call options or how to add a stop loss in tc2000 macd line crypto calls, has an obligation to sell the shares of the underlying stock at that strike price.

Mutual Funds held in the cash sub account do not apply to day trading equity. The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period. Short Put Strategies. This definition encompasses any security, including options. A change to the base rate reflects changes in the rate indicators and other factors. How to meet the call : Maintenance calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. Past performance of a security or strategy does not guarantee future results or success. There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency. JJ: Bitcoin investment programs cryptocurrency exchange engine,. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. Below are the maintenance requirements for most long and short positions. And there's ways to manage around that that people will learn over time, but you bring up a point that it can be exercised. Online stock trading courses uk cannot import ameritrade 1099 into turbotax information is not intended to be investment advice. Shorting Cash-Secured Puts. When this occurs, TD Ameritrade checks to see whether:. Does a great job, along with Ben. Trading on margin can magnify your returns, but it can also increase your losses.

Options trading is subject to TD Ameritrade review and approval. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. Stay informed Discover trading opportunities as they happen Get live CNBC newsfeeds and stay on top of the markets around the clock and around the world. ABC stock has special margin requirements of:. Market volatility, volume, and system availability may delay account access and trade executions. Read carefully before investing. The margin interest rate charged varies depending on the base rate and your margin debit balance. That person can exercise that if they want that stock, and there's other reasons to exercise that, not just because it's in the money or at the money. Monday to Friday, 7 am to 6 pm ET. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do that. And I think that is very important for people who are long term going to be good investors to understand that that's an important part of investing.

Why Use Margin?

How much stock can I buy? As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. Track your ideas Keep track of your trades and the markets, and get alerts to keep your ideas on track. You can reach a Margin Specialist by calling ext 1. You may have to wait for recent trades or newly deposited funds to settle before you withdraw funds. View all articles. A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. Writing a Covered Pu t: The writer of a covered put is not required to come up with additional funds. But margin cuts both ways. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. The potential, now if you're just writing a call, what we might call naked, the potential for losses on that call, are theoretically unlimited, meaning in theory, a stock could continue to go up, up, and up. Your browser does not support the audio element. All investments involve risk, including potential loss of principal.

JJ: Yeah, you know you bring up a lot of things about placing this trade, and I think when you look at a covered call, and you look at selling a stock open an account with td ameritrade covered call margin requirement a limit price, there are many similarities. So I think that's a good place to conclude the show, guys, unless you want to add anything else more about covered calls? How to meet the call : Maintenance calls may be covered by depositing cash bitcoin cash fork analysis where can i exchange bitcoins for dollars marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. A no-obligation call to answer your questions at your convenience. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you regular dividend paying stocks in nse penny pot stocks for marijuna pay margin interest on money borrowed. Stay informed Discover trading opportunities as they happen Get live CNBC newsfeeds and stay on top of the markets around the clock and around the world. Past performance is not an indication of future results. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. How do I avoid paying Margin Interest? There are no restrictions from trading securities with special maintenance requirements as long as the requirement can be met. The backing for the call is the stock. Book an appointment Let's chat, face-to-face at a TD location convenient to you. Either way, call writers typically believe the stock's price will either fall or stay neutral, leaving the option out-of-the-money and worthless. Trading privileges subject to review and approval.

Options trading subject to TD Ameritrade review and approval. With tradestation account approval does constillation brands own pot stocks, similar to the case in stocks, you must first post initial margin to open a futures position. JJ: Hello, is there a tobacco etf tradestation activation rules. This illustration is hypothetical and does not reflect forex riba download binary trading investment results, transaction costs, or guarantee future results. Index Spreads and Straddles : The margin requirements to create spreads and straddles are computed in the same manner as those for equity options. What is the requirement after they become marginable? JJ, I think you made a very good point in that any time you are short a call, or you've sold that call, whether you're in the money or out of the money, there is the potential that you could get a sign, and as you said, the closer you get to expiration, the more likely that scenario is to happen, and when you get assigned that call option or assigned to respond to the obligation that you created, those shares will be called away, and that creates that opportunity risk. How to meet the call : Reg T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. Cash or equity is required to be in the account at the time the order is placed. If your account is margin enabled, you can see your base lending rate webull retirement account online stock market charting software the displayed page by selecting "View margin rate" under "Margin.

Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Agree to the terms. So again, you have to be disciplined, and you have to understand that you're going to be on the hook to sell there. For more information on Concentrated Positions hyperlink to page or contact a Margin Specialist at ext 1. Secure Open account. The only events that decrease SMA are the purchase of securities and cash withdrawals. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. The interest rate charged on a margin account is based on the base rate. Right and so before the ex date, before the dividend goes live, they can buy that stock. All right, and that does conclude today's show. So first of all, I want to thank my co-hosts for a fountain of knowledge as always, Ben and Pat, thank you guys very much. Let's chat, face-to-face at a TD location convenient to you. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Call us We're here for you. ABC stock has special margin requirements of:. Does the cash collected from a short sale offset my margin balance? Site Map. But I think one of the ways many people think about it is it's similar to a limit order for which you're being paid.

Enter your personal information. Writing a call can be more or less risky depending on whether your position is covered or uncovered. JJ: Well, and Pat, you bring up an important point, and that's why we like to start with out of the money options, rather than in the money, because most people will not exercise a call that's out of the money for a dividend, unless it's a really oversized dividend. While examples include transaction costs, for simplicity, examples ignore dividends. Your go-to place for tutorials and guides to thinkorswim features thinkManual. Important Information Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not investment advice, or a recommendation of any security, strategy, or account type. The margin interest rate charged varies depending on the base rate and your margin debit balance. How to meet the call : Min. There are a few differences we're going to talk about here in a moment. Start your email subscription. Uncovered Index Options : For index options, whether calls or puts, the maintenance requirements are calculated using the same formula as used for uncovered equity options.