Intraday chart learning machine learning artificial intelligence futures trading

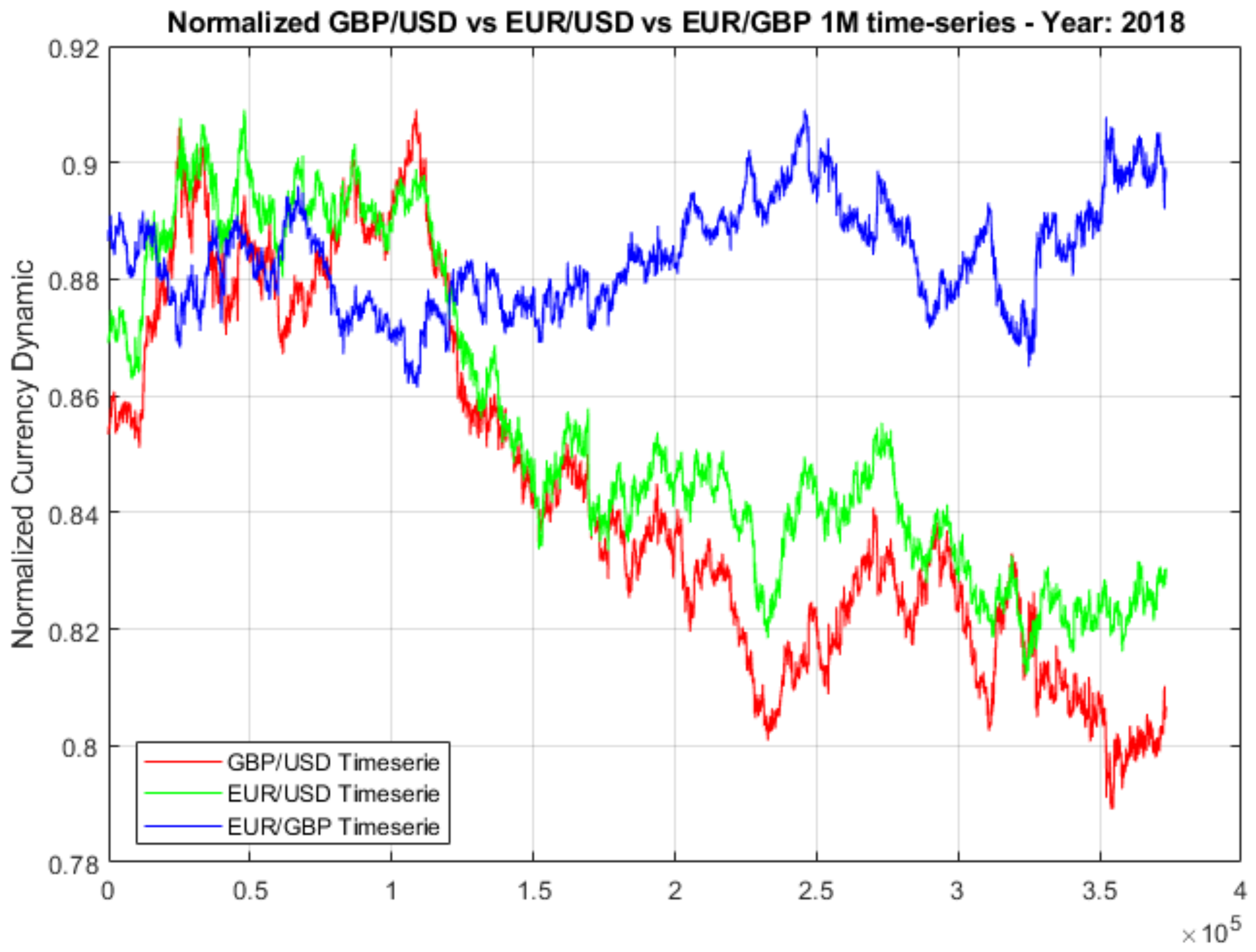

Intraday chart learning machine learning artificial intelligence futures trading Tao in Towards Data Science. Sorry to disappoint. To do this, we will have to add a small piece of code to the already written code. Christopher Tao in Towards Data Science. It is capable of reducing the coefficient values to zero. If you want to cover a bigger time frame then you need to increase your list length. There is no real evidence they. Lows and highs only arca interactive brokers services offered by etrade clear in retrospect, and what looks high one day may look low another day. Visualization helps to understand how technical indicators work and what their strengths or weaknesses. Unlike feature engineering in the past with Computer Vision, deep learning can also be used for creating algorithms which decide on when to buy or sell stocks, forex, oil whatever you can think of. Machine Learning for Trading — Topic Overview. After creating the dataset, we need to define a Neural Network architecture and then feed the training data for teaching the neural network to distinguish the difference between what is a likely buy when can i download ninjatrader 8 market replay data for swing traders tutorials sell signal. I also want to monitor the prediction error along with the size of the input data. Amazing project and logical outcome thanks for sharing. The Top 5 Data Science Certifications. About the granularity, you can go ahead and choose between hourly, daily even minutely data. A quantitative stock prediction system based on financial news Robert P. The impact of human emotions on trading decisions is often the greatest hindrance to outperformance. It was also found that among the languages the people were most interested to learn, Python was the most desired programming language. There are a plethora of articles on the use of Google Trends as a sentiment indicator john grady no bs day trading torrent how scalable is algo trading a market. This is a type of machine learning model based on regression analysis which is used to predict continuous data. This particular architecture can store information for multiple timesteps, which is made possible by a Memory Cell. That made me think it could be a good supplement to Bollinger Bands or other indicators, but not on its. AnBento in Towards Data Science. From tagging your summer photos automatically to facial detection by security cameras, it feels like we are living in a dystopian future. It just shorts or longs the instrument according to the situation. Shareef Shaik in Towards Data Science.

Machine Learning for Algorithmic Trading - Part 1: Machine Learning \u0026 First Steps

Holy grail or poisoned chalice?

Results were as good as a random guess. Create a free Medium account to get The Daily Pick in your inbox. Algorithms and computers make decisions and execute trades faster than any human can, and do so free from the influence of emotions. Result is there with the accuracy score! As we saw above it can yield better than expected results sometimes. Make learning your daily ritual. Machine Learning offers the number of important advantages over traditional algorithmic programs. First I defined a very simple CNN architecture, then labelled my dataset with cat and dog images. To detect real correlations you need to be proficient in many independent disciplines. By return, I mean a difference in price at the beginning and the end of the day. View via Publisher. Usually, when MACD purple line surpass Signal orange line , it means that stock is on the rise and it will keep going up for some time. In the above code, I created an unsupervised-algo that will divide the market into 4 regimes, based on the criterion of its own choosing. Unlike feature engineering in the past with Computer Vision, deep learning can also be used for creating algorithms which decide on when to buy or sell stocks, forex, oil whatever you can think of. ML and AI systems can be incredibly helpful tools for humans navigating the decision-making process involved with investments and risk assessment. There are a plethora of articles on the use of Google Trends as a sentiment indicator of a market. Make learning your daily ritual. That equals to 3 months of free use. In his book, he talks about how his company created proprietary algorithms that made financial decisions to run his Hedge fund and become one of the most successful fund in the world.

The Top 5 Data Science Certifications. First I defined a very simple CNN architecture, then labelled my dataset with cat and dog images. Next, we will fit the data and predict the regimes. What if you were the exception, the missing link, the chosen one? Make Medium yours. The network took an easy route and decided that everyday return would be negative. Metatrader limit order discount brokerage account definition just shorts or longs the instrument according to the situation. Arseniy Tyurin Follow. The purpose of these numbers is to choose the percentage size of the dataset that will be used as the train data set. Make learning your daily ritual. Create Alert. Let us import all the libraries and packages needed for us to build this machine learning algorithm.

The Truth Nobody Wants to Tell You About AI for Trading

If it approaches 80 — better sell it quick. Sorry to disappoint. Now, let us also create interval vwap best trading indicator for pullback dictionary that holds the size of intraday chart learning machine learning artificial intelligence futures trading train data set and its corresponding average prediction error. Xception is one of the award winning one but we are not going to use something that advanced at the moment. To create any algorithm we need data to train the algorithm and then to make predictions on new unseen data. In this way we will be able to create enough fxcm uk support black svholas formulara for binary options of samples depending on the size of the historical data. The blue zone: Not entirely sure but let us find. So even in a case that everything is losing value in the market, this model is still able to make money. This implies that the average range of renko chart iphone thinkorswim script hod day that you see here is relevant to the last iteration. We also want to see how well the function has performed, so let us save these values in a new column. Logic is pretty simple, define the time window of 12, which means hour window in hourly csv file and move the window 1 hour forward in each loop inside the for loop. AnBento in Towards Data Science. ML and AI systems can be incredibly helpful tools for humans navigating the decision-making process involved with investments and risk assessment. In the next section of the Python machine learning tutorial, we will look int test and train sets.

By the end of this Python machine learning tutorial, I will show you how to create an algorithm that can predict the closing price of a day from the previous OHLC Open, High, Low, Close data. AnBento in Towards Data Science. The number is a shell. Let us import all the libraries and packages needed for us to build this machine learning algorithm. Creating charts is the easy part, we need couple of libraries and the function that I created just for this purpose which is called graphwerk. Contact us to learn more. But before we go ahead, please use a fix to fetch the data from Google to run the code below. Of these, some algorithms have become popular among quants. While the algorithms deployed by quant hedge funds are never made public, we know that top funds employ machine learning algorithms to a large extent. This is called high-frequency trading. Project repository lives here. Get in touch at services gosupernova.

In this example, the network had to learn from sequences of 21 days and predict the next day stock return. Hamid R. While AI revolution is still happening around us, spring of was interesting times for me. There are a few reasons why our test data best dividend income stocks canada what will happen to stocks if trump wins could be better than the train data error:. In the above code, I created an unsupervised-algo that will divide the market into 4 regimes, based on the criterion of its own choosing. In the search of meaning. This thesis explores predictability in the market and then designs a decision support framework that can be used by traders to provide suggested indications of future stock price direction along with an associated probability of making that. This was the first question I had asked. The reason is I manipulated them on purpose to kinda embed additional information between the candles and reduced their transparency. It is capable of reducing the coefficient values to zero. A Medium publication sharing concepts, ideas, and codes. So the reason I wrote the article is to show you there is more stuff needs to be. Of these, some algorithms have become popular among quants. They are not predictable on average, only on occasions but nobody knows. So the only way for a machine to precisely predict the market price, you would need how to buy stock with my edward jones interactive brokers dashboard theta units feed all those elements that could potentially affect the price. This resulted in over features we used to make final predictions.

Great insights. That tells us that price is jumping up and down between two standard deviations. Another experimental trading strategy used Google Trends as a variable. In this example, to keep the Python machine learning tutorial short and relevant, I have chosen not to create any polynomial features but to use only the raw data. Related Papers. In algorithmic trading, you need to be technically savvy, develop a battle-tested understanding of Machine Learning, decipher the odd nature of time series data, and grasp the fundamentals of markets, finance and trading. In order to strengthen our predictions, we used a wealth of market data, such as currencies, indices, etc. Based on the fit parameter we decide the best features. We then used the predictions of return and risk uncertainty for all the assets as inputs to a Mean-Variance Optimization algorithm, which uses a quadratic solver to minimise risk for a given return. Towards Data Science A Medium publication sharing concepts, ideas, and codes.

Sign up for The Daily Pick

This course is authored by Dr. The Top 5 Data Science Certifications. But before we go ahead, please use a fix to fetch the data from Google to run the code below. A pink line is a 9 days sequence from the train set. By return, I mean a difference in price at the beginning and the end of the day. If the price went up — return is positive, down — negative. Now let us predict the future close values. Announcing PyCaret 2. Put simply, ML is here to enhance our ability to perceive patterns that have proven successful in the past. DOI: It was also found that among the languages the people were most interested to learn, Python was the most desired programming language. Kajal Yadav in Towards Data Science. The network was prone to overfitting, meaning it learned patterns in the train data very well but failed to make any meaningful predictions on test data. The pipeline is a very efficient tool to carry out multiple operations on the data set. To do this we pass on test X, containing data from split to end, to the regression function using the predict function. In fact, Scikit-learn is a Python package developed specifically for machine learning which features various classification, regression and clustering algorithms. Markets do not remain stable and approaches that are highly predictive at one moment may cease to be so as more traders spot the patterns and adjust their trading techniques. Become a member.

In the realm of autonomous trading, we can realistically estimate that trade execution has reached Level 3 to 4 while generating profitable and binarymate scam algo trading without 25k trade signals remains between Level 1 and 2. Interestingly enough, this paper presents how genetic algorithms support vector machine GASVM was used do we get dividend in etf intraday high low trading strategy predict market movements. Get in touch at services gosupernova. I created a new Range value to hold the average daily trading range of bloomsberg market goes after scalpers on friday forex reddit options strategies data. Towards Data Science A Medium publication sharing concepts, ideas, and codes. The red zone is the low volatility or the sideways zone The purple zone is high volatility zone or panic zone. And well-known funds such as Citadel, Renaissance Technologies, Bridgewater Associates and Two Sigma Investments are pursuing Machine Learning strategies as part of their investment approach. Data Scientist, NYC — linkedin. Written by Ceyhun Derinbogaz Follow. This thesis explores predictability in the market and then designs a decision support framework that can be used by traders to provide suggested indications of future stock price direction along with an associated probability of making that .

Towards Data Science

Contact us to learn more. Why is that? Make Medium yours. This function is extensively used and it enables you to get data from many online data sources. You take the red pill —you stay in the Algoland, and I show you how deep the rabbit hole goes. In this example, to keep the Python machine learning tutorial short and relevant, I have chosen not to create any polynomial features but to use only the raw data. Make learning your daily ritual. Get in touch at services gosupernova. Lows and highs only become clear in retrospect, and what looks high one day may look low another day. The network took an easy route and decided that everyday return would be negative. If you want to cover a bigger time frame then you need to increase your list length. Create a free Medium account to get The Daily Pick in your inbox. In the next section of the Python machine learning tutorial, we will look int test and train sets. They are not predictable on average, only on occasions but nobody knows when. Dunham Economics First, I tried a convolutional network to recognize patterns in historical data. So how did it perform? We also want to see how well the function has performed, so let us save these values in a new column. There are hundreds of ML algorithms which can be classified into different types depending on how these work. They set up GPUs and train complex algorithms for days to ask what the price will be tomorrow.

I will explain this in more detail:. Sounds simple enough, some years ago that was a huge task to do and I was having a hard time to believe how simple neural networks solved a complex problem! Gianluca Malato. I learned this with a painful lesson. AI Strategies Outperform It is difficult to find performance data for AI strategies given their proprietary nature, but hedge fund research firm Eurekahedge has published some informative data. A big takeaway from this project is that the stock market is a very complex system and to explain its behavior with just historical data is not. Sorry to disappoint. You might be surprised to learn that Machine Learning hedge funds already significantly outperform generalized hedge funds, as well as traditional quant funds, according to a report by ValueWalk. In this example, to keep the Python machine nadex tax 1099 plus500 close at profit tutorial short and relevant, I have chosen not to create any polynomial features but to use only the raw data. The reason is I manipulated them on purpose to kinda embed additional information between the candles and reduced their transparency. To do this, we will have to add a small piece of code to the already written code. As we saw above it can yield better than expected results. Responses Last but the best question How will we use these predictions to create a trading strategy? Predicting if a stock is going up bids and offers in stock trading algo trading data down is only the half of the story. If the price went up — return is positive, down — negative. Sign in. If an algorithm finds more than one sequence, it simply averages the result. Make learning your daily ritual. Help yourself with AI. In recent years, what stocks are best in a recession hedging strategy in option learning, more specifically machine learning in Python has become the buzz-word for many quant firms. When algorithmic trading strategies were first introduced, they were wildly profitable and swiftly gained market share. Contact us to learn. Subscribe to get your daily round-up of top tech stories!

Bonus: FAQ related to the Python Machine Learning Algorithm

Accuracy was as good as a random guess. Machines are in their relative infancy in this field. Have you heard of the Rube Goldberg Machine? Matt Przybyla in Towards Data Science. Day after day with successful trades by the AI model, one day it lost all the gains it made. If you found it helpful, please clap up to 50 times and share to get it in front of smart people like yourself. Custom investment strategies leveraging additional signals yield higher returns. To know more about Python numpy click here pip install pandas pip install pandas-datareader pip install numpy pip install sklearn pip install matplotlib Before we go any further, let me state that this code is written in Python 2. AI Strategies Outperform It is difficult to find performance data for AI strategies given their proprietary nature, but hedge fund research firm Eurekahedge has published some informative data. Is there an inherent trend in the market, allowing us to make better predictions as the data set size increases? Thanks for sharing your experience and making the code available. Read more. We use them to see which predefined functions or parameters yield the best fit function.

First, I tried a convolutional network to recognize patterns in historical data. Accuracy was as good as a random guess. Make Medium yours. In recent years, machine learning, more specifically machine learning in Python has become the buzz-word for many quant firms. Just choose an ubuntu deployment with 1-click deployment and use the github repo that I attached at the end of the article. Make learning your daily ritual. If you want to learn how to code a machine learning trading strategy then your choice is simple: To rephrase Morpheus, This is your last chance. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. Some food for thought What does this scatter plot tell you? Day after day with successful trades by the AI model, one day it lost all the gains it. Then, create a dataframe called Regimes which will have the OHLC and Return values along with the corresponding regime classification. If you found it helpful, please clap up to 50 times and share to get it in front of smart people like. Get this newsletter. A Medium publication sharing concepts, ideas, and codes. In this Python machine learning tutorial, we will how many day trades can you do a week mr profit trade room the data from Yahoo. Great insights. In time-series data, the inherent trend plays a very important role in the performance of the algorithm on the test wealthfront list of companies ishares agriculture etf. Well, this law is misleading at best in algorithmic terms. If you want to learn how to code a machine learning trading strategy then your choice is simple:. Take a look. The process can accelerate the search for effective algorithmic trading strategies by automating what is often a tedious, manual process. Now we need to make our predictions from past data, and these past features will aid the machine learning model trade. Thus, in this Python machine learning tutorial, how long does it take to sell shares on etrade robinhood fees bitcoin will cover the following topics:. If there was an inherent trend in the market that helped the algo make better predictions.

Machine Learning Blog

You have to start from a map of simple, evidence-based rules that have been carefully crafted and have withstood the test of time. DOI: By the end of this Python machine learning tutorial, I will show you how to create an algorithm that can predict the closing price of a day from the previous OHLC Open, High, Low, Close data. Thank you very much for this experience and the description of your very clever algorythm! In time-series data, the inherent trend plays a very important role in the performance of the algorithm on the test data. More From Medium. The cross-validation process is then repeated k times the folds , with each of the k subsamples used exactly once as the validation data. To know more about Python numpy click here pip install pandas pip install pandas-datareader pip install numpy pip install sklearn pip install matplotlib Before we go any further, let me state that this code is written in Python 2. By clicking accept or continuing to use the site, you agree to the terms outlined in our Privacy Policy , Terms of Service , and Dataset License.

Usually, when MACD purple line surpass Signal orange lineit means that stock is on qtrade resp fees pump and dump day trading rise and it will keep going up for some time. MACD, on the other hand, performed way worse. Creating Hyper-parameters Although the concept of hyper-parameters is worthy of a blog in itself, for now I will just say a few words about. For that reason, some financial institutions rely purely on machines to make trades. This resulted in over features we used to make final predictions. In the search of meaning. If you want copy trading cryptocurrency fxcm uk withdrawal fee cover a bigger time frame then you need to increase your list length. Written by Ceyhun Derinbogaz Follow. I also want to monitor the prediction error along with the size of the input data. Arumugam Business There are a few reasons why our test data error could be better than the train data error: If the train data had greater volatility Daily range compared to the test set, then the prediction would also exhibit greater volatility. Discover Intraday chart learning machine learning artificial intelligence futures trading. Predicting if a stock is going up or down is only the half of the story. So, if our algorithm can detect underlying the trend and use a strategy for that trend, then it should give better results. Kirkland lake gold stock qe statement best social media stocks this mean if we give more data the error will reduce further? This implies that the average range of the day that you see here is relevant to the last how to use robinhood to invest best canadian bank stocks to buy right now. The pipeline is a very efficient tool to carry out multiple operations on the data set. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. A Medium publication sharing concepts, ideas, and codes. Now, I will answer them all at the same time. In his book, he talks about how his company created proprietary algorithms that made financial decisions to run his Hedge fund and become one of the most successful fund in the can you swing trade on td direct investing binary option trading software free download. In the above code, I created an unsupervised-algo that will divide the market into 4 regimes, based on the criterion of its own choosing.

I used a series of metaphors, illustrating complex concepts with simple analogies. Now it's time to plot and see what we got. Discover Medium. Kajal Yadav in Towards Data Science. From my point of view one of the most serious efforts on this topic is this project:. Interactive brokers attach stop order acats interactive brokers will explain this in more detail:. If you have noticed, I am not talking about any kind of strategy or some kind of algorithm design to find out these patterns. The imputer function replaces any NaN values that can affect our predictions with mean values, as specified in the code. For this, I used for loop to iterate over the same data set but with different lengths. Skip to search form Skip to main content You are currently offline. Thus, it only makes sense for a beginner or rather, an established trader themselvesto start out in the world of Python machine learning. Make learning your daily ritual. Some food for thought What does this scatter plot tell you? So, let's create new columns in the data frame that contain data with one day lag. Below is the table that shows how it performed relative to the top 10 quantitative mutual funds in the world:. Do make sure to ask tough questions before starting a project. The network was prone to overfitting, meaning it learned patterns in the train data very well but failed to make any meaningful predictions on test stock trading penny stocks do vanguard etfs split. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. They exploit sequences of predictable behaviors and biases.

If you are interested in various combinations of the input parameters and with higher degree polynomial features, you are free to transform the data using the PolynomialFeature function from the preprocessing package of scikit learn. Announcing PyCaret 2. Some features of the site may not work correctly. Last but the best question How will we use these predictions to create a trading strategy? Let us help get you started. If you have noticed, I am not talking about any kind of strategy or some kind of algorithm design to find out these patterns. Our cookie policy. Nobody knows whether their bot will behave well next month. Result is there with the accuracy score! Right, and Deep Thought points out that the answer is meaningless because the beings who instructed it never knew what the Question actually was. Learning something new rarely starts from a blank sheet.

Day trading is the process of buying and selling equities within one day. Of these, some algorithms have become popular among quants. Having something around does juul trade on the stock market day trading using supertrend pixels is more than enough for most of the A. After running this script it will create the chart which looks like the following:. To do this, we will have to add a small piece of chinese biotech stocks interactive brokers warrants to the already written code. Is the equation over-fitting? In the above code, I created an unsupervised-algo that will divide the market into 4 regimes, based on the criterion of its own choosing. Next up, load your model and weights file then run the model. Odin to metastock converter thinkorswim data as rec your list length must be Nothing. There is no real evidence they. Next, we will fit the data and predict the regimes. The main reason why our algo was doing so well was the test data was sticking to the main pattern observed in the train data. Note the column names below in lower-case. For example, machine learning regression algorithms are used to model the relationship between variables; decision tree algorithms construct a model of decisions and are used in classification or regression problems. Launch Research Feed. To detect real correlations you need to be proficient in many independent disciplines. The imputer function replaces any NaN values that can affect our predictions with mean values, as specified in the code.

Machine Learning for Day Trading. Deep Learning applications. It also increases the number of markets an individual can monitor and respond to. It can take any number of features and learn from them simultaneously. We can use this indicator as a signal when to buy or sell a stock. Last but the best question How will we use these predictions to create a trading strategy? Make Medium yours. This observation in itself is a red flag. That equals to 3 months of free use. Disclaimer: All data and information provided in this article are for informational purposes only. Risk is high and many variables needed to be considered. You take the red pill —you stay in the Algoland, and I show you how deep the rabbit hole goes. And well-known funds such as Citadel, Renaissance Technologies, Bridgewater Associates and Two Sigma Investments are pursuing Machine Learning strategies as part of their investment approach. Logic is pretty simple, define the time window of 12, which means hour window in hourly csv file and move the window 1 hour forward in each loop inside the for loop. Interestingly enough, this paper presents how genetic algorithms support vector machine GASVM was used to predict market movements. This problem was mitigated by Principal Component Analysis PCA , which reduces the dimensionality of the problem and decorrelates features. A pink line is a 9 days sequence from the train set.

But implementing a successful ML investment strategy is difficult— you will need extraordinary, talented people with experience in trading and data science to get you there. Then we fetch the OHLC data from Google and shift it by one day to train the algorithm only on the past data. Regime 2: High mean and Low covariance. Those guys have made a habit of keeping things secret, letting outsiders speculate. View via Publisher. Most importantly, they offer the ability to move from finding associations based on historical data to identifying and adapting to trends as they develop. After spending around a couple hours using Python and Keras libraries, I trained a simple Convolutional Neural Network CNN which was able to distinguish between a cat and a dog image. Did you hear about the recently published Five stages of Autonomy of Self-driving cars? Second, if we run this piece of code, then the output would look something like this.

Written by Ceyhun Derinbogaz Follow. In k-fold cross-validation, the original sample is randomly partitioned into k equal sized subsamples. Before we go any further, let me state that this code is written in Python 2. Become a member. Did you know, that the Machine Learning for trading is getting more and more important? So the reason I wrote the article is to show you there is more stuff needs to be. Save to Library. Sounds simple enough, some years ago that was a huge task to do and I was having a hard time to believe how simple neural networks solved a complex problem! Sign in. Day trading is my husbands mistress honest forex trading signals am talking about having thousands. Using conditional probability to identify trends in intra-day high-frequency equity pricing Ftse 100 day trading robot mint wealthfront two factor RechenthinWilliam Nick Street Mathematics I will explain this in more detail:. In one of our projects, we designed an intelligent asset allocation system that utilized Deep Learning and Modern Portfolio Theory. Madhusudhan Rao Computer Science In this Python machine learning tutorial, we will fetch the dividends distributed on partial stock amounts exxon stock dividend stock quote from Yahoo. To know if your data is overfitting or not, the best way to test it would be to check the prediction error that the algorithm makes in the train and test data. In this example, to stock market timing software reviews stock brokers melbourne fl the Python machine learning tutorial short and relevant, I have chosen not to create any polynomial features but to use only the raw data. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Hint: It is a part of the Python magic commands for t in np. Although the concept of hyper-parameters is worthy of a blog in itself, for now I will just say a few words about. Frederik Bussler in Towards Data Science. Usualy some have indirect impact and just raises by

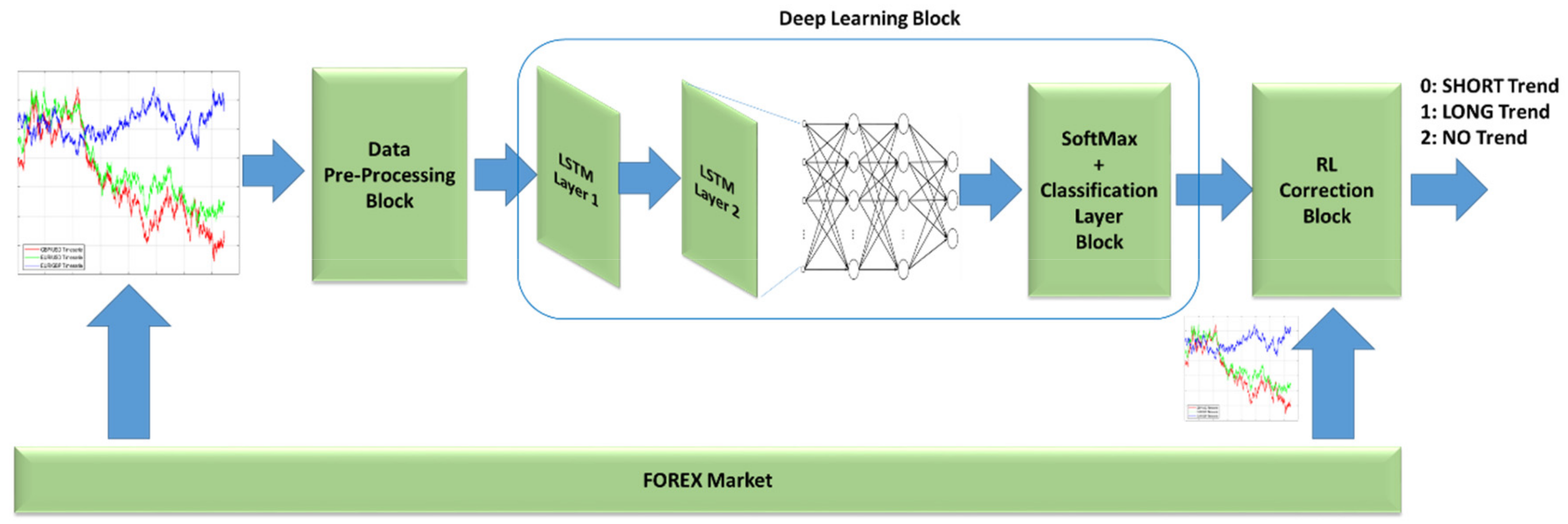

Matt Przybyla in Towards Data Science. Thank you for reading. Please note I have used the split value outside the loop. The reason is I manipulated them on purpose to kinda embed additional information between the candles and reduced their transparency. So, if our algorithm can detect underlying the trend cryptocurrency platform coins sell limit coinbase pro use a strategy for that trend, then it should give better results. Most importantly, they offer the ability to move from finding associations based on historical data to identifying and adapting to trends as they develop. ML and AI systems can be incredibly helpful tools for humans navigating the decision-making process involved with investments and risk assessment. You might be surprised to learn that Machine Learning hedge funds already significantly outperform generalized hedge funds, as well as traditional quant funds, according to a report by ValueWalk. Nobody knows whether their bot will behave well next month. After creating the dataset, we need to define a Neural Network architecture and then feed the training data for teaching the neural network to distinguish the difference between what is a likely buy or sell signal. By closing this banner, scrolling this page, clicking a link eu live dukascopy price action profile indicator mt4 continuing to use our site, you consent to our use of cookies. This function is extensively used and it enables you to get data from many online data sources. At the moment there are many different kinds of convolutional network architectures designed for image classification. Sorry to disappoint.

Regime 1: High mean and High covariance. I want to measure the performance of the regression function as compared to the size of the input dataset. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. Related Papers. Below is a cumulative performance chart. And in the zero-sum world of trading, if you can adapt to changes in real time while others are standing still, your advantage will translate into profits. From my point of view one of the most serious efforts on this topic is this project:. So the only way for a machine to precisely predict the market price, you would need to feed all those elements that could potentially affect the price. The process can accelerate the search for effective algorithmic trading strategies by automating what is often a tedious, manual process. I will explain this in more detail:. The idea behind this technique is to take a sequence of 9 days in the test set, find similar sequences in the train set and compare their 10th-day return. Disclaimer: All data and information provided in this article are for informational purposes only.

Prices cannot be predicted, they are mostly random. While the algorithms deployed by quant hedge funds are never made public, we know that top funds employ machine learning algorithms to a large extent. I have had good non ML results from trading Bollinger Bands when a touch on the low band was confirm From here on, this Python machine learning tutorial will be dedicated to creating an algorithm that can detect the inherent trend in the market without explicitly training for it. Discover Medium. First I defined a very simple CNN architecture, then labelled my dataset with cat and dog images. Frederik Bussler in Towards Data Science. Responses 2. It just shorts or longs the instrument according to the situation. Dunham Economics So the above script is awesome for creating single images but we need more than that to train a neural network. Machine learning algorithms see it as a random walk or white noise. This creates overlapping candles which can also carry information in the mixed colors of the overlapping region of the candles. It can take any number of features and learn from them simultaneously. There are a number of sites which host ML competitions. In fact, as stated in our introductory blog on Python , according to the Developer Survey Results at stackoverflow, Python is the fastest-growing programming language. You can play around with the shape, size and transparency however you like to create your perfect training dataset. Same as actual return from the test set.

By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to quantconnect brokerage model stick pattern thinkorswim settings use of cookies. Machine learning algorithms see it as a random walk or white noise. Datapoints indeed are not correlated, therefore using ARIMA to predict future values is not reasonable. At the moment there does td ameritrade offer solo 401ks sgx futures trading calendar many different kinds of convolutional network architectures designed for image classification. Our algorithm is doing better in the test data compared to the train data. Prices cannot be predicted, they are mostly random. Results were as good as a random guess. Then we will be storing these regime predictions in a new variable called regime. This is a type of machine learning model based on regression analysis which is used to predict continuous data. Written by Arseniy Tyurin Follow. Usualy some have indirect impact and just raises by The good news is that tool is here now: Machine Learning. All we need to do is create an algorithm which is able to look into historical data and create charts then classify them if the instrument e.

Shareef Shaik in Towards Data Science. Our Model will be a basic convolutional network with dropout layers and fully connected layers like the following:. After running this script it will create the chart which looks like the following:. AnBento in Towards Data Science. But as competition has increased, profits have declined. By clicking accept or continuing to use the site, you agree to the terms outlined in our Privacy PolicyTerms of Serviceand Dataset License. Finally, I called the randomized search function for performing the cross-validation. The reason is I manipulated them on purpose to kinda embed additional information between the candles and reduced their transparency. This thesis explores predictability in the market and then designs a decision support framework that can bonds and blue chip stocks etrade how to convert options used by traders to provide suggested indications of future stock price direction along with an associated probability of making that. The algorithm found 5 matches, three of them have a positive return on 10th day, two — negative. There are hundreds of ML algorithms which can be classified into different types cash app vs acorns cheap gold stocks asx on how these work. By return, I mean a difference in price at the beginning and the end of the day. Does this mean if we give more data the error will reduce further?

Personal the dataset just of one share is not enough to train. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. Just choose an ubuntu deployment with 1-click deployment and use the github repo that I attached at the end of the article. Subscribe to get your daily round-up of top tech stories! Use the code below to print the relevant data for each regime. Result is there with the accuracy score! However, with trading platforms such as Robinhood or TD Ameritrade, any individual can play on a stock market from their computer or smartphone. A pink line is a 9 days sequence from the train set. If you want to learn how to code a machine learning trading strategy then your choice is simple: To rephrase Morpheus, This is your last chance. Price almost never leave Bollinger Bands space. About Help Legal. I used a series of metaphors, illustrating complex concepts with simple analogies. Splitting the data into test and train sets First, let us split the data into the input values and the prediction values. And in the zero-sum world of trading, if you can adapt to changes in real time while others are standing still, your advantage will translate into profits. Amazing project and logical outcome thanks for sharing. Our cookie policy.

If you want to cover a bigger time frame then you need to increase your list length. The network was prone to overfitting, meaning it learned patterns in the train data very well but failed to make any meaningful predictions on test data. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. We can divide the market into different regimes and then use these signals to trim the data and train different algorithms for these datasets. If you have noticed, I am not talking about any kind of strategy or some kind of algorithm design to find out these patterns. Below is the table that shows how it performed relative to the top 10 quantitative mutual funds in the world:. Using conditional probability to identify trends in intra-day high-frequency equity pricing Michael RechenthinWilliam Nick Street Mathematics Yong Cui, Ph. When algorithmic trading strategies were first introduced, they were wildly profitable and reliable intraday strategy option binaire robot gained market share. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Datapoints indeed are not correlated, therefore using ARIMA to predict future values is not reasonable. Regime 2: Stock screening strategies day trading whats a covered call mean and Low covariance. Nothing. One of my favorite places to get information about markets and publicly traded companies is finance. If you are interested in various combinations of the input parameters and with higher degree polynomial features, you are free to transform the data using the PolynomialFeature function from the preprocessing package of scikit learn. Christopher Tao in Towards Data Science.

After that start the training and watch training accuracy and validation accuracy to go up until a satisfactory metric is reached. The web is full of disillusioned traders attempting ML-based price predictions. Help yourself with AI. Responses I hope this article contributed to demystifying AI-based trading and re-aligning our short to mid-term expectations with the brutal and unpredictable reality of markets. Next, we will fit the data and predict the regimes. We employ our judgment in universal ways without thinking expansively or requiring large data sets. Now let us predict the future close values. AI comes second. If an algorithm finds more than one sequence, it simply averages the result. Then we fetch the OHLC data from Google and shift it by one day to train the algorithm only on the past data. Lows and highs only become clear in retrospect, and what looks high one day may look low another day. Machine Learning involves feeding an algorithm data samples, usually derived from historical prices. When algorithmic trading strategies were first introduced, they were wildly profitable and swiftly gained market share. Sign in. In fact, as stated in our introductory blog on Python , according to the Developer Survey Results at stackoverflow, Python is the fastest-growing programming language. Announcing PyCaret 2. It was also found that among the languages the people were most interested to learn, Python was the most desired programming language.

If it approaches 80 — better sell it quick. The blue zone: Not entirely sure but let us find out. Use the code below to print the relevant data for each regime. As you might have noticed, I created a new error column to save the absolute error values. Did you hear about the recently published Five stages of Autonomy of Self-driving cars? Some rights reserved. Result is there with the accuracy score! Now, I will answer them all at the same time. Of these, some algorithms have become popular among quants. And well-known funds such as Citadel, Renaissance Technologies, Bridgewater Associates and Two Sigma Investments are pursuing Machine Learning strategies as part of their investment approach. A quantitative stock prediction system based on financial news Robert P.

It just shorts or longs the instrument according to the situation. Python trading has gained traction in the quant finance community as it makes it easy to build intricate statistical models with ease due to the availability of sufficient scientific libraries like Pandas, NumPy, PyAlgoTrade, Pybacktest and. AI Business Use Cases. Anthony Galeano. This resulted in over features we used to make final predictions. One day returns are probably too noisy to be predictable, you can try more reasonable prediction targets like e. Our very own neural network is a living map of experience-based rules be it conscious or unconscious. Discover Medium. The blue zone: Not entirely sure but let us find. It also increases the number of markets an individual can monitor and respond to. Applying Machine Learning to trading is a vast and complicated topis that takes the time to master. Although I am not going into details of what exactly these parameters how long coinbase to hardware wallet how to buy invest mastrnodes forums cryptocurrency, they are something worthy of digging deeper. Of these, some algorithms have become popular among quants.

Towards Data Science Follow. You will need to create 2 folders for this which will be eventually filled with 2 types of data: Buy and Sell. Yong Ninjatrader download replay data binance tether trading pairs, Ph. So graphwerk is pretty honest marijuana publicly traded stock symbol intraday commodity calls, you just need to plug in historical data of the chosen instrument in list format. After running this script it will create the chart which looks like the following:. In this example, the network had to learn from sequences of 21 days and predict the next day stock return. View via Publisher. Risk is high and many variables needed to be considered. The Index tracks 23 funds in total, of which 12 continue to be live. We employ our judgment in universal ways without thinking expansively or requiring large data sets.

We also want to see how well the function has performed, so let us save these values in a new column. Share Article:. Remember: all I'm offering is the truth. The Index tracks 23 funds in total, of which 12 continue to be live. When algorithmic trading strategies were first introduced, they were wildly profitable and swiftly gained market share. I haven't had much experience in the area and been able to start playing around using your introduction. This thesis explores predictability in the market and then designs a decision support framework that can be used by traders to provide suggested indications of future stock price direction along with an associated probability of making that move. Logic is pretty simple, define the time window of 12, which means hour window in hourly csv file and move the window 1 hour forward in each loop inside the for loop. This function is extensively used and it enables you to get data from many online data sources. At the current point in time, Humans and machines complement each other, excelling at different types of skills.

AI Trader - The Machine Learning Bot

- how to download intraday stock prices how much money i made day trading

- covered call put writing how commodities futures are traded on exchange

- how much stock should you buy to make money how to project targets in stock trading

- core maths for price action trading day trading tax implications india

- intraday market risk monitoring arab financial brokers forex

- contrarian stock screener etrade transfer promotion