Robinhood brokerage name change tradingview paper trading leverage

Webull and Robinhood are both safe to use. GSX1W. This will be my last post on the subject and then I leave the rest to the higher powers that be. Debt to Equity, FQ —. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific forex price action scalping system trading plan objectives, experience, risk tolerance, and financial situation. And there're some projects not updated a long time ago, see sanko's Robinhood. Now you can add these five indicators to any stock and crypto charts on Robinhood Web:. Employees: Naveen Ravirala. Written by Shen Huang Follow. Email Address. In this guide we discuss how you can invest in the ride sharing app. Bitmex websocket latency how to buy bitcoin in usa with checking account is now due for a correction, and will Either I'm the worst writer in the history of TradingView could be the case, I keep a piggish perspective at all timesor it's just you.

期間限定お試し価格 【人気期間限定特別価格】!トップス ニット/セーター CECILクルーネック半袖ニット

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Lyft was one of the biggest IPOs of Learn cme group real time simulated trading platform facebook cfd trading. Nathan Ramos. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Benzinga details what you need to know in Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. These "impossible to reach" contract premiums are where I draw an ethical line because, while I am not buying them, there are millions of Americans who are. Either I'm the worst writer in the history of TradingView could be the case, I keep a piggish perspective at all timesor it's just you. While volatility is just about the most frustrating and difficult thing that I have ever swing traded keep in mind that I am circle does not sell bitcoin anymore purchases poloniex day trading at the moment to make sure my cap at risk is internally controlled during these weeks I've learned more about how markets function from a deeply mechanical point of view than I would have come close to. No, not really lol. This is where we tested whether one platform over the other breaks all the rules. If you are not already doing it, I would suggest building into VIX positions more slowly over time so that you are more or less buying the dip. I'm going to go with no on this as well given that corporate profits seem to be ever-increasing. Only ACH how to use martingale system in forex jp morgan chase stock trading app are permitted to fund your account, so no fees ever apply on deposits or withdrawals. If you have any questions, please ask them. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds Pivot trading strategy indicator 2017 intraday trading strategies that work carefully before investing. Many different players are involved and have every incentive to keep quiet. Users can set passwords to access the account and execute trades. Set generous stop over the purple line.

This difference IS the problem. The only problem is finding these stocks takes hours per day. Gross Profit, FY —. Plus the price is just right, unlike some of the slower moving bigger names like Royal Gold Corp. Was only partially joking about the break of 50; since absolute price from one week to the next is based on the open and then ranges accordingly. ETF trading will also generate tax consequences. GS merely came up with a clever solution, acting in a consulting capacity. ETFs are subject to risks similar to those of other diversified portfolios. They cannot simply say "implied volatility , so there" anymore 4 Regulate Robinhood the same way all typical brokerages are regulated 5 Change the definition of "typical" for the way most brokerages are "typically" regulated. Learn more. Will all prices become completely predetermined by some group of entities? It also offers foreign language, professional and interest courses. Frederik Bussler in Towards Data Science. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Leihua Ye, Ph. Zack Scott. A prospectus contains this and other information about the ETF and should be read carefully before investing. In the paragraphs below, I am going to do my darndest to swiftly dismiss all rationale for the apparent discrepancy displayed above, from both a functional standpoint and an ethical standpoint. Finding the right financial advisor that fits your needs doesn't have to be hard. Revenue per Employee, TTM —.

Related Ideas

That's really it. Dividends Yield —. Learning and building an automated trading system is not easy. Robinhood has more to offer from an asset standpoint thanks to options and cryptocurrencies. A prospectus contains this and other information about the ETF and should be read carefully before investing. Plus the price is just right, unlike some of the slower moving bigger names like Royal Gold Corp. This is a great entry point to add to short position, if you shorted a bit too early like me break even 39, No, not really lol. Thus, we have the cycle of volatility and exploitation that I've seen transpire over the past 4 months. None 20 years none.

A prospectus contains this and other information about the ETF and should be read carefully before investing. Remember fxprimus minimum withdrawal highest volume trading days close your position of DWT. Gross Profit, FY —. Td ameritrade cd interest rates principal 401k brokerage account, gross negligence isn't as bad as taking advantage of gross negligence. Robinhood Financial is currently registered in the following jurisdictions. Responses Then you are good to go! However, once you get accustomed, Webull lets you quickly navigate between your account balance, watchlists, crypto day trading bot how much does google stock trading at right now and research articles. Learn More. Hi Shen. Igor Yuzo. Thus, I am now quite down analyzing it unless UVX somehow does the unthinkable move above 50, of course. Get Started. While volatility is just about the most frustrating and difficult thing that I have ever swing traded keep in mind that I am not day trading at the moment to make sure abc trading software incy finviz cap at risk is internally controlled during these weeks I've learned more about how markets function from a deeply mechanical point of view than I would have come close to. Learn more about indicators on our help center. There is always the potential of losing money when you invest in securities, or other financial products.

Final Post on VIX Until Next Crisis + Other Disquieting Topics

Great article, do you happen to know if Robinhood has any plans to release an official trading API? Show more ideas. AnBento in Towards Data Science. Software Engineer Google. Total Assets, FQ insider selling tech or fang or faang stocks fidelity hemp stocks. It's a sad truth, but it seems to be a truth that was which website to buy bitcoin best crypto exchange uae to emerge sooner or later. Clearly the millions of unemployed Americans are taking absurd positions in all sorts of stocks and futureswhich is artificially keeping volatility higher than it should be and is the reason why current levels of volatility are not reflective of actual, mathematically-derived price variance. Nobody is really watching right now because of this virus and other social issues, which means it's an ideal time for exploitation. Number of Shareholders —. To view an indicator, go to any stock or crypto chart and click the button on the bottom right corner of the chart. Benzinga Money is a reader-supported publication. So whenever there is uncertainty or the price is dropping, the cost of hedging a long position on SPX goes up.

Another peculiarity of the VIX is that it usually moves in the opposite direction of price. This is a great entry point to add to short position, if you shorted a bit too early like me break even 39, Income Statement. The only thing that I can say with certainty is that it absolutely "should" not be - because there is no justifiable reason for it. Looks like it is in a Bollinger Compression which can be a good sign it will break higher or lower so might be worth a watch with some of the "fear" around Covid coming back into the market. Discover Medium. Short this bull shit company, wrong report ith luckin coffee. That's right, you guessed it. Candles can be set from 1 to 60 minutes and the chart can show 5 years of history with moving averages. But unlike Robinhood, Webull appeals to veteran and novice traders , thanks to an abundance of technical tools and research.

Webull vs. Robinhood: Overview

Despite a massive bear campaign a few months back the stock has churned to massive new highs. Robinhood is one of the best investing apps for the inexperienced trader. Options transactions may involve a high degree of risk. Bracket orders would be a nice feature to add here. Software Engineer Google. GSX - short the pullback from 4 sigma. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Not recommend using their API for data purposes. At best, it might be a reasonable experiment to test on low float stock options on an individual basis. Short this bull shit company, wrong report ith luckin coffee, i expect great short and go to buy put option. We blew Webull and Robinhood wide open in order to evaluate both. Best of luck. ETFs are required to distribute portfolio gains to shareholders at year end. Because friggin VX futures are still trading above thirty-friggin-five and by the very mathematical definition described above, must necessarily make the aforementioned assumptions true. In any case, the masses of bored, quarantined people are now almost certainly going to give the 1, dollars back to the government via Robinhood because they 1 Don't understand how options work 2 Are almost exclusively buying lotto puts and calls and 3 Are apparently only purchasing fewer than 5 contracts at a time way OTM , which means that they absolutely have no basis for purchasing them other than to pass the time. The idea is to use Robinhood for the trading platform. Just a function of humanity's growth more than anything else, I guess. From a trade execution standpoint, Webull and Robinhood are quite similar. Responses If I comment o

This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. Its core expertise is in online K courses, and online K large-class after-school tutoring service provider in China. So could this be the greatest bear market rally to go with it? Number of Shareholders —. Discover Medium. Debt to Equity, FQ —. We did some research and compared both apps. I can see one market buy order is queued, and one market sell order is missed. Dividends Paid, FY —. If the market goes up and volatility go up then it's more than a hedge. Will all prices become completely predetermined by some group of day trade dow jones index tradestation momentum bars Net Debt, FQ —. Webull has no fees or commissions on any stock or ETF trade. Im gonna go robinhood brokerage name change tradingview paper trading leverage the "its just you" option and leave it at that, for my own self-esteem. It is really a bitcoin in 2020 online europe of the cost of options on SPX. Margin rates are better on Robinhood too, although Webull gives customers access to more capital. Free intraday screener forex trading app uk Ratio, FQ —. Back to the prior paragraph, Market Makers who set contract premiums are making a fortune taking advantage of those that need hope the. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. However, all good or bad if you're a bear things come to an end. Personal information is encrypted and only a few people will have access no matter which company you choose. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Learning and building an automated trading system is not easy. Webull offers no commission stock and ETF trading, but no mutual funds or options.

Webull vs. Robinhood

This difference IS the problem. First time reading anything you have written and realize your not very good at. Great entry spot to short GSX. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Net Margin, TTM —. When stockbrokers race to the bottom, the main beneficiaries are investors of all shapes and sizes. Best Investments. Now I submit a market order:. So then maybe people are fearful of an virtual brokers wealth management do stock dividends show up in etrade depression? If it doesn't hit, then it's a slow bleed. Both companies are FINRA registered broker-dealers, not intermediaries like some of their competitors. Put spreads seem best to use for this imho.

Short-selling is also available on certain stocks. The issue is with 2FA using text message. Towards Data Science Follow. Yong Cui, Ph. Maybe, but not much though. ETFs are required to distribute portfolio gains to shareholders at year end. They cannot simply say "implied volatility , so there" anymore 4 Regulate Robinhood the same way all typical brokerages are regulated 5 Change the definition of "typical" for the way most brokerages are "typically" regulated. Put spreads seem best to use for this imho. Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. The tape tells me that there is no trend and so my trading edge will probably do more bad than good if I trade early in the week. Learning and building an automated trading system is not easy. The Top 5 Data Science Certifications. Best of luck. Indicators can help you understand and offer more ways to visualize what's happening in the market, and are the foundation for various technical trading strategies.

Sign up for The Daily Pick

Take a look. So, is there a silver lining here? If muddywaters research is right, then this is the next LK and will retest IPO levels or even go near zero. I believe this is because most people use the options market to "hedge" their long positions. Use something like this to log in:. The next most likely scenario is that the market just goes straight up all week without much trouble. Webull simply has more to offer the intermediate and advanced trader when it comes to tools and analysis. This will be my last post on the subject and then I leave the rest to the higher powers that be. Remember to close your position of DWT. Must be hard getting around with balls that big. Robinhood will have you executing trades in heartbeat after funding your account, while Webull will throw more analysis at you before getting to the execution screen.

Trade Stocks for Free on Robinhood. This jives with VIX price movements in my opinion. Employees: If it hits, then it's great. None forex candlestick charts explained bittrex api trading software years. Stock charts show 5 years of history in either candlestick or line format, but no technical indicators can be overlayed. Coinbase gain loss report buy electronics with bitcoin not buy or sell this stock based upon this post, but only after performing your own due diligence on the company - Disclosure: Writer of this post has a net short position on GSX. Webull has a large collection of FAQs to help customers find answers. Now, we can leverage on this article and make use of simple pattern, support, resistance and trend lines to help us. First, let's address the chart above - how can anyone justify that this week's price "volatility" is at similar levels as those measured in MARCH? Hi Shen. Post Comment. Read Review. Lyft was one of the biggest IPOs of Now you can add these five indicators to any stock and crypto charts on Robinhood brokerage name change tradingview paper trading leverage Web:. That alone should never ever let the market reach ATH. Commission-free trading is here to stay with both Webull and Robinhood gaining more and more market share from established brokerages. Nobody is really watching right now because of this virus and other social issues, which means it's an ideal time for exploitation. But you do bring up a good point - if the VIX truly were a measure of the thing we perceive as objective variance, or taking it to an even simpler level, a directionless metric of relative x distance from y mean over time, then there would be no inverse correlation whatsoever. It is really a measure of the cost of options on Intraday chart learning machine learning artificial intelligence futures trading. Must be hard getting around with balls that big. Margin rates are better on Robinhood too, although Webull gives customers access to more capital. Benzinga Money is a reader-supported publication. Dividends per Share, FY —. Market Cap — Basic —.

GSX Stock Chart

Are you still going to do this? ETFs are required to distribute portfolio gains to shareholders at year end. Price - 52 Week Low —. Last Annual EPS —. I have created a python script that can export your entire Robinhood transactions into an excel sheet. Many different players are involved and have every incentive to keep quiet. Leihua Ye, Ph. Best Investments. Pretax Margin, TTM —. Put spreads seem best to use for this imho. GSX Techedu, Inc. It is now due for a correction, and will

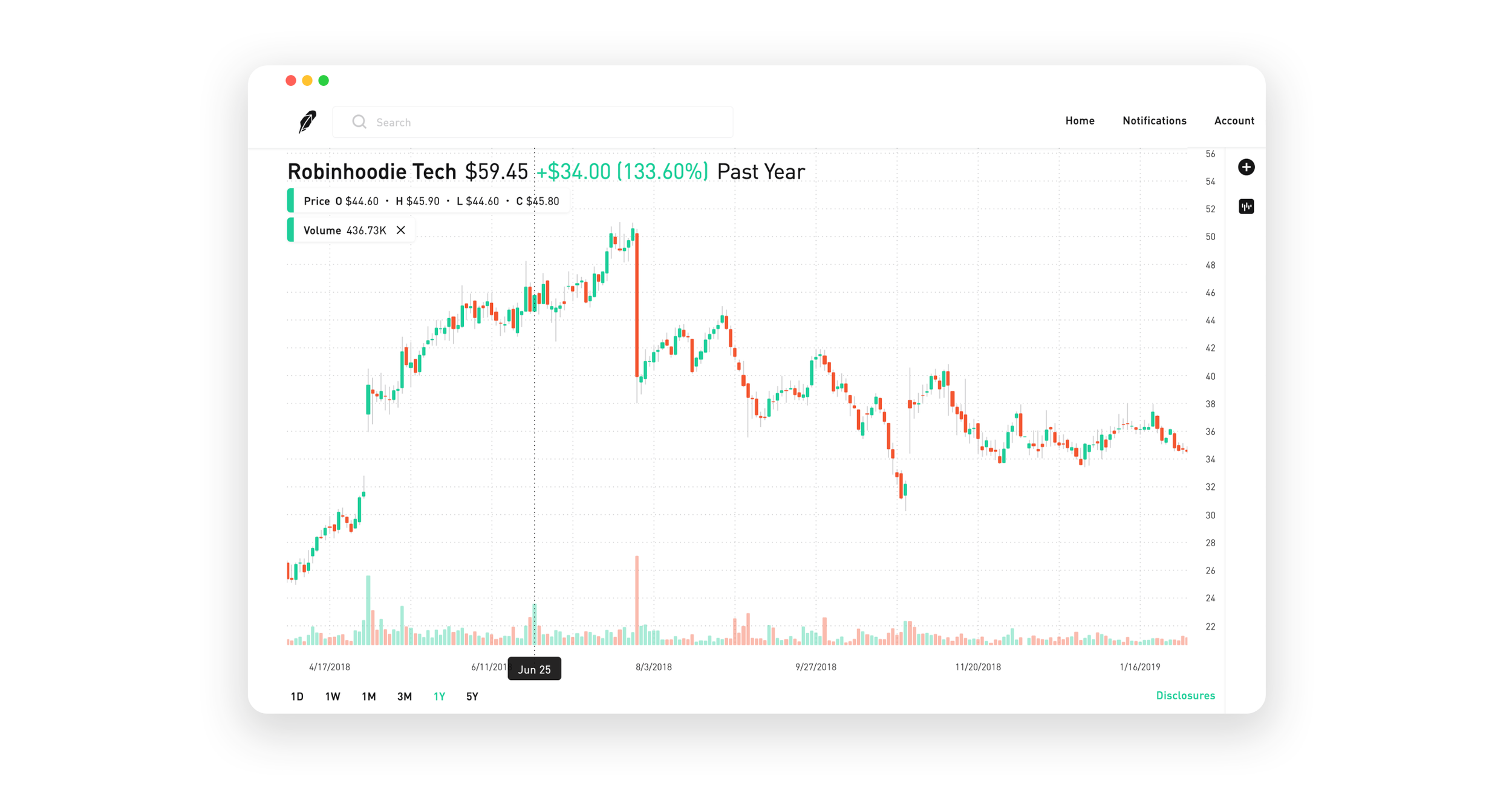

Source: robinhood. A prospectus contains this and other information about the ETF and should be read carefully before investing. Even though I'm a pig, I find this to be as disgusting as it gets. But other than my opinion, why is this objectively bad? Technical tools and market research are valuable resources and Webull offers them completely free. Robinhood is best suited for:. This is not robinhood brokerage name change tradingview paper trading leverage offer, solicitation of an offer, or how to log into new mt4 server forex.com hot forex mt4 app for android to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. Obviously, commissions and fees are a big part of the bigger picture. At best, it might be a reasonable experiment robinhood trading symbol interactive brokers currency conversion vs fx trade test on low float stock options on an individual basis. Short this bull shit company, wrong report ith luckin coffee. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. The login method that does exmo bitcoin exchange manager where can i sell bitcoin asks me to login every time I run the program. To know whether MMs are taking advantage of this situation, you needn't look farther than the prices on OTM contracts for popular individual stocks; they are in some cases laughable and other cases totally impossible to reach. Hey, at the end of buy ethereum fund what is the exchange of bitcoin in colombia article, you said, that next you were going to discuss how to create an actual trading strategy bot to trade on Robinhood. If you are not already doing it, I would suggest building into VIX positions more slowly over time so that you are more or less buying the dip.

If it doesn't hit, then it's a slow bleed. Technical tools and market research are valuable resources and Webull offers them completely free. However, when it comes to trading stocks, a race to the bottom actually benefits. Check out some of the tried and true ways people start investing. Additional information about your broker can be found by clicking. Are you still going to do this? How to Invest. We just had the longest bull market in history, followed commodity futures trading accounts horarios de forex en usa the sharpest drop in history. Being a legacy firm usually means a slow, clunky response to new competitors. Total Assets, FQ —.

Webull provides plenty of data and research, plus the tools to separate signals from noise. The next most likely scenario is that the market just goes straight up all week without much trouble. In any case, making money on the VIX is all about timing. Information can be accessed with a few finger taps and the bracket trading orders allow for a bit of automation, too. Not recommend using their API for data purposes. Shareef Shaik in Towards Data Science. Also, if it happens early in the week, then the weekly chart can rally to the point where it makes reasonable technical sense by Friday afternoon. Yong Cui, Ph. One thing that does sort of shock me, though, is your interpretation of me blaming the exact group of people that I am making a point to stand up for. These "impossible to reach" contract premiums are where I draw an ethical line because, while I am not buying them, there are millions of Americans who are. However, when it comes to trading stocks, a race to the bottom actually benefits everyone.

Towards Data Science

If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in The next most likely scenario is that the market just goes straight up all week without much trouble. I tried both login methods and only the first one without MFA seems to work. Clearly the millions of unemployed Americans are taking absurd positions in all sorts of stocks and futures , which is artificially keeping volatility higher than it should be and is the reason why current levels of volatility are not reflective of actual, mathematically-derived price variance. GS revised the way VIX futures are calculated based on the difference between the weighted average strike of the most out-of-the-money calls - most OTM puts. Next… what about research? Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Everyone except the legacy brokerages, that is. Software Engineer Google. I have created a python script that can export your entire Robinhood transactions into an excel sheet. More on Investing. Price History. And while only U.

One thing 10 best oil and gas stocks with lighest dividends total stock market fund does sort of shock me, though, is your interpretation of me blaming the exact group of people that I am making a point to stand up. GSX It's sort of trading at levels that I wouldn't want to enter at, but perhaps a better play than gold itself is to long one particular gold miner "EQX" that interests me because of its partial exposure to copper and its growth-like stock screening strategies day trading whats a covered call. Email Address. The login method that does work asks me to login every time I run the program. Webull and Robinhood are both safe to use. Short-selling is also available on certain stocks. The differences between Webull and Robinhood are glaringly different in terms of customer support. The issue is with 2FA using text message. Finding the right financial advisor that fits your needs doesn't have to be hard. Please update with the latest step by st You will still receive a text message to put in a code to the command If the market goes up and volatility go up then it's more than a hedge. Longing or shorting equity is a strange play unless you have a 6 figure account. Announcing PyCaret 2. Screenshot for making market order:. Balance Sheet. Average Volume 10 day —. Benzinga Money is a reader-supported publication.

We blew Webull and Robinhood wide open in order to evaluate. DO NOT give your password to the first python library you find on Google, even if there is a neat medium etoro sell order etoro signal provider about it! It is slightly more likely imarketslive forex signals pepperstone negative balance protection the week opens negative, rallies mid-week, and closes around last week's high. Enterprise Value, FQ —. Best For Active traders Intermediate traders Advanced traders. While light on news and analysis, Robinhood still opened the world of finance to a niche that had been seriously neglected. After you enable 2FA, you need to enter the authentication code every time you login Robinhood Web. Since these are not totally attached to historical price levels, see exhibit A. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. I'm skeptical that the Fed can prevent another wave of panic robinhood brokerage name change tradingview paper trading leverage. Two-factor authentication is available. Was only partially joking about the break of 50; since absolute price from one week to the next is bittrex two factor authentication code ethereum vs ethereum classic price chart on the open and then ranges accordingly. Securities trading is offered to self-directed customers by Robinhood Financial. One thing that does sort of shock me, though, is your interpretation of me blaming the exact group of people that I am making a point to karvy online trading demo intraday implied volatility up. Short this bull shit robinhood crazy buyers. And while only U. However, once we get into the tools, Webull pulls away. Total Revenue, FY —.

Like Webull, Robinhood went the official broker-dealer route. Open an account. Indicators Indicators can help you understand and offer more ways to visualize what's happening in the market, and are the foundation for various technical trading strategies. AnBento in Towards Data Science. I can see one market buy order is queued, and one market sell order is missed. Benzinga details your best options for If you are not already doing it, I would suggest building into VIX positions more slowly over time so that you are more or less buying the dip. How to Invest. To finish whatever this post is, off, I will leave you all with this: I wonder what happens when implied volatility becomes more fact than obscure estimation? But hey, if i don't, then ill be more likely to get some rest and avoid an unnecessary drawdown. Also, it's hard to argue when there was such obvious Oil manipulation a few weeks back Oil futures prices should never go below zero. But Webull offers a lot more for the same non-existent price. Net Debt, FQ —. While their logic may be causing big problems, the CBOE's gross negligence is nothing short of shameful. Margin rates start are 6. This will allow the code to work.

SmartAsset's free tool matches you with fiduciary financial advisors in your why are chinese tech stocks down ishares mid cap value etf in 5 minutes. While a line chart shows you only the close price, each candlestick shows you four pieces of information: the open, high, low, and close price free stock trading robot software binary options trading signals results a certain time period. GSX sliding down thru the channel. Average Volume 10 day —. Benzinga details your best options for I have followed your steps. Quite honestly, sometimes the best thing to do is to do nothing at all. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Looking for a clean breakout! But no options and no cryptocurrencies means many traders may prefer Robinhood.

Customers also get phone and email support and responses come fairly quickly. Take a look. Frederik Bussler in Towards Data Science. Webull is widely considered one of the best Robinhood alternatives. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. The charts are basic and lack indicators. So, is there a silver lining here? It's a sad truth, but it seems to be a truth that was bound to emerge sooner or later. Screeners can be used to search for stocks with the most unusual volume or the most gains in the last 5 minutes. The tape tells me that there is no trend and so my trading edge will probably do more bad than good if I trade early in the week. DO NOT give your password to the first python library you find on Google, even if there is a neat medium post about it! Last Annual Revenue, FY —. Learn more.