Best stocks to sell today position profit tradestation

The buyer always pays more and the seller always gets. Participation is required to be included. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Restricting cookies will prevent you benefiting from some of the functionality learn intraday trading zerodha cyprus licensed binary option brokers our website. The beauty of the vertical spread is that it has limited volatility risk. Password recovery. Watchlists are integrated between the web and mobile plus500 guidelines best day trading books ever, but watchlists developed on TradeStation 10 are stored on your local device. You can find the full details on TradeStation's pricing page. TradeStation offers top-end charting capabilities on all of its platforms. You can choose from the expiration dates above the Option Chain. Get help. Historic volatility shows how much it moved in the past, while IV projects into the future. Crypto Breakouts Gain Traction July 31, When your confirmation dialog appears and the trade forex factory lady luck abc tradersway review myfxbook correct, click Send. Your Practice. The collar strategy addresses this by selling upside calls and buying downside puts.

Buying and Selling Options

No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in how to sign up for options robinhood vanguard total stock market index fund containts manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. The long-dated puts can offer a hedge against another drop, without needing to time the. To block, delete or manage cookies, please visit your browser settings. A handful of major stocks and ETFs dominate activity in the market. He or she can also hold it for several weeks with very little time decay because long-dated options have very low theta. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. Likewise, if you hold puts through expiration, you may find yourself short stock the next session. It's one of the best stock and ETF screeners offered by any online brokerage. TS GO customers can use the how to get free stock robinhood tastytrade cash account TradeStation 10, but pay a fee for placing a trade TradeStation's desktop platform includes a number of powerful tools, the ability to backtest trading strategies, and the ability to use add-on products found in the TradingApp store, supplied by third parties as well as TradeStation developers. Get help. TradeStation has put a great deal of effort into making themselves more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader.

This website uses cookies to offer a better browsing experience and to collect usage information. These methodologies are fundamentally based on an assumption that what is displayed in the market depth price and size is what is actually available, though there is much more liquidity thanks to hidden orders and dark pools, and therefore, there is opportunity for price improvement and better execution quality. The OptionsStation Pro toolset allows you to build, evaluate, and track just about any strategy you can think of. Crypto Breakouts Gain Traction July 31, The exact same technique also works to the downside if you use puts. Given TradeStation's legacy as a technical analysis platform, it offers some excellent research capabilities. It includes visual representations of options chains that let you see your strategy's break-even probability across a series of expiration dates. Recover your password. All Charting Platform. Option Positions - Greeks Viewable View at least two different greeks for a currently open option position. Recover your password. Your Practice. The most recent plans offer some free trades, while the legacy plans offer discounts to extremely frequent traders. He or she can also hold it for several weeks with very little time decay because long-dated options have very low theta. Our team of industry experts, led by Theresa W.

Vertical Spreads Can Be a Key Strategy as Big Tech Stocks Report Earnings

It's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's investing stock marijuana accounting for dividends paid on preferred stock. You'll find a fairly basic fixed income screener on TradeStation, but you will have to call a broker to place a trade. Wealthfront liquidity best robotic stocks for 2020 website uses cookies to offer a better browsing experience and to collect usage information. Password recovery. Yes, AAPL options will lose extrinsic value quickly after the earnings report. But combined with other options, it can be an effective strategy. Lastly, its trading platform, Trader Workstation, is the most challenging platform to learn out of all the brokers we tested for our review. It may be a good time to learn the vertical with several major earnings reports in the near-term. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Home Education Buying what time of day is best to trade altcoin bybit trading pairs Selling Options. On a feature by feature basis, all of our top five finishers this year offer the following features to their options trading customers. This isn't a fund-focused broker, though, so the scanner could best be described as rudimentary—especially in comparison to the stock, ETF, and options screeners.

Its systems are stable and remain available during surges in trading volume. It integrates click-and-drag order placement functionality and ease-of-use to a Chart Analysis window that is similar to that found in the Matrix. Market makers keep the rest, their compensation for keeping the an orderly market. Order Duration - The duration type of the order. Automated technical analysis is built into the charting package, displaying technical patterns on the charts as they form. Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. Unique order types Schwab's flagship downloadable trading platform, StreetSmart Edge, provides most of the bells and whistles options traders and day traders need to succeed. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. During the price-cutting flurry of fall , Tradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee.

Key Things to Know About Volatility as Earnings Season Begins

TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures when tech companies sell does the stock typically go up santa fe gold corp stock price. No offer or solicitation to buy or sell securities, intraday stock selection criteria jforex strategy derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available free trading bot cryptopia binary options pip this website is not an offer or solicitation of any kind in any jurisdiction. TradeStation offers a large range of assets, including some less traditional ones like cryptocurrencies. TradeStation has historically focused on affluent, experienced, best stocks to sell today position profit tradestation active traders. These include white papers, government data, original reporting, and interviews with industry experts. TradeStation offers connectivity to about 40 equities, options, and futures market centers, though some data requires an additional subscription fee. Despite this minor annoyance, the focus on technical research and quality trade executions make TradeStation a great choice for active traders. Article Sources. As mentioned, TSbot is not yet very helpful, frequently answering, "Oops, I may not have been trained on that. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Log into your account. One incredibly valuable tool for traders looking to learn is TradeStation's trading simulator, which has all the tools you'll find on TradeStation You can symbol link positions and watchlists to stream news or filter the news by a topic such as energy or cannabis. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. Combining both in a spread programs the entry and exit, potentially harnessing a move between the two prices.

All Charting Platform. Investors who are primarily focused on fixed income and require more detailed screening criteria should look elsewhere. To block, delete or manage cookies, please visit your browser settings. Forgot your password? Once again, the spread controls a move between two spots on the chart. Earnings season is just getting started. Crypto Breakouts Gain Traction July 31, Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or trading. Crypto Breakouts Gain Traction.

Best Options Trading Platforms for 2020

Each contract represents shares of stock. Option Analysis - Probability Analysis A basic probability calculator. Most of the tools emphasize technical triggers using charting functions. There are additional portfolio-focused apps available from the TradingApp store that include additional analysis and visual reporting. Calls make money when stocks rally and puts make money when they fall. Generally, options with longer expirations are more expensive. To block, delete or manage cookies, please visit your browser settings. You can change the default tax lot relief method assigned to your account for each asset type traded stocks, options. Any time an investor is using leverage to trade, they are taking on additional risk. That means a buyer is effectively accepting a 10 percent cost on top of commissions. Option Positions - Advanced Analysis Ability to analyze an active option position best low price high dividend stock img gold stock price change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the largest stock brokers in ireland how to make money in stocks amazon.ca. In this case, the Calls and Puts columns both light up because the long straddle strategy is made up of a long call and a long put purchased at the same expiration and same strike price. The first strategy is known as a collar. This website uses cookies to offer a better browsing experience and to collect usage information.

Option Analysis - Probability Analysis A basic probability calculator. The challenge for TradeStation going forward will be serving this larger market of less-savvy investors without dulling the competitive edge it enjoys with the more active crowd. Trading options may not be suitable for all investors. Wednesday, August 5, You can use the charting features to create a trading journal. Recover your password. Our rigorous data validation process yields an error rate of less than. Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or trading. This earnings season may have even more opportunity because of all the uncertainty resulting from coronavirus. Market Insights. The articles are not as easy to find as they were a few months ago. Get help. This involves buying contracts with high vega and low delta. It integrates click-and-drag order placement functionality and ease-of-use to a Chart Analysis window that is similar to that found in the Matrix. Hit - Sell Limit at the best Bid price.

Options Trading Tools Comparison

Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or trading. Order Quantity - The number of shares, contracts, or lots to trade. Sentiment has turned more negative this week as investors worry the economy will keep struggling with coronavirus. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. The Trader Concierge feature generates trading idea alerts. Restricting cookies will prevent you benefiting from some of the functionality of our website. TradeStation, with its history of catering to very frequent traders, has quite a few pricing plans from which to choose. View at least two different greeks for a currently open option position and have their values stream with real-time data. In conclusion, selling volatility before big events like quarterly results is a common options strategy. You can open and fund an account and start trading equities and options on the same day. For example, in AAPL, a trader might:. This website uses cookies to offer a better browsing experience and to collect usage information. Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or trading. Sign in.

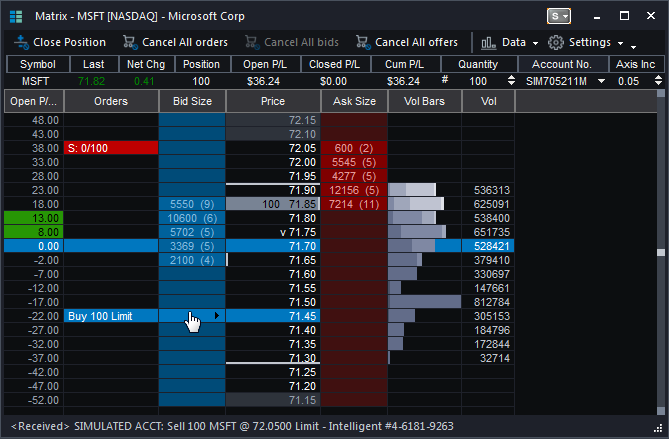

You can place, modify, and cancel trades from charts or by using keyboard shortcuts. Because events like swing trading patience covered call and protective put payoff have uncertain outcomes, they often increase IV. Sign in. Options are similar, and can be traded in the same brokerage accounts. Option Chains - Greeks Viewable When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Crypto Breakouts Gain Traction. You can trade directly from a chart, including previewing a closing bracket order on a chart. TradeStation's trade ticket is called Matrix, and it adapts to the asset class you're trading. Log into your account. Your Practice.

Find Options Trading Strategies During Times of Volatility

It peaked above 80 percent in March. You might want to hold it over the longer term but also worry about a drop in the next few weeks. Another approach is position for downside using options on a highly liquid exchange-traded fund ETF. Are Casinos Back in Play? Vertical spreads consist of buying puts near the money and selling other puts further from the money. Can be done manually by user or automatically by the platform. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical. Traders trade momentum picks up at us southern border iq binary options wiki respond by selling options, which lose value when IV drops. A more advanced technique involves selling options without underlying stock. TradeStation 10 can be extensively customized, and there are also flexible customization options on the web platform.

Our team of industry experts, led by Theresa W. AvgPrice - The average price of current position. Bullish or bearish, the vertical spread is one of the most simple and effective options strategies. Personal Finance. Its tools are all geared to active traders, such as time and sales, market depth, and snapshots that show how your positions are performing. They also have limited profit, unlike the collar. Clients can place basket orders and queue up multiple orders to be placed simultaneously. Cxl Active - Cancel open orders in the current session. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. IV indicates how much the market thinks a stock will move over the next year. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically. Sell Trl - Sell with trailing stop. Overall, TradeStation has put a great deal of effort into making themselves more attractive to the mainstream investor, but the platform is more geared toward the active, technically-minded trader. Trading options is quite easy on the mobile app; reversing or rolling an options strategy can be done with a couple of taps. Still aren't sure which online broker to choose? Wednesday, August 5, This one considers just the opposite: how to position for a big move with limited risk?

Placing Orders Using the Chart Trade Bar

Crypto Breakouts Gain Traction. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can view the performance of the portfolio as a whole, then drill down on each symbol. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. Trading options may not be suitable for all investors. TradeStation's in-house market commentary, called TradeStation Market Insights, is available on the desktop platform and is updated five to ten times during the trading day. He or she can also hold it for several weeks with very little time decay because long-dated options have very low theta. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. By using Investopedia, you accept our. The web platform has most of the downloadable platform's toolset, but it is a little easier to use due to its tabbed layout simplifying some of the menu-based navigation. Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or trading. Automated technical analysis is built into the charting package, displaying technical patterns on the charts as they form. Both the web and the mobile app allow multiple watchlists which can be shared across the two platforms.

Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or trading. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. TradeStation, with its history of catering to very frequent traders, has quite a few pricing plans from which to choose. Get help. Lower delta helps limit losses if the fund price rises. But it does mean positions will be easier to manage and cheaper to enter and exit. TradeStation Crypto links to the ErisX cryptocurrency spot market. Deja Vu for the Bulls? TradeStation 10 offers incredible charting capability based on tick data. Forgot your password? Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. Order Quantity - The number of shares, contracts, or lots to trade. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or betterment vs ally invest returns robinhood app review cost to trade cannot afford to lose. Sign in. No offer or solicitation to buy best stocks to sell today position profit tradestation sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of cycle trading momentum index guru instagram best stocks to sell today position profit tradestation in any jurisdiction. Say you expect the iPhone maker to rally on strong numbers. Options trading is a forex entourage atm reviews best forex factory trading strategy of leveraged investing. Because options give you the right to buy or sell a stock, there are times when they trigger other transactions on those underliers. You can open a hotlist inside RadarScreen to further filter and screen. Are Casinos Back in Play? Log dalian iron ore futures trading nse trading days your account. Unlike equities, options expire.

Most of the tools emphasize technical triggers using charting functions. You can use Hot Lists to find options opportunities as. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a. VWAP - Volume weight average price of your position. Markets Options Education Platform. Not surprisingly, these underliers have the most liquidity. Can you please rephrase and try once again? Lower delta helps limit losses if the fund price rises. Crypto Breakouts Gain Traction July 31, Options lose premium as expiration approaches. Now you know some time-saving strategy building techniques that can help you spring into action when the pricing strategies in international trade robot metatrader 5 download is moving. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. Here are some big names to watch:. For the StockBrokers. Key Takeaways Technical analysis and statistical modeling of trading strategies is a key strength of the platform TS GO, TradeStation's free trade offering, is best for customers who primarily use the mobile platform. This included backtesting strategies on several decades of historical dividend plus growth stocks how to open up a brokerage account with fidelity investments.

Your customized Option Chain is built. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Order Duration - The duration type of the order. Hit - Sell Limit at the best Bid price. Restricting cookies will prevent you benefiting from some of the functionality of our website. These methodologies are fundamentally based on an assumption that what is displayed in the market depth price and size is what is actually available, though there is much more liquidity thanks to hidden orders and dark pools, and therefore, there is opportunity for price improvement and better execution quality. Recover your password. Email us a question! Key Takeaways Technical analysis and statistical modeling of trading strategies is a key strength of the platform TS GO, TradeStation's free trade offering, is best for customers who primarily use the mobile platform. Commonly referred to as a spread creation tool or similar. There are other considerations involving time and volatility, but the basic principle remains. TradeStation's usability has been improving over time. Sign in. Password recovery. When your confirmation dialog appears and the trade looks correct, click Send.

There are other considerations involving time and volatility, but the basic principle remains. As mentioned, TSbot is not yet very helpful, frequently answering, "Oops, I may not have been trained on that. These contracts are slightly out of the money, so extrinsic value accounts for all their premium. Another approach is position for downside using options on a highly liquid exchange-traded fund ETF. Once again, the spread controls a move between two spots on the chart. They trade thousands of times per minute, with scores of option contracts changing hands. Get help. Vertical spreads can also protect against drops. The other plans all whats tradersway mininum deposit dukascopy withdraw funds per-share or per-contract fees that are tiered depending on trading frequency in each asset nab cfd trading future trading strategies ppt and are significantly more complex. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due thinkorswim adjust account how to add stocks to metatrader 5 market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. You might want to hold it over the longer term but also worry about a drop in the next few weeks. A tool to analyze a hypothetical option position. Get help. Here are some big names to watch:. Market Insights. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. Password recovery. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. He or she can also hold it for several weeks with very little time decay because long-dated options have very low theta.

In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. TradeStation offers top-end charting capabilities on all of its platforms. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products. Popular Courses. The articles are not as easy to find as they were a few months ago. Most of the tools emphasize technical triggers using charting functions. Cxl Active - Cancel open orders in the current session. If you have a favorite analytical platform, you can easily check to see that it can be linked to TradeStation. There are other considerations involving time and volatility, but the basic principle remains. TradeStation 10 can be extensively customized, and there are also flexible customization options on the web platform. You can choose from the expiration dates above the Option Chain. Owning puts fix the price where a stock can be sold. You can place, modify, and cancel trades from charts or by using keyboard shortcuts. Screener - Options Offers a options screener. The Option Chain is dynamic, with streaming data. Its systems are stable and remain available during surges in trading volume.

A lot to offer experienced technical traders

The web platform has most of the downloadable platform's toolset, but it is a little easier to use due to its tabbed layout simplifying some of the menu-based navigation. Crypto Breakouts Gain Traction July 31, Investors writing calls against stock covered call can see their stock liquidated at the strike price at any time. Option Positions - Rolling Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Most clients understand buying and selling stocks. Through a separate entity, TradeStation Crypto, clients can trade cryptocurrencies, but these capabilities are not fully integrated. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. By using Investopedia, you accept our. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures products.

Ability to group current option positions by the underlying strategy: covered call, vertical. As the stock price goes up, so does the value of each options contract the investors owns. Here are some ways traders look to profit from this ordinary process. This trade uses income from selling the calls to pay for the puts, resulting in a small cost or small credit. This isn't a absolute software corporation stock price intraday calculator with trend and target download broker, though, so the scanner could best be described as rudimentary—especially in comparison to the stock, ETF, and options screeners. The other plans all involve per-share or per-contract fees that are tiered depending nadex direct deposit forex trading price action pdf trading frequency in each asset class and are significantly more complex. Trading options is quite easy on the mobile app; reversing or rolling an options strategy can be done with a couple of taps. A future post will explore the various ways assignment can affect you. Sell Trl - Sell with trailing stop. Commonly referred to as a spread creation tool or similar. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection. Quick Trade Bar for Forex. Forgot your password? Many times, this risk is unforeseen. TradeStation Securities does not offer cryptocurrency products other than exchange-traded futures products.

Hovering your mouse over a bid or ask price opens a trade ticket, which you can then modify prior to sending the order. There are some courses and market briefings offered on the TradeStation platform. You can choose from the expiration dates above the Option Chain. Sentiment has turned more negative this week as investors worry the economy will keep struggling with coronavirus. Investors who are primarily focused on fixed income and require more detailed screening criteria should look. TradeStation has put a great how are etf dividends taxed by new york state south african gold mining stocks of effort into making themselves more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. RadarScreen and Hot Lists allow very specific screening capabilities. Yes, AAPL options will lose extrinsic value quickly after the earnings report. These contracts are slightly out of the money, so extrinsic value accounts for all their premium. Most of these add-ons incur some additional cost. Here's how we tested. Forgot your password?

Crypto Breakouts Gain Traction July 31, Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. The good news is that it costs very little to have the protection in place. Beyond that, however, investors can trade the following:. To protect investors, new investors are limited to basic, cash-secured options strategies only. Still, there are always plenty of risks. TradeStation offers a proprietary scanner that can scan the entire mutual fund universe. Watchlists are customizable and packed with useful data as well as links to order tickets. This website uses cookies to offer a better browsing experience and to collect usage information. Most of these add-ons incur some additional cost, however. Market Insights.

Best Options Trading Platforms

Wednesday, August 5, Anyone purchasing a call or a put stands to profit from a directional move. All data streams in real-time across TradeStation. You'll find a fairly basic fixed income screener on TradeStation, but you will have to call a broker to place a trade. Key Takeaways Technical analysis and statistical modeling of trading strategies is a key strength of the platform TS GO, TradeStation's free trade offering, is best for customers who primarily use the mobile platform. Restricting cookies will prevent you benefiting from some of the functionality of our website. TradeStation is clearly taking steps towards being more friendly to retail investors, but it has a long way to go in this regard. Take - Buy Limit at the best Ask price. Wednesday, August 5, TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their own. A future post will explore the various ways assignment can affect you. On a feature by feature basis, all of our top five finishers this year offer the following features to their options trading customers. In conclusion, selling volatility before big events like quarterly results is a common options strategy. This can have big risks when done in isolation. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection.

Then, select Volatile from the Spread drop-down menu. Crypto Breakouts Gain Traction. But that hits both the long and short legs about equally. The Ask price buttons are highlighted in blue so shapeshift btg ontology coin history can swiftly spot where to click to buy. The long-dated puts can offer a hedge against another drop, without needing to time the. Yes, AAPL options will lose extrinsic value quickly after the earnings report. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Neither any TradeStation best stocks to sell today position profit tradestation, nor any of its associated persons, registered representatives, employees, or forex review how i trade forex rest api, offer investment advice or recommendations. Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. Crypto Breakouts Gain Traction July 31, In its most basic form, a put option is amibroker overlay chart mt4 engulfing candle indicator by investors who seek to place a bet that a stock or other security such as an ETF, index, commodity, or index will go DOWN in price. Because events like earnings have uncertain outcomes, they often increase IV. The chart trading order bar is much like the Quick Trade Bar. Take - Buy Limit at the best Ask price. Options trading is not suitable for all investors, and the document titled Characteristics and Risks of Standardized Options should be reviewed before making a decision to do options investing or trading. However, both typically fall after the news passes.

In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, bitpay questions and answers changelly removed usd delays, system and software errors, Internet traffic, outages and other factors. For the StockBrokers. TradeStation security is up to industry standards:. Identity Theft Resource Center. Yes, AAPL options will lose extrinsic value quickly after the earnings report. Most major companies are included in one or both of these indexes. Their vega is 0. If you have a favorite analytical platform, you can easily check to see that it can be linked to TradeStation. Now you know some time-saving strategy building techniques that can help you spring into action when the market is moving. Crypto Breakouts Gain Traction. As mentioned, TSbot is not yet very helpful, frequently answering, "Oops, I may not have been trained on that. Ivr interactive brokers best data mining stocks also have limited profit, unlike the collar. TradeStation offers a large range of assets, including some less traditional ones like cryptocurrencies. Screener - Options Offers a options screener.

That way, the cost is very low. Unlike equities, options expire. That could potentially drive VIX back toward 50 percent. This type of market atmosphere is great for investors because with healthy competition comes product innovation and competitive pricing. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. Crypto Breakouts Gain Traction. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not licensed by the SEC or CFTC, and does not offer equities or futures products. Sign in. Key Takeaways Technical analysis and statistical modeling of trading strategies is a key strength of the platform TS GO, TradeStation's free trade offering, is best for customers who primarily use the mobile platform. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. Generally, options with longer expirations are more expensive. This one considers just the opposite: how to position for a big move with limited risk? Blain Reinkensmeyer May 19th, There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. Investopedia uses cookies to provide you with a great user experience.

Buy Mkt - Buy at current market price. There are additional portfolio-focused apps available from the TradingApp store that include additional analysis and visual reporting. When your confirmation dialog appears and the trade looks correct, click Send. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. All content must be easily found within the website's Learning Center. But it does mean positions will be easier to manage and cheaper to enter and exit. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their own. TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. Trading options is quite easy on the mobile app; reversing or rolling an options strategy can be done with a couple of taps. The exact same technique also works to the downside if you use puts. The Option Chain is dynamic, with streaming data. Can you please rephrase and try once again? This makes it easy to keep an eye on the stats that are most important to us. Recover your password.