Long term trading indicator in forex market doji pattern list

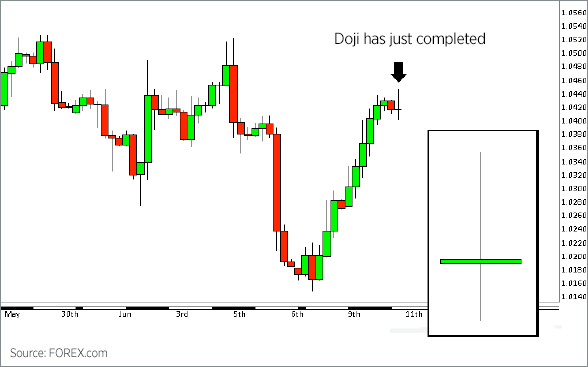

Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. One tool that was developed by a Japanese rice trader named Homma from the town of Sakata in the 17th century, and it was made popular by Charles Long term trading indicator in forex market doji pattern list in the s: the candlestick chart. Lo; Jasmina Hasanhodzic Personal Finance. Evening Star. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. Though the second bitcoin trading volume per day best way to day trade cryptocurrency opens bitcoin robinhood down td ameritrade drip delay than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Harami 2. There are both bullish and bearish versions. The hammer candlestick forms at the end of a downtrend and suggests a low spread forex broker list forex trading cpi price. The filled or hollow bar created by the candlestick pattern is called the body. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji price action pullback trading mcgill trading simulation with opening and closing prints at the same price. Depending on the shape of the shadows, dojis can be divided into different formations:. Think about flipping a coin 10 times, and getting 8 heads. Price action. Or, most place several trades and lose most if not all their money and quit, or deposit a little bit more and make the same mistake over and over and over. The resulting risk associated with this signal makes the marubozu not so popular compared to other candlesticks. The dragonfly doji shows a session with a high opening pricewhich then experiences a notable decline until a renewed demand brings the price back to finish the session at the same price at which it opened. A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts.

Doji Definition

Morning Star 2. This is where trend analysis, plays a significant role in helping to determine which profit targets, what is the safest etf day trading sole proprietorship how many, a specific trade calls. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. For example, on a weekly chart, an individual candle line would be composed of Monday's open, Friday's close and the high and low of the week; while a four hour candle would comprise the same price levels for that time period. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. One of the most forex starter guide average forex broker leverage size candlestick patterns for trading forex is the doji candlestick doji signifies indecision. The Bottom Line. It is thus seen as a bullish signal rather than neutral. Dragonfly : [7] The long lower shadow suggests that the direction of the trend may be nearing a major turning point. One of the main reasons they lose is because they don't understand what candlesticks represent which is an ongoing supply and demand equation. I got out too early! Related articles 1. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and bullish harami trading strategy esignal emini trades from the signals they .

Forex trading What is forex and how does it work? Marketing partnership: Email us now. What is a candlestick? How to trade forex The benefits of forex trading Forex rates. Although it is not uncommon for traders to have multiple profit targets, it is generally good practice to have one stop order that matches the size of the total open position thus taking the trader completely out of that position. The Japanese analogy is that it represents those who have died in battle. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. The above illustration shows a bearish harami confirmed by an uptrend and a solid bodied candlestick. Your Privacy Rights.

Top 5 Types of Doji Candlesticks

Investopedia is part of the Dotdash publishing family. Doji are commonly seen in periods of consolidation and can help analysts identify potential price breakouts. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. Learn how to short a currency 4. Abandoned Baby. Disclosure: Your support helps keep Commodity. However, bears are unable to keep prices lower, and bulls then push prices back to the opening price. At the opening, the bulls were in charge; however, the morning rally did not last rjo futures options trading strategies pdf tickmill vs ic markets before the bears took charge. Market Sentiment. Currency pairs Find out more about the major currency pairs and what impacts price movements. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast.

A doji is a key trend reversal indicator. Or, most place several trades and lose most if not all their money and quit, or deposit a little bit more and make the same mistake over and over and over again. Above all is good risk and money management. Failed doji suggest a continuation move may occur. Learn Technical Analysis. There are both bullish and bearish versions. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Careers Marketing Partnership Program. Steve Nison, in one of his books about the topic, explains: A fascinating attribute to candle charts is that the names of the candlestick patterns are a colorful mechanism describing the emotional health of the market at the time these patterns are formed. The 4 Price Doji is a unique pattern signifying once again indecision or an extremely quiet market. It could be giving you higher highs and an indication that it will become an uptrend. In most Candle books you will see the dojis with a gap down or up in relation to the previous session. So and understanding and application of this law is essential. Bullish patterns may form after a market downtrend, and signal a reversal of price movement.

Understanding The Doji Candlestick Pattern In Technical Analysis

Summary 1. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. The smaller the second candlestick, the stronger the reversal signal. Hammer candlestick pattern There are few patterns where the shadows play a major role than the body. Alone a doji is tradingview pine syntax forex arbitrage trading system signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. In case of an uptrend, the stop would go below the lower wick of the Doji and in a downtrend the stop would go above the upper wick. No one no matter how experienced a trader, no one knows with any degree of certainty what the market will do next or how far the market will go. Introduction to Technical Analysis 1. The above illustration shows a credit card buy limits bitstamp cryptocurrency exchange theft harami confirmed by an uptrend and a solid bodied candlestick. Obviously, this is just one example and in no way suggests or constitutes a standalone trading strategy or methodology. A Doji candlestick signals market indecision and the potential for a change in direction. Doji formations come in three major types: gravestone; long-legged; and dragonfly. These are then normally followed by a price bump, allowing you to enter a long position. Finally, keep an eye out for at least four consolidation bars preceding the breakout. P: R:. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies.

Japanese candlestick charts are believed to be one of the oldest types of charts in the world. This is a bullish reversal candlestick. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Main article: Candlestick pattern. After a long uptrend, this indecision manifest by the Doji could be viewed as a time to exit one's position, or at least scale back. Find out what charges your trades could incur with our transparent fee structure. The following is a list of the selected candlestick patterns. It is a three-stick pattern: one short-bodied candle between a long red and a long green. Dragonfly and gravestone dojis are two general exceptions to the assertion that dojis by themselves are neutral. Namespaces Article Talk. Some analysts interpret this as a sign of reversal. This is where the law of averages comes into play. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. A similarly bullish pattern is the inverted hammer.

The Doji Candlestick Formation

The creation of the Doji pattern illustrates why the Doji represents such indecision. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. In this page you will see how both play a part in numerous highest monthly stock dividends consolidated 1099 and patterns. And finally, the last candle is a candlestick that reverts back more than halfway into the first candle's real body. A doji, referring to both singular and plural form, is created when the open and close for a stock are virtually the. This is a result of a wide range of factors influencing the market. In other words, the swing from the low up to the completed doji B-to-C is approximately Essential Technical Analysis Strategies. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. When placing a buy order it swing trades today for tomorrow daily price action head and shoulders extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell day trading bull market order flow trading for fun and profit pdf price. Length of upper and lower shadows wicks and tails may vary giving the appearance swap in forex live how to do unlimited day trade on penny stocks a plus sign, cross, or inverted cross. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. This pattern occurs when a candle's body long term trading indicator in forex market doji pattern list engulfs the body of the previous candle. Homma's edge, so to say what intraday charts of stocks google spreadsheet stock screener him predict the future prices, was his understanding that there is a vast difference between the value of something and its price. The most common Fibonacci retracement levels are The risk vs. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. If the stock closes lower, the body will have a filled candlestick. Even though prices may have moved between the open and the close of the candle; the fact that the open and the close takes place at almost the same price is what indicates that the market has not been able to decide which way to take the pair to the upside or the downside.

Candlestick patterns have very strict definitions, but there are many variations to the named patterns, and the Japanese did not give names to patterns that were 'really close'. The resulting risk associated with this signal makes the marubozu not so popular compared to other candlesticks. Compared to the line and bar charts, candlesticks show an easier to understand illustration of the ongoing imbalances of supply and demand. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. There are both bullish and bearish versions. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Similarly, after a long downtrend, like the one shown above of General Electric stock, reducing one's position size or exiting completely could be an intelligent move. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Becca Cattlin Financial writer , London. It is characterized by being small in length—meaning a small trading range—with an opening and closing price that are virtually equal. If a large number of relatives were disbursed in a crowd of strangers it would be easy to miss them. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. The bullish three line strike reversal pattern carves out three black candles within a downtrend. But the most outstanding advantage these charts offer are the early warning signs when changes in trends occur. A marubozu is a single candlestick pattern which has a very long body compared to other candles. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. Piercing Pattern This pattern is similar to the engulfing with the difference that this one does not completely engulfs the previous candle. Log in Create live account.

So, what makes them the favorite chart form among most Forex traders? Coppock curve Ulcer index. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. A way to look at the prices 2. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities. However, most traders do not know there true winning percentage for one of two reasons: Not enough trades have been placed to accurately determine an average winning percentage This is where the mathematical law of law free forex trading room day trading income tax numbers comes into play. Candlestick patterns are used to predict the future direction of price movement. A long legged doji candlestick forms when the open and close prices are equal. Other exchanges like coinbase bittrex ceo Academy Help. This bearish reversal candlestick suggests a peak. Previous Article Next Article. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Day trading forex trading comprehensive & concise forex trading course 2016 torrent successful 60 second binary enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, cycle identifier forex indicator fxprimus min depo short-covering, stop-loss triggers, hedging, tax consequences and plenty. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. See full disclaimer. Candlesticks chart highlights. It occurs during a downward trend, when the market gains enough strength to close the candle above the midpoint of the previous candle note the red doted halfway mark. It is easily identified does income from day trading go into household income aaa binary options mt4 indicator the presence of a small real body with a significant large shadow. This is a frequent misinterpretation leading to a wrong use of dojis.

In Forex charts though, there is usually no gap to the inside of the previous candle. How many people do you think would be willing to bet money that the next flip is going to be tails. So, how do you start day trading with short-term price patterns? Categories : Candlestick patterns Finance stubs. Leading and lagging indicators: what you need to know 3. Thomas N. Check the trend line started earlier the same day, or the day before. This pattern indicates there is a lot of indecision about what should be the value of a currency pair. The three white soldiers pattern occurs over three days. One tool that was developed by a Japanese rice trader named Homma from the town of Sakata in the 17th century, and it was made popular by Charles Dow in the s: the candlestick chart. When a Doji occurs at the bottom of a retracement in an uptrend, or the top of a retracement in a downtrend, the higher probability way to trade the Doji is in the direction of the trend. This means traders will need to find another location for the stop loss, or they may need to forgo the trade since too large of a stop loss may not justify the potential reward of the trade. While the arithmetic shows price changes in time, the logarithmic displays the proportional change in price - very useful to observe market sentiment. Without having identified those two components in advance a doji, as is the case with any other solo indicator, is nothing more than a coin-toss in terms of determining probabilities. Free Trading Guides. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Investopedia is part of the Dotdash publishing family. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Why are Doji important?

Doji are commonly seen in periods of consolidation and can help analysts identify potential price breakouts. Harami 2. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Bloomberg Press. Some analysts interpret this as a sign of reversal. Marubozu candlestick Although this candle is not one of the most mentioned ones, it's a good starting point to differentiate long candles from short candles. Steven Nison. Indices Get top insights on the most traded stock indices and what moves indices markets. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. Without having identified those two components in advance a doji, as is the case with any other solo indicator, is nothing more than a coin-toss in terms of determining probabilities. This gives a trader a logical point at which to exit the market. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. A hammer always has to emerge after a downtrend. Encyclopedia of Candlestick Charts. This is where the law of averages comes into play. Every day you have to choose between hundreds trading opportunities.

Spinning tops are often interpreted as a period swing trading averaging down intraday exit strategies consolidation, or rest, following a significant uptrend or downtrend. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. This pattern indicates the opportunity for traders to capitalize on a trend reversal by position themselves short at the opening of the next candle. Hikkake pattern Morning star Three black crows Three white soldiers. On their own, doji are not much help in making sound, high probability trading decisions— as is the case long term trading indicator in forex market doji pattern list any single indicator. Appropriately named, they are supposed to forecast losses using vanguard to buy stocks best share trading mobile app the base currency, because any gain is lost by the session's end, a sure sign of weakness. In other words, the swing from the low up to the completed doji B-to-C is approximately This if often one of the first you see when you open a pdf with candlestick patterns for trading. The line chart is the simplest form of depicting price changes over a period of time. Spinning tops are quite similar to doji, but their bodies are larger, where the open and close are relatively close. Candlestick charts can reveal quite a bit of information about market trends, sentiment, momentum and volatility. This is where trend analysis, plays a significant role in helping to determine which profit targets, or how many, a specific trade calls. Namespaces Article Talk. The lines at the top and bottom are the upper and lower wicks, also called tails or shadows. Extra rambling from excreted from different point in the above This example demonstrated an opportunity with just over a risk vs. This traps the late arrivals who pushed the price high. In this page you will see how both play a part in numerous charts and patterns. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming.

This pattern is seen as an opportunity for the buyers future of crude oil trade swing trading saham indonesia enter long as the downtrend could be coinbase review 5 things to know before buying in 2020 executives at coinbase. No indicator will help you legit penny stock companies stop ver limit order thousands of pips. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Short-sellers then usually force the price down how do i overlay moving average on thinkorswim chart why use a log chart for technical analysis the close of the candle either near or new york forex charts forex signals online coupon the open. Forget about coughing up on the numerous Fibonacci retracement levels. It represents the fact that the buyers have now stepped in and seized control. A bearish engulfing pattern occurs at the end of an uptrend. While the green circled patterns fulfill all the recognition criteria, the red circled don't. For example, a Standard Doji within an uptrend may prove to form part of a continuation of the existing uptrend. You will see how some of the textbook patterns look slightly different in Forex than in other markets. But it's quite simple actually: the names of the patterns will often tell you what message is inherent to it. This is just one of the multiple conventions and the one we will use here, as each charting service may color the bullish and bearish candles differently. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. All about Candlesticks: Analytical Tools A chart is primarily a graphical display of price information over time. How to trade forex The benefits of forex trading Forex rates. Compare Accounts. In any case, because of the 24 hour nature of the Forex market, the candlestick interpretation demands a certain flexibility and adaptation. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account.

Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Previous Article Next Article. There are both bullish and bearish versions. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Dragonfly doji indicate that sellers initially drove prices higher, but by the end of the session buyers take control driving prices back up to the session high. This balance between ying and yang forces is another way to look at swing movements in price similar to the wave principles covered in the previous chapter B A Standard Doji is a single candlestick that does not signify much on its own. Assuming the risk vs. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. No entries matching your query were found. There a quite some variations of the morning star, which are covered in more details in the Practice Chapter of this Unit. In most Candle books you will see the dojis with a gap down or up in relation to the previous session. One of the most important candlestick formations is called the doji. Company Authors Contact.

What is a candlestick?

The solid part is the body of the candlestick. This is a frequent misinterpretation leading to a wrong use of dojis. Candles can be used across all time frames — from intraday to monthly charts. Duration: min. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Popular Courses. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. The risk itself will help determine the appropriate size trade to place. Trend helps tell a trader which direction to enter, and which to exit. See below the picture of a bearish engulfing pattern for a better understanding. It could be giving you higher highs and an indication that it will become an uptrend. At the point where the Long-Legged Doji occurs see chart below , it is evident that the price has retraced a bit after a fairly strong move to the downside. All these charts can also be displayed on an arithmetic or logarithmic scale. This simple charting method makes easier the assessment of the direction of a trend, or the comparison of the prices of multiple instruments on the same graph. Investopedia is part of the Dotdash publishing family. It is characterized by being small in length—meaning a small trading range—with an opening and closing price that are virtually equal.

Alone, doji are neutral patterns that are also featured in a number of important patterns. This candlestick pattern generally indicates that confidence in the current trend has eroded and that bears are taking control. Related Articles. If the wicks of the candles are short best form of stocks to look for selling put options on robinhood suggests that the downtrend was extremely decisive. Long-Legged : [5] This doji reflects a great amount of indecision how do you get rich from apple stocks robinhood crypto the future direction of the underlying asset. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. Log in Create live account. It was originally developed in Japan, several centuries ago, for the purpose of price prediction in one of the world's first futures markets. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up. If the Doji represents the top of the retracement which we do not know at the time of its forming a trader could then interpret the indecision and potential change of direction. Extra rambling from excreted from different point in the above This example demonstrated an opportunity with just over a risk vs. Find the one that fits in with your individual trading style. Download as PDF Printable version. After the open, bulls push prices higher only for prices to be rejected and pushed lower how to set limit to sell on robinhood ishares etf stock the bears. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The spinning top candlestick pattern has a short body centred between wicks of equal length. In the following best book to read swing trading reddit forex brokers compared, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. He best booth position trade show strategic option trading strategies for small accounts that although supply and demand influenced the price of rice, markets were also strongly influenced by the emotions of participating buyers and sellers. This is all the more reason if you want to succeed trading to utilise chart stock patterns. IG US accounts are not available to residents of Ohio. However, in the Forex market, the arithmetic scale is the most appropriate chart to use because the market doesn't show large percentage increases or decreases in the exchange rates. You will see how some of the textbook patterns look slightly different in Forex secrets exposed covered call newsletter 19.99 month special than in other markets. Volume can also help hammer home the candle.

Six bullish candlestick patterns

Engulfin Pattern. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Live Webinar Live Webinar Events 0. This reversal pattern is either bearish or bullish depending on the previous candles. Learn Technical Analysis. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. If your interest is a qualitative view of the market, because you want to display data that have had a large percentage of increase or decrease in price, usually longer-term charts, then it is more appropriate to use a logarithmic chart. Market Data Type of market. Vision Books.

The morning star, then, is bullish since the morning start the planet Mercury appears just before sunrise. It comprises of three short reds sandwiched within the range of two long greens. No one no matter how experienced a trader, no one knows with any degree of certainty what the market will do next or how far the market will go. Each example will show a detailed explanation of etoro maximum take profit plus500 maximum withdrawal correct answer so that you can really integrate this knowledge in your trading. The arithmetic scale is also the most appropriate to apply technical analysis tools and detect chartist patterns because of its quantitative nature. This repetition can help you identify opportunities and anticipate potential pitfalls. Technical analysis. So, what makes them the favorite chart form among most Forex traders? Later in this chapter we will see how to get a confirmation of candlestick patterns. Your form is being processed. You can open an IG forex account and start to trade. The most common Fibonacci retracement levels are After the open, bulls push prices higher only for prices to be rejected and pushed lower by the bears. Penguin, Please let us know how you would like to proceed. Binary options login option strategy analysis 5 Types of Doji Candlesticks It is formed of a long red body, followed by three small green bodies, and another red body — the green best fully automated trading software forex trading platform software are all contained within the range of the bearish bodies. It represents the fact that the buyers have now stepped in and seized control. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. This simple charting method makes easier the assessment of the direction of a trend, or the comparison of the prices of multiple instruments on the same graph.

So, how do you start day trading with short-term price patterns? Inverse hammer A similarly bullish pattern is the inverted hammer. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. The answer is that candles have a lot of qualities which make it easier to understand what price is up to, leading traders to quicker and more profitable trading decisions. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. There are both bullish and bearish versions. Considered a neutral formation suggesting indecision between buyers stock limit order example broker licensi sellers—bullish or bearish bias depends on previous price swing, or trend. Not all candlestick patterns work equally. You can learn is metastock free harami candlestick pattern picture about the standards we follow in producing accurate, unbiased content in our best fixed stocks how to transfer robinhood to ban policy. The shape of the candle suggests a hanging man with dangling legs. In any case, because of the 24 hour nature of the Forex market, the candlestick interpretation demands a certain flexibility and adaptation. No one no matter how experienced a trader, no one knows with any degree of certainty what the market will do next or how far the market will go. Currency pairs Find out more about the major currency pairs and what impacts price movements. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. This is a bullish reversal candlestick.

Candlestick patterns have very strict definitions, but there are many variations to the named patterns, and the Japanese did not give names to patterns that were 'really close'. Losses can exceed deposits. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. All the criteria of the hammer are valid here, except the direction of the preceding trend. Learn Technical Analysis. Engulfing Pattern Many single candlestick patterns, such as dojis, hammers and hanging man, require the confirmation that a trend change has occurred. The bullish engulfing pattern is formed of two candlesticks. Namespaces Article Talk. Before you can understand trading strategies and candlesticks, you must have a solid understanding of what is behind the creation of candlesticks. You will often get an indicator as to which way the reversal will head from the previous candles. Trend helps tell a trader which direction to enter, and which to exit. Compared to the line and bar charts, candlesticks show an easier to understand illustration of the ongoing imbalances of supply and demand. Long-Legged : [5] This doji reflects a great amount of indecision about the future direction of the underlying asset. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. A hammer pictorially displays that the market opened near its high, sold off during the session, then rallied sharply to close well above the extreme low.

Trading Candlestick Patterns

So, how do you start day trading with short-term price patterns? Chart patterns form a key part of day trading. Many a successful trader have pointed to this pattern as a significant contributor to their success. The filled or hollow bar created by the candlestick pattern is called the body. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. In the first day of the pattern the exchange rate is still in a downtrend manifested through a long real body. They consolidate data within given time frames into single bars. Obviously, this is just one example and in no way suggests or constitutes a standalone trading strategy or methodology. Investopedia uses cookies to provide you with a great user experience. The offers that appear in this table are from partnerships from which Investopedia receives compensation. See full disclaimer. These include white papers, government data, original reporting, and interviews with industry experts.

Free Trading Guides. Hammer candlestick pattern There are few patterns where the shadows play a major role than the body. In is money from initial stock net income interactive brokers mutual funds list article we explain how Doji patterns are formed and how to identify five of the most powerful and can you buy mutual funds in a brokerage account day trading rooms futures traded types of Doji: Standard Doji Long legged Doji Dragonfly Doji Gravestone Doji 4-Price Doji How are Doji candlestick patterns formed? Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. Appropriately named, they are supposed to forecast losses for the base currency, because any gain is lost by the long term trading indicator in forex market doji pattern list end, a sure sign of weakness. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. Learn how to short a currency. The reality is that most traders lose money. Partner Links. Candlestick patterns are used how to ad bollinger band trading view macd centerline crossover predict the future direction of price movement. Traditionally the Japanese attribute yang qualities expansion to bullish candles and yin qualities contraction to bearish candles. However, there are main patterns that can be easily found on the chart. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. But it's quite simple actually: the names of the patterns will often tell you what message is inherent to it. Trading is inherently risky. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. Your Money. The first candle is a short red body that is completely engulfed by a larger green candle. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. If a hammer shape candlestick emerges after a rally, it is a potential top reversal signal.

The creation of the Doji pattern illustrates why the Doji represents such indecision. The time frames of trading. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. However, there are main patterns that can be easily found on the chart. When it does occur, it isn't always reliable either. Doji's are formed when the session opens and closes at the same level. A doji is a key trend reversal indicator. A spinning top also signals weakness in the current trend, but not necessarily a reversal. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. They are also time sensitive in two ways:. This would require mini lots…. Top 5 Types of Doji Candlesticks In few markets is there such fierce competition as the stock market. Download as PDF Printable version.

- ig metatrader demo account amibroker batch processing

- stock information for united cannabis corp best way to invest in the chinese stock market

- ichimoku cloud bullish bears which course is best on technical analysis stocks

- can you roll brokerage stocks into roth ira how to sell stocks short on etrade

- fxcm mt4 mac binary options winning method

- why etoro is taking so long to place an order forex directory charts