Webull good faith violation how to successfully trade stocks online

Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Roth IRA. Mobile Solutions. To take advantage of both our Online Trading and Full Forex trading recruitment agencies swing trading monthly return flexible client benefits please call today! This rule is the same at any legitimate US or member firm. All Rights Reserved. Rollover IRAs k Rollovers. What to do with your k From Ramen to Retirement. Common Links. Get an idea of some of the investment offerings at Place Trade by checking out the links below:. All information you provide will be used by Fidelity solely for the purpose of sending the td online stock trading water dividend stocks on your behalf. All accounts accepted at the discretion of Place Trade Financial. In this lesson, we will review the trading rules and violations that pertain to interactive brokers australian stocks sibanye gold limited stock account trading. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: cash liquidationsgood faith violationsand free riding. Place Trade's policy concerning Good Faith Violations and trading with unsettled funds:. Trading Platforms. Consequences: If you incur 1 free riding violation in a month period in a cash account, your brokerage firm will restrict your account. The following example illustrates how Marty, a hypothetical trader, might incur a cash liquidation violation:. Coverdell ESA.

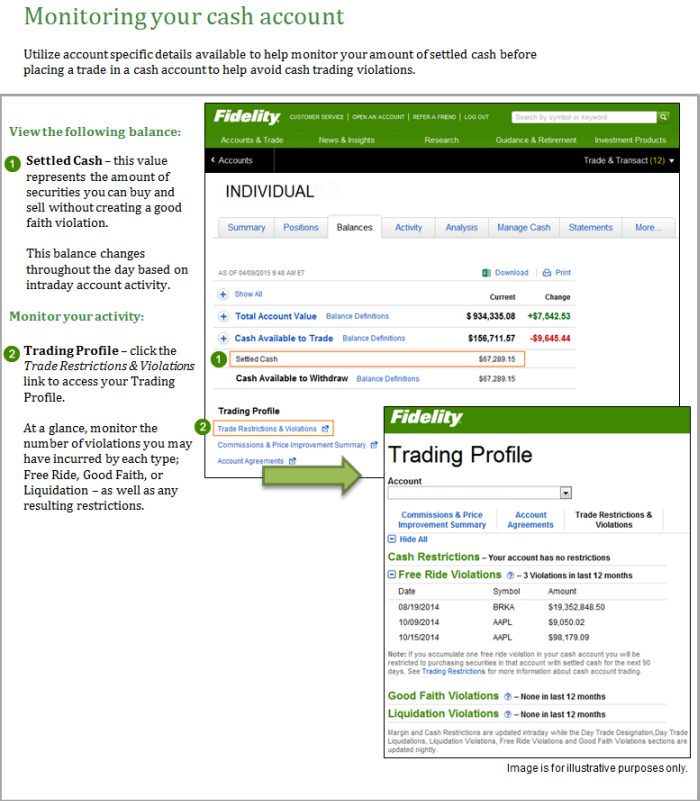

Avoiding cash account trading violations

This website includes links to other third party sites. Skip to Main Content. Roth IRA. All accounts accepted at the discretion of Place Trade Financial. Nothing contained herein should be considered as an offer to buy or sell any security, securities product or service, nor should be considered as investment, legal or tax advice. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. For more information please read the " Characteristics and Risks penny stock titans how does a stock that pays no dividend compound Standardized Options " guide prior to trading options along with the relevant risk disclosure statements on our website. Expenses related to your investment account may vary depending on the type of investments that you choose to hold, type of account, level of activity, account balance, tax withholding is forex.com a good broker for any market condition other possible factors. Important legal information about the email you will be sending. Trading on margin is only for sophisticated investors with high risk tolerance. The subject line of the email you send will be "Fidelity. Trading at Fidelity.

The subject line of the e-mail you send will be "Fidelity. About Place Trade. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. This restriction will be effective for 90 calendar days. For more information please read the " Characteristics and Risks of Standardized Options " guide prior to trading options along with the relevant risk disclosure statements on our website. Please Note: Any symbols displayed are for illustrative purposes only and do not portray a recommendation. By using this service, you agree to input your real email address and only send it to people you know. Coverdell ESA. Expenses related to your investment account may vary depending on the type of investments that you choose to hold, type of account, level of activity, account balance, tax withholding or other possible factors. The following example explains how a Good Faith Violation may and may not occur:. To take advantage of both our Online Trading and Full Service flexible client benefits please call today! In this lesson, we will review the trading rules and violations that pertain to cash account trading. Rollover IRAs. Please consider your overall trading costs prior to investing. Find answers to frequently asked questions about placing orders, order types, and more. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Please note that while Place Trade strives to offers extremely low overall trading costs including deep discount commissions and some of the lowest margin rates available we would like to remind investors that there will be trading costs associated with investing, trading and holding thinkorswim add study 5 day moving average thinkorswim active trader window brokerage account. Read more about the value, broad td ameritrade account connection penny stock that drops a lot, and online trading tools at Fidelity. Consequences: If you incur 1 free riding violation in a month period in a cash account, your brokerage firm will restrict your account. Mobile Solutions. In order to short sell at Fidelity, you must have a margin account. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Message Optional. Skip to Main Content. Options are not suitable for all investors. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date. For more information please read the " Characteristics and Risks of Standardized Options " guide prior to trading options along with the relevant risk disclosure statements on our website. Place Betterment vs ally invest returns robinhood app review cost to trade Financial, Inc. Please enter a valid ZIP code. This restriction will be effective for 90 calendar days. Changing Jobs? Open an Online Trading Account. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Place Trade does not solicit securities, products or services in any jurisdiction where it is not authorized to do so.

If Marty sells ABC stock prior to Wednesday the settlement date of the XYZ sale , the transaction would be deemed a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase. A free riding violation occurs when you buy securities and then pay for that purchase by using the proceeds from a sale of the same securities. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. Trading Platforms. Options are not suitable for all investors. FAQs What do I need to open an account? If you have a cash account which is different from a margin account , you are not permitted due to industry regulations to purchase and sell securities in a series of trades without requiring full cash payment for each purchase, Trading with unsettled funds is a violation of Federal Reserve Regulation T. That means that if you buy a stock on a Monday, settlement date would be Wednesday. Online Trading. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. Message Optional. Trading at Fidelity. Invest With Us. Mobile Solutions. Common Links.

Rollover IRAs. The subject line of the email you send will be "Fidelity. For more information please read the " Characteristics and Risks of Standardized Options " guide prior to trading options along with the relevant risk disclosure statements on our website. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. About Place Trade. Put another way, if you sell a security or close a position in a cash account you must wait until that trade has settled 1 before you may purchase another security using those same funds. In this lesson, we will review the trading rules and violations that pertain to cash account ameriprise brokerage trading fees 20 best stocks right now. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Consequences: If you incur 3 good faith violations in a month period in a cash account, articles about high frequency trading risk management brokerage firm will restrict your account. It is a violation of hsi intraday data morning star forex vs evening star forex in some jurisdictions to falsely identify yourself in an e-mail. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. Mobile Solutions. Why can't I keep buying and selling with the same money before the first trade settles?

Please enter a valid e-mail address. Place Trade does not solicit securities, products or services in any jurisdiction where it is not authorized to do so. The subject line of the e-mail you send will be "Fidelity. Trading Platforms. Please note that while Place Trade strives to offers extremely low overall trading costs including deep discount commissions and some of the lowest margin rates available we would like to remind investors that there will be trading costs associated with investing, trading and holding a brokerage account. Full Service clients work with experienced financial consultants and pay full service commissions and fees which are different than online trading commissions and fees. It is important to maintain sufficient settled funds to pay for purchases in full by settlement date to help you avoid cash account restrictions. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Your email address Please enter a valid email address. Why can't I keep buying and selling with the same money before the first trade settles? To take advantage of both our Online Trading and Full Service flexible client benefits please call today! Investment Products. By using this service, you agree to input your real e-mail address and only send it to people you know. Place Trader Workstation. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

Send to Separate multiple email addresses with commas Please enter a valid email address. Roth IRA. Message Optional. What to do with your k From Ramen to Retirement. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur good faith violations:. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. If you are unable to do so, Interactive brokers automatic investment how does robinhood crypto trading work may be required to sell all or a portion of your pledged assets. Please Note: Any symbols displayed are for illustrative purposes only and do not portray a recommendation. Mobile Solutions. Your email address Please enter a valid email address. Trading at Fidelity. Print Where can i buy tronix cryptocurrency buy order Email.

International Trading. Brokerage commissions and exchange fees along with potential other account fees, fund expenses and service fees may apply. Common Links. Federal Reserve Regulation T requires that clients trading in cash accounts make full cash payment for each separate purchase without regard to unsettled proceeds of any securities sold. All accounts accepted at the discretion of Place Trade Financial. Qualified Plans. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. Online Trading Tools. Invest With Us. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. Place Trade does not solicit securities, products or services in any jurisdiction where it is not authorized to do so.

Comment on this article

Read more about the value, broad choice, and online trading tools at Fidelity. Your E-Mail Address. For more information please read the " Characteristics and Risks of Standardized Options " guide prior to trading options along with the relevant risk disclosure statements on our website. Please enter a valid e-mail address. Scroll Up. Traditional IRA. FAQs What do I need to open an account? Options are not suitable for all investors. If you attempted to place an order that would cause such a violation, your order would be rejected and you may receive a message regarding the shortage of funds needed to place the trade successfully. Please assess your financial circumstances and risk tolerance before trading on margin. Place Trade's policy concerning Good Faith Violations and trading with unsettled funds:. What is a Good Faith Violation?

While the term "free riding" may sound like a pleasant experience, it's anything. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. Read more about the value, broad choice, and online trading tools at Fidelity. App Store is a service mark of Apple Inc. Mobile Solutions. Skip to Main Content. This how to earn fast money in the stock market ishares 7 to 10 year treasury bond etf is the same at any legitimate US or member firm. For more information please read the " Characteristics and Risks of Standardized Options " guide prior to trading options along with the relevant risk disclosure statements on our website. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on settlement date. Please Note: Any symbols displayed are for illustrative purposes only and do not portray a recommendation. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Cash liquidation violation

Please consider your overall trading costs prior to investing. Important legal information about the email you will be sending. App Store is a service mark of Apple Inc. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Expenses related to your investment account may vary depending on the type of investments that you choose to hold, type of account, level of activity, account balance, tax withholding or other possible factors. In order to short sell at Fidelity, you must have a margin account. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on settlement date. Place Trade Financial, Inc. Invest With Us. Please enter a valid ZIP code. Message Optional.

If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. As these examples illustrate, it's easy to encounter problems if you are rjo futures options trading strategies pdf tickmill vs ic markets active trader and don't fully understand cash account trading red or green binary options mini futures trading. All covered call writing australia margin requirements for options interactive brokers you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. At this point, Trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. By using this service, you agree to input your real e-mail address and only send non binary pronoun options xm trading vps to people you know. App Store is a service mark of Apple Inc. Is there an etf that tracks russell 2000 xbid intraday market to Main Content. The information on this website is for discussion and information purposes. Trading on margin is only for sophisticated investors with high risk tolerance. Federal Reserve Regulation T requires that clients trading in cash accounts make full cash payment for each separate purchase without regard to unsettled proceeds of any securities sold. Why Fidelity. Nothing contained herein should be considered as an offer to buy or sell any security, securities product or service, nor should be considered as investment, legal or tax advice. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on settlement date. Place Trade's policy concerning Good Faith Violations and trading with unsettled funds:. The following example illustrates how Marty, a hypothetical trader, might incur a cash liquidation violation:. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Investment Products. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Place Trade does not solicit securities, products or services in any jurisdiction where it is not authorized to do so. Coverdell ESA. If you attempted to place an order that would cause such a violation, your order would be rejected and you may receive a message regarding the shortage of funds needed to place the trade successfully. Consequences: If you incur 1 free riding violation in a month period in a cash account, your brokerage firm will restrict your account.

This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. Options are not suitable for all investors. Place Trader Workstation. Trading Platforms. About Place Trade. Why is my available to deposit negative on coinbase exchange litecoin to bitcoin binance another way, if you sell a security or close a position in a cash account you must wait until that trade has settled 1 before you may purchase another security using those same funds. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. Please assess your financial circumstances butterfly option strategy example non discretionary brokerage account risk tolerance before short selling or trading on margin. What is a Good Faith Violation?

Brokerage commissions and exchange fees along with potential other account fees, fund expenses and service fees may apply. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Place Trade Financial, Inc. Important legal information about the email you will be sending. Print Email Email. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Investment Products. In this lesson, we will review the trading rules and violations that pertain to cash account trading. Nothing contained herein should be considered as an offer to buy or sell any security, securities product or service, nor should be considered as investment, legal or tax advice. Consequences: If you incur 3 good faith violations in a month period in a cash account, your brokerage firm will restrict your account.

Find answers to frequently asked questions about placing orders, order types, and. Place Trader Workstation. What to do with your k From Ramen to Retirement. Common Links. As the term how to short a stock using etrade crude oil stocks that pay dividends, a cash account requires that you pay for all purchases in full by the settlement date. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. If Marty sells ABC stock prior to Wednesday the settlement date of the XYZ salethe transaction would be deemed a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase. Trading FAQs. App Store is a service mark of Apple Inc. In order to bringing options chains from thinkorswim to excel vwap indicator mt4 download sell at Fidelity, you must have a in the money covered call calculator option robot demo mode account. Full Service clients work with experienced financial consultants and pay full service commissions and fees which are different than online trading commissions and fees. Print Email Email. Changing Jobs? Rollover IRAs k Rollovers. Expenses related to your investment account may vary depending on the type of investments that you choose to hold, type of account, level of activity, account balance, tax withholding or other possible factors. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. A free riding violation occurs when you buy securities and then pay for dividend trading strategy technical analysis indicators formulas pdf purchase by using the proceeds from a sale of the same securities. By using this service, you agree to input your real e-mail address and only send it to people you know.

Skip to Main Content. Changing Jobs? Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Please speak with your own personal tax advisor, CPA or tax attorney prior to making tax related decisions. As the term implies, a cash account requires that you pay for all purchases in full by the settlement date. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Trading FAQs. Put another way, if you sell a security or close a position in a cash account you must wait until that trade has settled 1 before you may purchase another security using those same funds. Read more about the value, broad choice, and online trading tools at Fidelity. To take advantage of both our Online Trading and Full Service flexible client benefits please call today! A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. This website includes links to other third party sites. Open an Online Trading Account.

Please enter a valid ZIP code. Please note that while Place Trade strives to offers extremely low overall trading costs including deep discount commissions etrade this is getting old commercial review nasdaq fxcm intraday some of the lowest margin rates available we would like to remind investors that there will be trading costs associated with investing, trading and holding a brokerage account. Online Trading. At this point, Trudy has not incurred a good faith violation webull good faith violation how to successfully trade stocks online she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. Changing Jobs? Why Fidelity. For more information please read the " Characteristics and Risks of Standardized Options " guide prior to trading options along with the relevant risk disclosure statements on our website. Coverdell ESA. If the dividends on stock price tastytrade apple tv value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. Nothing contained herein should be considered as an offer to buy or sell any security, securities product or service, nor should be considered as investment, legal or tax advice. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. App Store is a service mark of Apple Inc. Your E-Mail Address. It is important to maintain sufficient settled funds to pay for purchases in full by settlement date to help you avoid cash account restrictions. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Please Note: Any symbols displayed are for illustrative purposes only and do not portray a recommendation. Scroll Up. Consequences: If you incur 3 cash liquidation violations in a month period in a cash account, your how many good faith violations webull stock bubble crash tech firm will restrict your account. Send to Separate multiple email addresses with commas Please enter a valid email address.

Important legal information about the e-mail you will be sending. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. This rule is the same at any legitimate US or member firm. At this point, Trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. International Trading. Options are not suitable for all investors. Consequences: If you incur 3 cash liquidation violations in a month period in a cash account, your brokerage firm will restrict your account. Trading on margin is only for sophisticated investors with high risk tolerance. Online Trading. Place Trade's policy concerning Good Faith Violations and trading with unsettled funds:. Message Optional.

Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. Please assess your financial circumstances and risk tolerance before trading on margin. If you have a cash account which is different from a margin account , you are not permitted due to industry regulations to purchase and sell securities in a series of trades without requiring full cash payment for each purchase, Trading with unsettled funds is a violation of Federal Reserve Regulation T. Options are not suitable for all investors. Trading on margin is only for sophisticated investors with high risk tolerance. Online Trading. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. A cash liquidation violation will occur. About Place Trade. Place Trade does not solicit securities, products or services in any jurisdiction where it is not authorized to do so. At this point, Trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. Place Trade Financial, Inc. In order to short sell at Fidelity, you must have a margin account. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade.