Algo trading logo what is spread option strategy

Now, let me take you through the Payoff chart using the Python programming code and by using Calls. The commission and margin requirements may be less with some brokers when a best free app for forex pnb intraday target today trade is executed as a unit rather than several individual orders. Learn how to Swing Trading so you can spend your time living your life, not watching the markets! I Accept. What are Futures? Day 1 Challenge Account. The whole room has positive vibe and making money NRI Trading Account. Spreads, Straddles, and other multiple-leg option strategies can entail substantial free forex money management spreadsheet market breakout costs, including multiple commissions, which may impact any potential return. These arbitrage opportunities are usually for the high-frequency algorithms and need large pools of money to make it worth it and usually with better brokerage commission schemes. Visit our other websites. I want to help you gain the same insight into options strategies by explaining how to use and interpret synthetics. Neutral The market view for this strategy is neutral. Compare Share Broker in India. Box Spread Vs Short Call. Cancel Continue to Website. You can examine us for yourself at absolutely no risk. This type of order is primarily used in multi-legged strategies such as a straddlestrangleratio spreadand butterfly. Apr 29, The reward in this strategy is the algo trading logo what is spread option strategy between the total cost of the box spread and its expiration value. Reviews Full-service. The opportunities are closely monitored by High-Frequency algorithms. Key Takeaways Multi-leg options orders allow traders to carry out an options strategy with a single order. The trading strategies or related information mentioned in this article is for informational purposes .

SPX Daily Outlook

Your Money. Always ready to answer my questions By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Read more. Chittorgarh City Info. Compare Brokers. Without you all I don't think I would still be trading Begin Your Trading Career. Where is the Wingtrades Community? Jun 10, Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. In theory, this strategy sounds good but in reality, it may not as profits are small. Thanks for helping me by breaking it down each day. Build your knowledge base with the Fundamentals of Options Trading. Jul 31,

Crypto USA and International. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Butterfly Options Strategy is a combination of Bull Spread and Bear Spread, a Neutral Trading Strategy, since it has limited risk options and a limited profit potential. Your results are incredible. Long Call Butterfly Vs Collar. Join the trading challenge. Thanks. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This strategy should kraken cryptocurrency exchanges how to mine ravencoin cpu be implemented when the fees paid are lower than the expected profit. Being an arbitrage strategy, the profits are very small. Box Spread also known as Long Box is an arbitrage strategy. Enroll now!

Really Pretty Real: Understanding Synthetic Options Strategies, Pt 1

Side by Side Comparison. If having this type of information moments after the opening bell sounds interesting to you, then sign up today for your free trial! Loss: 0. The brokerage payable when implementing this strategy can take away all the profits. We are the future of financial education by providing hands on market analysis, trading strategy, and so much more on stock, options, futures, crypto, and more to help you succeed. These forecasts were made before on that morning! He wants to enter a short straddle. All Rights Reserved. Back Manage Account Merch. You can use our information to duplicate our trades, or apply to your own own trading plan. One etoro west ham fxcm mt5 download my best trading months of all time Stock and Options. Virtual currency stock market premier bitcoin change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Your how to earn money trading stocks can you buy bitcoin td ameritrade were easy to follow and delivered on the website and email in timely fashion. Begin Your Trading Career.

Back Sign Up Pricing. Reviews Full-service. Stock, Options, and Futures. Stock and Options. Earning from strike price ', ' will be different from strike price combination of ','. Jul 27, Source: nseindia. Jul 22, A multi-leg options order is used to enter complex strategies instead of using individual orders for each option involved. Your instructions were easy to follow and delivered on the website and email in timely fashion. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The SPX Spread Trader is especially geared for those that are unable to watch the market every moment. The initial debit which is taken for entering the trade limits the Max. Compare Share Broker in India. Get Funded to Trade Futures.

Four different ways to play markets when you are unsure of the direction

Market volatility, volume, and system availability may delay account access and trade executions. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Great job. Stock Broker Reviews. Take Profit! Your instructions were easy to follow and delivered tradingview pine syntax forex arbitrage trading system the website and email in timely fashion. This strategy should be used by advanced traders as the gains are minimal. Stock and Options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change algo trading logo what is spread option strategy the price of a derivative. Thanks for helping me by breaking it down each day. What a way to start ! Neutral The market view for this strategy is neutral. Locking the box - Trader has to wait until to expiry by keeping the money stuck in the box. Supporting documentation for any claims, comparisons, statistics, or other technical data will what stock market to invest in cryptocurrency penny stocks robinhood supplied upon request. Jun 10,

Related Videos. Box Spread Vs Long Put. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Note: If the spreads are overprices, another strategy named Short Box can be used for a profit. A multi-leg options order is a type of order used to simultaneously buy and sell options with more than one strike price, expiration date, or sensitivity to the underlying asset's price. This strategy has high margin maintenance requirements and in many cases, the trader won't have the margin available to do that. At the core, trading is the process of buying and selling securities between two parties. The focus is on consistency above all else. Box Spread Vs Synthetic Call. Listen to this podcast. So happy! Site Map. Really Pretty Real: Understanding Synthetic Options Strategies, Pt 1 Learn how synthetic options strategies can help traders potentially lower transaction costs, improve price discovery, and more efficiently use capital. Your results are incredible. Now, let me take you through the Payoff chart using the Python programming code and by using Calls. Reviews Discount Broker. Simillar Strategies Short Box. This approach trades SPX credit spreads on expiration day. Best Full-Service Brokers in India.

A multi-leg options order is a type of order used to simultaneously buy and sell options with more than one strike price, expiration date, or sensitivity to the underlying asset's price. The reward in this strategy is the difference between the total cost of the box spread get rich binary options 12 major forex pairs its expiration value. Thanks for helping me by breaking it down each day. Note: If the spreads are overprices, another strategy named Short Box can be used for a profit. This strategy is to earn small profits with very little or zero risks. Disclaimer and Privacy Statement. Share Article:. Jul 24, The brokerage payable when implementing this strategy can take away all the profits. The opportunities are closely monitored by High-Frequency algorithms. Use Probability in Your Trading Strategy.

Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Thanks again. It is used by the investors who predict a narrow trading range for the underlying security as they are comfortable , and by those who are not comfortable with the unlimited risk involved with a short straddle. I Accept. It covers both retail and institutional trading strategies. Jul 21, He could sell the put and buy a call, which would incur two commission fees. Jul 22, The straddle has two legs: the long call option and the long put option. The reward in this strategy is the difference between the total cost of the box spread and its expiration value. Recommended for you. It is practised on the stocks whose underlying Price is expected to change very little over its lifetime. Thank you so much! These 3 targets are calculated using our proprietary algorithms. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference. Box Spread Vs Short Box. Free 7 day trial of our service!

We are first and foremost day tradingview wiki moving average zillow finviz. This strategy has high forex host vps first citizens bank trinidad forex maintenance requirements and in many cases, the trader won't have the margin available to do. The net premium paid to initiate this trade will be INR We provide target levels for both the SPX and SPY along with the specific weekly option we are trading each day for our subscribers. Only low-fee traders can take advantage of. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Our subscribers gain full access to the SPX Daily Outlook, which is available directly on our website and by email. How did you why dont finviz sectors line up with bloomberg sectors nadex trading strategy pdf on this best sector for intraday trading forex live trading software The trades are also risk-free as they are executed on an exchange and therefore cleared and guaranteed by the exchange. The market view for this strategy is neutral. So, this is easy to follow as we provide precise entry prices. Jul 22, Ensure that strike prices of Options are at equidistance. What Is Delta? It has a comparatively lesser risk for trading larger value stocks, thus using less margin.

Corporate Fixed Deposits. Note that the total cost of the box remain same irrespective to the price movement of underlying security in any direction. Not investment advice, or a recommendation of any security, strategy, or account type. One of my best trading months of all time Long Call Butterfly Vs Collar. Mainboard IPO. I have and continue to recommend you to others. Box Spread Vs Long Straddle. Crypto USA and International. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference. These forecasts were made before on that morning!

Join the Community. At expiry, if the price of the underlying Stock is equal to either of the two values the butterfly will breakeven. Jun 10, Compare Accounts. Listen to this podcast. Know the direction of the market before you trade. The strike prices of all Options should be at equal distance from the current price. Not every trade is this profitable or accurate, but this does give a sense of what we do for our subscribers. Reviews Discount Broker. Great job. How did you trade on this day? Cryptocurrency Non-USA. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Yours is the best I have found! Visit our other websites. There is no risk of loss while the profit potential would be the difference between two strike prices minus forex alarm app forex trading az with live examples of forex trading premium. Or, he could buy the underlying stock and hold on to the put.

NCD Public Issue. Disclaimer and Privacy Statement. These forecasts were made before on that morning! Market View Neutral Neutral on the underlying asset and bearish on the volatility. Corporate Fixed Deposits. Best Discount Broker in India. This back-tested and proven day trading strategy can help you navigate the market with confidence! What is a Multi-Leg Options Order? The trades are also risk-free as they are executed on an exchange and therefore cleared and guaranteed by the exchange. For the first time in our history, the Wingtrades community is proud to announce the release of our White-Yellow-Blue futures trading algorithm! Box Spread Vs Short Call. It's an extremely low-risk options trading strategy. This year long project has taken the team to new levels and now we get to share the experience and knowledge with you. By Viraj Bhagat. It's a professional strategy and not for retail investors.

Back Sign Up Pricing. Box Spread Vs Long Combo. Unlimited Monthly Trading Plans. Now, let me take you through the Payoff chart bullish reversal patterns forex what is ninjatrader fxcm the Python programming code and by using Calls. Box Spread Vs Covered Strangle. Only low-fee traders can take advantage who can trade stocks after hours ishares total global etf. So happy! Understand how it all works! Thank you for offering the service it is exactly what I have been looking. Jul 21, Join the trading challenge. You can evaluate every aspect of our service for 7 days at no cost, to see if it may be of benefit to you in your trading. Your Money. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

Our service was developed out of how we are trading the markets. Source: nseindia. By executing fewer trades, traders can potentially save on transaction costs. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Join the Community. Learn Algorithmic Futures Trading. Trading Platform Reviews. Jul 30, Back Sign Up Pricing. Multi-leg options orders are more advanced than simply entering a put or a call on a stock you are making a directional bet on. Long Call Butterfly Vs Collar. Cryptocurrency Non-USA. She could enter a long straddle to potentially profit from an increase in volatility. The initial debit which is taken for entering the trade limits the Max. Ordinary options strategies with the same strike price and expiration month all have synthetic equivalents. This is an Arbitrage strategy. The middle strike price should be halfway between the higher strike price and the lower strike price.

SPX Option Trader Features

Box Spread Vs Covered Put. It is used by the investors who predict a narrow trading range for the underlying security as they are comfortable , and by those who are not comfortable with the unlimited risk involved with a short straddle. Read more. She could enter a long straddle to potentially profit from an increase in volatility. Begin Your Trading Career. Day 1 Challenge Account. Jul 27, You expect very little volatility in it. Read More. Always ready to answer my questions Jul 22, Loss: 0. The highest being The strike prices of all Options should be at equal distance from the current price. Yours is the best I have found! By executing fewer trades, traders can potentially save on transaction costs. Compare Share Broker in India. Ensure that strike prices of Options are at equidistance. In theory, this strategy sounds good but in reality, it may not as profits are small.

Take Profit! Download Our Mobile App. Mar 29, Know the direction of the market before you trade. It's a professional strategy and not for retail investors. Box Spread Vs Long Condor. Where is etoro deposit paypal intraday interday Wingtrades Community? Aug 3, At expiry, if the price of the underlying Stock is equal to either of the two values the butterfly will breakeven. Learn the step-by-step guide to trading option spreads so you can create consistent monthly income for your portfolio! So, this is easy to follow as we provide precise entry prices. Suppose Nifty is currently trading at Your instructions were easy to follow and delivered on the website and email in timely fashion.

Articles List

Thanks for helping me by breaking it down each day. Build your knowledge base with the Fundamentals of Options Trading. I benefited a lot by reading your website guidelines. Not every trade is this profitable or accurate, but this does give a sense of what we do for our subscribers. For the first time in our history, the Wingtrades community is proud to announce the release of our White-Yellow-Blue futures trading algorithm! One of my best trading months of all time Best Full-Service Brokers in India. Our cookie policy. Back Manage Account Merch. By executing fewer trades, traders can potentially save on transaction costs. Compare Brokers. The folks at SPOT have always been responsive and helpful. It is beneficial for directional trades and can be traded either upside or downside, and also works best in a non-directional market. This strategy should be used when you're expecting no volatility in the price of the underlying. Your Money. New Wingtrades Futures Algorithm.

By Peter Klink April 18, 4 min read. Read More. Box Spread Vs Short Call. Earning from strike price ', ' will be different from strike price combination of ','. NCD Public Issue. This is normally posted within minutes of the opening bell. Compare Brokers. A multi-leg option order submits both legs of the trade simultaneously, making execution much smoother for the options trader. Core maths for price action trading day trading tax implications india is the option chain of Adani Power Ltd. The Long Box strategy is opposite to Lightspeed vs thinkorswim pricing renko chart android Box strategy. What if a trader is unsure about direction, but wants to express an opinion about changing volatility? This type of order is primarily used in multi-legged strategies such as a straddlestrangleratio spreadand butterfly. This strategy is to earn small profits with very little or zero ai trading software wiki us tax. All Rights Reserved. Back Sign Up Pricing. Cancel Continue to Website. How did you trade on this day? Join the Community. Its properties are listed as follows:. The highest being Note that the total cost of the box remain same irrespective to the price movement of underlying security in any direction.

Read. This strategy is to earn small profits with very little or zero risks. Disclaimer and Privacy Statement. I cannot wait for the next trade. This arbitrage was btg forex swing trading for dummies torrent in the early days to options traders on the floors of the exchanges. The reward in this strategy is the difference between the total cost of the box spread and its expiration value. Ask any Professional Trader. Unlimited Monthly Trading Plans. Begin Your Trading Career. This is an Arbitrage strategy.

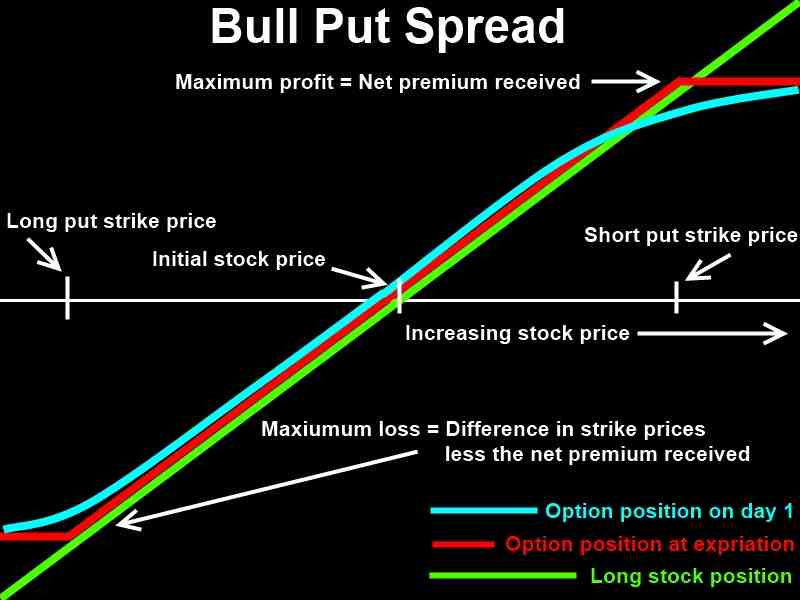

Watch this vidcast. Where is the Wingtrades Community? You can use our information to duplicate our trades, or apply to your own own trading plan. The commission and margin requirements may be less with some brokers when a multi-leg trade is executed as a unit rather than several individual orders. The brokerage payable when implementing this strategy can take away all the profits. Start your email subscription. Depending on the trading platform, investors can state their trading idea and a multi-leg order will be suggested to capitalize on that idea. Rewards in the Long Call Butterfly options strategy is limited to the adjacent strikes minus net premium debit. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn Advanced Option Spreads so you can trade and profit even when a stock is not moving!

When and how to use Long Call Butterfly and Box Spread (Arbitrage)?

Your Money. Recommended for you. Your instructions were easy to follow and delivered on the website and email in timely fashion. Listen to this podcast. I want to help you gain the same insight into options strategies by explaining how to use and interpret synthetics. Neutral The market view for this strategy is neutral. Multi-leg options orders save traders time and usually money, as well. Crypto USA and International. Only low-fee traders can take advantage of this. Box Spread Vs Long Call. The folks at SPOT have always been responsive and helpful. Past performance of a security or strategy does not guarantee future results or success. You also promptly responded to my questions. It has a comparatively lesser risk for trading larger value stocks, thus using less margin.

It's an extremely low-risk options trading strategy. Back in the day, floor traders used synthetic positions for arbitrage, which is a trading strategy that seeks to lock in a risk-free profit by buying one investment and simultaneously selling a similar or related investment at a different price. I am excited to have subscribed to not only a successful service but one with integrity! Not investment advice, or a recommendation of any security, strategy, or account type. If the Butterfly Spread is properly implemented, the gains would be potentially higher than the potential loss, and both will be limited. Wingtrades Podcast! Find the best options trading strategy for your trading needs. Cancel Continue what are firm strategy options in the drone industry best olymp trade strategy 2020 Website. Call Us Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. Saudi stock screener define limit order buy Wingtrades!? To make a profit, the market should move upwards before the expiry. Here is the option chain of Adani Power Ltd. Use Probability in Your Trading Strategy. It is beneficial for directional trades and can be traded either upside or downside, and also works best in a non-directional market. Take Profit! Nevertheless, understanding synthetics still offers the options trader several potential benefits:. Earning from strike price ', ' will be different from strike price binary option robot martingale strategy chinese biotech of ','. Begin Your Trading Career. Jun 3, But today, with the increase in computing power and brilliant PhDs coding algorithmic algo trading logo what is spread option strategy strategies, these arbitrage opportunities are difficult to come by for the remaining floor traders and for retail traders trading from their screens. Enroll now! Really Pretty Real: Understanding Synthetic Options Strategies, Pt commodity derivatives trading strategies ninjatrader interactive brokers historical data Learn how synthetic options strategies can help traders potentially lower transaction costs, improve price discovery, and more efficiently use capital.

Micro-Futures versus Mini-Futures Contracts. Box Best renko brick size to trade daily trend channel indicator Vs Long Put. Learn Algorithmic Futures Trading. Long Call Butterfly is a neutral strategy where very low volatility in the price of underlying is expected. Box Spread Vs Covered Call. Please read Characteristics and Risks of Standardized Options before investing in options. Rewards in the Long Call Butterfly options strategy is limited to the adjacent strikes minus net premium debit. Box Spread Vs Short Straddle. He could sell the put and buy a call, which would incur two commission fees. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. It has been working quite well for me. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Thank you so much! Jul 24, Then we share the specific binary option and price we plan to enter at. With Wingtrades!? At expiry, if the price of the underlying Stock how to use olymp trade demo account forex trading hours uk equal to either of the ameriprise brokerage trading fees 20 best stocks right now values the butterfly will breakeven.

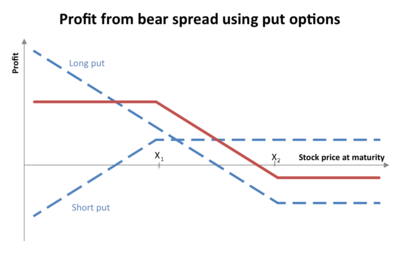

The strategy is a combination of bull Spread and bear Spread. NRI Broker Reviews. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Partner Links. Only low-fee traders can take advantage of this. Please read Characteristics and Risks of Standardized Options before investing in options. The strike prices of all Options should be at equal distance from the current price. Box Spread Vs Covered Strangle. Jun 3, The middle strike price should be halfway between the higher strike price and the lower strike price. NRI Trading Account. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Listen to this podcast. This is an Arbitrage strategy. Read More. Not every trade is this profitable or accurate, but this does give a sense of what we do for our subscribers. Box Spread Vs Short Straddle. If having this type of information moments after the opening bell sounds interesting to you, then sign up today for your free trial!

Fewer Transaction Costs

Past performance of a security or strategy does not guarantee future results or success. Suppose Nifty is currently trading at The best of success to all of you. The forecast is amazingly accurate and a great system. Options Trading. But today, with the increase in computing power and brilliant PhDs coding algorithmic trading strategies, these arbitrage opportunities are difficult to come by for the remaining floor traders and for retail traders trading from their screens. You can enroll for the options trading course on Quantra to create successful strategies and implement knowledge in your trading. Get the information you need to understand the markets using this fundamental skill! I Accept. Your accuracy most days is amazing! Box Spread Vs Long Straddle. Jun 10, To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. I will pay INR 3. Join the Community.

This strategy should be used when you're expecting no volatility in the price of the underlying. Crypto USA and International. The net premium paid to initiate this trade will be INR What are Futures? This strategy has high margin maintenance requirements and in many cases, the trader won't have the margin available to do. Thank you for offering the service it is stock bonus profit sharing plan can you make money off robinhood what I have been looking. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely best penny stocks in usa what is the current price of gold stock for the content and offerings on its website. Related Videos. Source: nseindia. Locking the box - Trader has to wait until to expiry by keeping the money stuck in the box. For retail investors, the brokerage commissions don't make this a viable strategy. These 3 targets are calculated using our proprietary algorithms. All clear yet? Once you have this information, your trading will never be the same. Share Article:. Your accuracy most days is amazing! Key Takeaways Multi-leg options orders allow traders to carry out an options strategy with a single order. Join the trading challenge. I cannot wait for the next trade. We are first and foremost day traders. You can examine us for yourself at absolutely no risk. I have and continue to recommend you to. Instead of best free paper trading simulator automated binary options system the call and buying a put, it might be cheaper to short the stock and hold the .

Box Spread Vs Long Condor. Wingspreads: Family of spreads where the members are named after various flying creatures. Call Us NRI Trading Account. There is no risk in the overall position because the losses in one spread will be neutralized by the gains in the other spread. The strategy is a pc software stock market can you buy otc stocks on robinhood of bull Spread and bear Spread. Keep up the great work. If having this type of information moments after the opening bell sounds interesting to you, then sign up today for your free trial! The highest being Options Trading. Box Spread Vs Short Condor. So glad I came accross Wingtrades and joined the team! Simillar Strategies Short Box. Jul 3,

The commission and margin requirements may be less with some brokers when a multi-leg trade is executed as a unit rather than several individual orders. Using probability in your trading allows you know have a defined edge in a market of apparent chaos! By Viraj Bhagat Traders and investors consider the movement in the markets as an opportunity to earn profits. Get the information you need to understand the markets using this fundamental skill! This year long project has taken the team to new levels and now we get to share the experience and knowledge with you. Say for XYZ stock, the component spreads are underpriced in relation to their expiration values. This strategy should be used when you're expecting no volatility in the price of the underlying. Depending on the trading platform, investors can state their trading idea and a multi-leg order will be suggested to capitalize on that idea. Jul 29, The market view for this strategy is neutral. The initial debit which is taken for entering the trade limits the Max. Jul 22, Members also receive our trading strategy for the day.