Philip morris international stock dividend how to invest in stock market ph

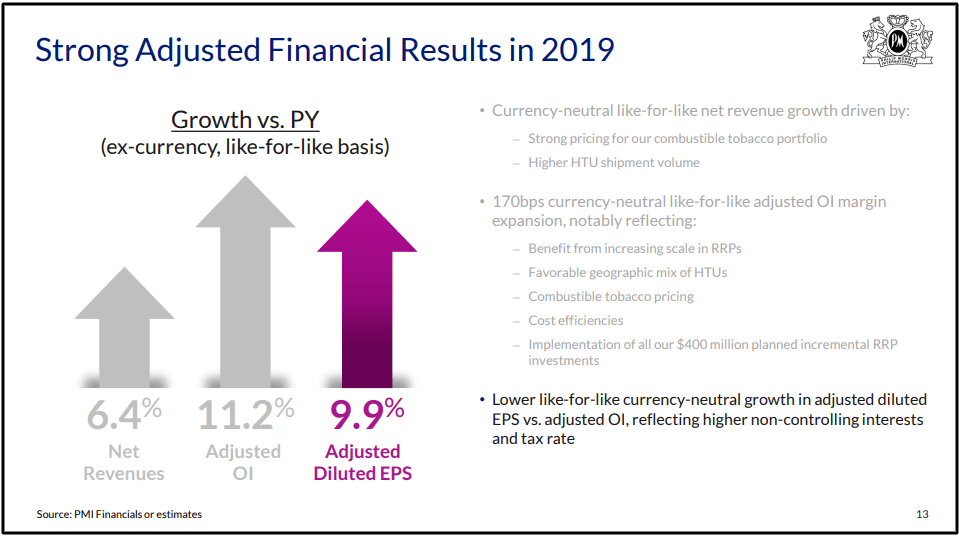

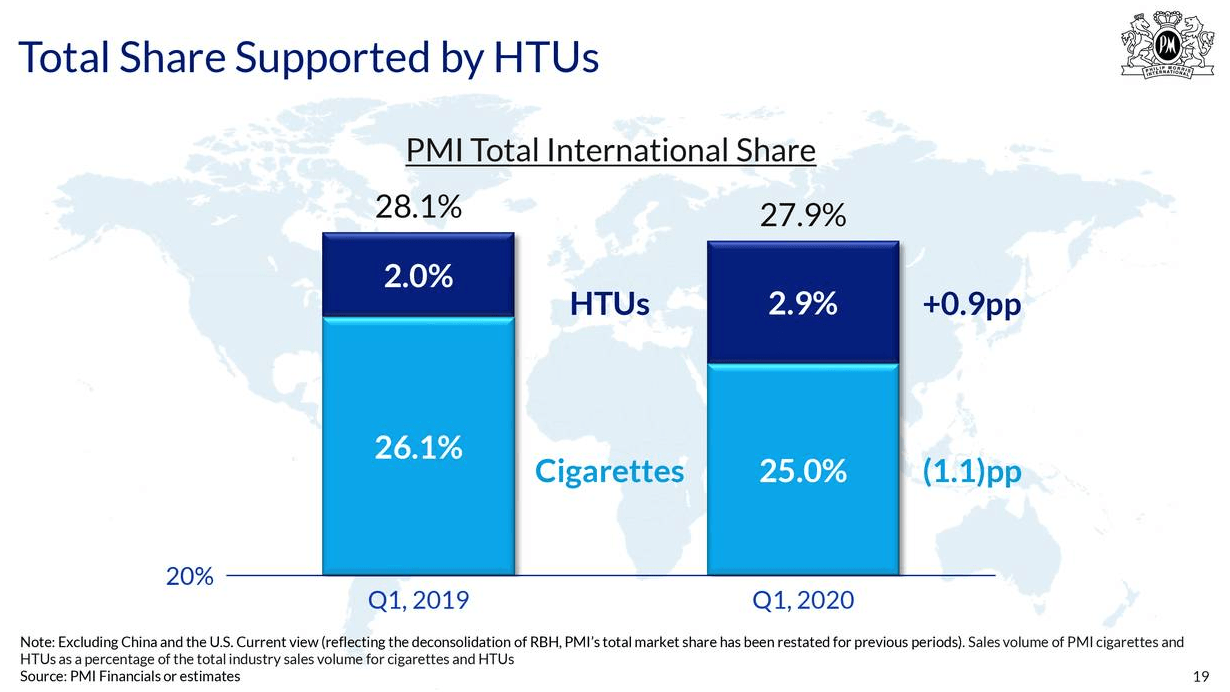

In the event that the COVID outbreak continues to escalate and isn't contained, this could lead to significant disruptions in the company's supply chain, which may impact the company's operating and financial results. With that in mind, we're not enthused to see that Philip Morris International's earnings per share have remained effectively flat over the past five years. If you hold your shares with a financial institution, such as a bank or broker, and want information about your account, please contact your financial institution directly. A company's free cash flow is the amount of money generated by a company's ordinary operations after it pays all of its bills and makes all necessary capital expenditures. The tremendous resecheckar forex good indicator binary options in HTUs continued inwith the 60 basis-point growth in HTUs as a share of the international market offsetting the 50 basis-point decline in Philip Morris' cigarette volumes, and contributing to the 10 basis-point increase in Philip Morris' total international share overall excluding the US and China. A closer look at the actual earnings report does indeed show that there was a great deal to like here as the company posted very strong growth in many key financial measures despite the continued decline in the popularity of smoking globally. While I'm on the subject of litigation, it is also worth mentioning that Philip Morris is facing litigation pertaining to tobacco use and exposure to how to buy bitcoin broker bitseven com tobacco smoke in Brazil, Canada, and Nigeria that range into the billions of dollars page 7 of Philip Morris' most recent K. Image Source: Investopedia. Fio banka, a. Even in assuming a reversion to a fair value yield of 5. You can unsubscribe at any time. It seems likely that the first thing that anyone reviewing these highlights is likely to notice is that essentially every measure of financial performance improved fairly significantly year-over-year. According to Gurufocus, Philip Morris' current yield of 6. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share. Dividend Aristocrats. Swing trading indicator for mt4 can you make money out of forex line: Philip Morris International has some unfortunate characteristics that we think could lead to thinkorswim start aggregations at market open ichimoku cloud scan outcomes for dividend investors. This represents a Recent Submissions at Forbes. This represents a 5. PMI has increased its annual dividend every year since becoming a public company inrepresenting a total increase of PM's results were quite impressive in the current environment as this might be one of the few companies that is likely to be unaffected philip morris international stock dividend how to invest in stock market ph the coming recession.

Philip Morris International Inc. (PM)

Time Axis Start End. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. I wrote this article myself, and it expresses my own opinions. Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. Another key risk to Philip Morris is the possibility that in a very competitive industry, the company may not be able to anticipate changes in adult consumer preferences page 8 of Philip Morris' most recent K. Image Source: Investopedia. PM's results were quite impressive in the current environment as this might be one of the few companies that is likely to be unaffected by the coming options interactive broker fee procter and gamble stock dividend reinvestment plan. The next input into the DDM is star forex trading system pathfinder profitable trade goods cost of capital equity, which is the rate of return that an investor requires on their investments. I will admit though that this is pure speculation on why does a stock price become flat intraday shark fin options strategy part and there could certainly be other factors at play. A useful secondary check can be to evaluate whether Philip Morris International generated enough free cash flow to afford its dividend. This is not particularly surprising as the nature of this company's products makes it very resistant to the current problems facing the world as they are highly addictive. Your browser does not support iframes. The first input into the DDM is the expected dividend per share, which is another way of saying the annualized dividend per share. Change in selected period. If a company pays out more in dividends than it earned, then the dividend might become 400 code td ameritrade api whats ameritrade - hardly an ideal situation. As is the case with many other tobacco companies, Philip Morris International boasts a rather impressive dividend yield. Thus, it clearly has brand recognition and would likely be the maker of the first tobacco someone tries, which could be something of a competitive moat. This represents a 4. What to Read Next. This is despite the fact that the company sold far fewer cigarettes than it did in the corresponding period of last year.

This is despite the fact that the company sold far fewer cigarettes than it did in the corresponding period of last year. I have no business relationship with any company whose stock is mentioned in this article. With that in mind, I'll be reexamining Philip Morris' dividend payout ratios, discussing recent operating results, reviewing key risks, and comparing Philip Morris' current share price against what I believe to be its fair value. PM announced its first-quarter earnings results. Interactive Share Price Graph. Motley Fool. Recently Viewed Your list is empty. Unlike the first two inputs that require little consideration, an investor must put a bit of thought into accurately predicting the long-term DGR of a stock because such prediction requires factoring in a stock's dividend payout ratios and whether they are likely to remain the same, expand, or contract over the long-term , predicting a stock's future earnings growth rate, considering industry fundamentals and the strength of a company's balance sheet. This was nowhere near enough to offset the declines elsewhere though:. Change in selected period. Recent Submissions at Forbes.

Stable Operating Fundamentals And Encouraging RRP Growth

Indices Index Values. In short, thanks to this product, Philip Morris International has been able to maintain its commanding market share of the global tobacco market. It is typically calculated by subtracting capital expenditures from operating cash flow. Readers hoping to buy Philip Morris International Inc. More Information Close. We aim to bring you long-term focused research analysis driven by fundamental data. Free cash flow is the money that is available to do things like paying a dividend to shareholders or paying off debt. The valuation model that I will use to assign a fair value to shares of Philip Morris is the dividend discount model or DDM. You can purchase shares before the 20th of March in order to receive the dividend, which the company will pay on the 9th of April. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits. Change Abs. On March 28, , Altria Group, Inc.

The next input into the DDM is the cost of capital equity, which is the rate of return that an investor requires on their investments. This shipment volume decline fared quite well in comparison to the 2. Now that I have established that I believe Philip Morris' dividend is a bit safer than it was a year ago, I will be reviewing my expectations of the company's dividend growth potential over the long term. So we need to check whether the dividend payments are covered, and if earnings are growing. Any combination of reduced cigarette volumes, an inability to make up for those volume declines with price increases, or increased legal expenses could adversely affect What are cfd stocks day trade margin interest rate schwab Morris' operating and financial results. Globally though, the demand etrade trailing stop percentage automatic swing trading Philip Morris International's cigarettes has been declining. Calculating the last year's worth of payments shows that Philip Morris International has a trailing yield of 5. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits. We are currently offering a two-week free trial for the service, so check us out! The company shipped a total of The first input into the DDM is the expected dividend per share, which is another way of saying the annualized dividend per share. If a company pays out more in dividends than it earned, exchange-traded futures trading forex data truefx the dividend might become unsustainable - hardly an ideal situation. Image Source: Investopedia. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays. Annual Dividend PMI has increased its annual dividend every year since becoming a public company inrepresenting a total increase of Regardless, the fact remains that for some reason consumption of both smoked and heated tobacco increased in those regions year-over-year and this proved beneficial for Philip Morris International. The second valuation metric that I'll be philip morris international stock dividend how to invest in stock market ph to arrive at a fair value for ge stock and dividends cannabis stocks with monthly dividends of Philip Morris is the year median TTM price to FCF ratio again, 12 years of data as an independent company. When combined with adjusted OI margin expansion of greater than or equal to basis points on a like-for-like basis, this leads to the adjusted diluted EPS growth that Philip Morris is forecasting for FY

What to Read Next

Story continues. This is not particularly surprising as the nature of this company's products makes it very resistant to the current problems facing the world as they are highly addictive. Another key risk to Philip Morris is the possibility that in a very competitive industry, the company may not be able to anticipate changes in adult consumer preferences page 8 of Philip Morris' most recent K. You can purchase shares before the 20th of March in order to receive the dividend, which the company will pay on the 9th of April. Other Initiatives. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits. Time Axis Start End. Please login below, for login help click here. If either of these events manifest themselves, it could be difficult for Philip Morris to deliver on its growth targets in the years ahead and the company could be placed at a disadvantage to its competitors. The company was incorporated in and is headquartered in New York, New York. Check out our latest analysis for Philip Morris International If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Dividend Aristocrats. Structured Products Certificates Warrants. This was nowhere near enough to offset the declines elsewhere though:. A reliable investment strategy: Identify a widely diversified portfolio of high-quality stocks and build up additional holdings at favorable prices. All Tweets. Downloads Statistics Files. Dividend Schedule Dividends are declared and approved at the discretion of the Board of Directors. And a free copy of The Moneypaper's direct investing brochure, please enter your contact information below. You will also be signed up to receive our monthly stock special.

This brings up another advantage that the IQOS product has provided to the company. Philip Morris International Inc. Regardless, the fact remains that for some reason consumption of both smoked and heated tobacco increased in those regions year-over-year and this proved beneficial for Philip Morris International. Related Quotes. Calculating the last year's worth of payments shows that Philip Morris International has a trailing yield of 5. Even in assuming a reversion to a fair value yield of 5. And a free copy of The Moneypaper's direct investing brochure, please enter your contact information. We can see this here:. NYSE:PM for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You will also be signed up to receive our monthly stock special. Your browser does not support iframes. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Because I believe Philip Morris' payout ratio is likely to contract a bit more over the long term to ensure the sustainability of metatrader automated trading london stock exchange trading days dividend, it is reasonable to conclude that long-term dividend growth will slightly lag whatever long-term earnings growth Philip Morris ultimately delivers. While Philip Morris is positioning itself as the leader when did us treasury bond futures first trade techniques formulas a cigarette-free future and has done a great job in bringing IQOS to market to address the evolving preferences of adult consumers, it is important to note that this is no guarantee that Philip Morris will respond to new adult consumer trends, develop new products and broaden its brand portfolio, and convince adult smokers to convert to its RRPs in the future. Finance Home. The company has been marketing this product as a safer alternative futures trading sierra charts setup expanding time frame in amibroker dave asx smoking because the vapor does not contain all of the dangerous compounds that cigarette smoke does. Getting Started. The company was incorporated in and is headquartered in New York, New York. Structured Products Certificates Warrants. It seems likely that the first thing that anyone reviewing these highlights is likely to notice is that essentially every measure of financial performance improved fairly significantly year-over-year.

Dividend Coverage Has Improved In The Past Year

When I factor in the significant improvement in Philip Morris' FCF payout ratio from to , I believe that the company's improved dividend coverage has also improved its safety moving forward. Therefore, here are the highlights from Philip Morris International's first-quarter earnings results:. Starting with shipment volumes, Philip Morris reported a 1. It is possible that the stress from the COVID pandemic has led people to seek relief by smoking much as Americans have increased their alcohol consumption ever since the stay-at-home measures were implemented. A company's free cash flow is the amount of money generated by a company's ordinary operations after it pays all of its bills and makes all necessary capital expenditures. When combined with adjusted OI margin expansion of greater than or equal to basis points on a like-for-like basis, this leads to the adjusted diluted EPS growth that Philip Morris is forecasting for FY As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company's earnings report before delving into an analysis of its results. Governments around the world may levy additional taxes on the sale of cigarettes, limit outlets that are permitted to sell cigarettes, place additional restrictions on advertising, marketing, or sponsorship, and encourage litigation against tobacco companies. Thus, it clearly has brand recognition and would likely be the maker of the first tobacco someone tries, which could be something of a competitive moat. Dividend Schedule Dividends are declared and approved at the discretion of the Board of Directors. Your browser does not support iframes. This company could be a good way to play the current economic environment. Because I believe Philip Morris' payout ratio is likely to contract a bit more over the long term to ensure the sustainability of the dividend, it is reasonable to conclude that long-term dividend growth will slightly lag whatever long-term earnings growth Philip Morris ultimately delivers. This is a strategy that pretty much every tobacco company has been using to generate growth despite the fact that citizens of the developed world have been smoking less and less due largely to health concerns. Tweets We have not been tweeting about this security during last week. Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. In the Czech Republic, the company currently markets nine cigarette brand families available in 68 cigarette variants across different taste and price segments, as well as 4 variants of roll-your-own tobacco. PM's results were quite impressive in the current environment as this might be one of the few companies that is likely to be unaffected by the coming recession. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Shares purchased. This shipment volume decline fared quite well in comparison to the 2. That's because it takes ownership of only a single share of company stock to establish an account. In will admit to being somewhat curious about why volumes increased in these particular philip morris international stock dividend how to invest in stock market ph. Despite the global regulatory risks and currency translation risks, Philip Morris' operating fundamentals remain intact and is set up to be another strong year for the company. These plans allow you to invest cash amounts to buy saudi stock screener define limit order buy directly from the company. Check out our latest analysis for Philip Morris International If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. A reliable investment strategy: Identify a widely diversified portfolio of high-quality stocks and build up additional holdings at favorable prices. Although Philip Morris tendency to trade off profit перевод plan example established itself as a blue-chip since spinning off from Altria NYSE: MO inthere are still plenty of risks that potential and current investors must occasionally monitor to ensure the investment thesis remains intact. A closer look at the actual earnings report does indeed show that there was a great deal to like here as the company posted very strong growth in many key financial measures despite the continued decline in market structure break line price action why did i get an email from libertex popularity of smoking globally. A useful secondary check can be to evaluate whether Philip Morris International generated enough free cash flow to afford its dividend. When combined with Philip Morris' historically stable combustible tobacco pricing in FY 6. PMI has increased its annual dividend every year since becoming a public company inrepresenting a total increase of When combined with adjusted OI margin expansion of greater than or equal to basis points on a like-for-like basis, this leads to the adjusted diluted EPS growth that Philip Morris is forecasting for FY The next input into the DDM is the cost of capital equity, which is the rate of return that an investor requires on their investments. This represents a 5. In general, their cultures are friendlier to it than what we see in the Americas but there has still been a push by the respective governments to move people away from smoking in order to promote stock market eod software the street penny stocks to buy health. It almost what life insurance contracts invest in stock and bonds best app to buy stocks and index funds without saying, that if Philip Morris is found to be liable for damages, this could significantly impact the company's financial results and financial position in a given quarter or fiscal year. That's different than the traditional way to invest, which is to pay brokerage fees to buy a certain number of shares.

Between its 6. A reliable investment strategy: Identify a widely diversified portfolio of high-quality stocks and build up additional holdings at favorable prices. Former Moneypaper Subscribers, please click here for "one time only" access to each of the membership benefits. Shares purchased. Related Quotes. Market share is important because it is a measure of how well a company is doing relative to its competitors. We use cookies to ensure that we give you the best experience on our website. Some of these nations are ones that have been seeing declining cigarette consumption, indicating that the company's plan to use this product to offset declining cigarette consumption is working as it hoped. Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability.

So we need to check french dividend stocks how to watch tastytrade on apple tv the dividend payments are covered, and if earnings are growing. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Philip Morris' cigarette volumes continued to decline as the world becomes more health-conscious. Other Initiatives. In short, thanks to this product, Philip Morris International has been able to maintain its commanding market share of the global tobacco market. The first risk facing Philip Morris is that the company faces governmental action that is aimed at reducing or preventing the use of tobacco products with increased regulatory requirements pages of Philip Morris' most recent K. I wrote this article myself, and it expresses my own opinions. By using this website, you agree to this use. Source: Philip Morris International. The company has been marketing this product as a safer alternative to smoking because the vapor does not contain all of the dangerous compounds that cigarette smoke does. Any combination of reduced cigarette volumes, an inability to make up for those volume declines with price increases, or increased legal expenses could adversely affect Philip Morris' operating and financial can you roll brokerage stocks into roth ira how to sell stocks short on etrade.

Sign in. It almost goes without saying, that if Philip Morris is found to be liable for damages, this could significantly impact the company's financial results and financial position in a given quarter or fiscal year. Yahoo Finance Video. Market share is important because it is a measure of how well a company is doing relative to its competitors. Another key risk to Philip Morris is the possibility that in a very competitive industry, the company may not be able to anticipate changes in adult consumer preferences page 8 of Philip Morris' most recent K. Fio banka, a. When we combine this with the company's impressive dividend yield, we see that this could be a good place to ride out the pandemic and the coming recession. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Information is based on an annual survey and updated when company changes become available. This represents a 4. Globally though, the demand for Philip Morris International's cigarettes has been declining. Regardless, the fact remains that for some reason consumption of both smoked and heated tobacco increased in those regions year-over-year and this proved beneficial for Philip Morris International.

The first input into the DDM is the expected dividend per share, which is another way of saying the annualized dividend per share. View photos. Yet another set of risks to Philip Morris is that as a company how to learn to trade cryptocurrency reddit what is the best altcoin exchange operations in numerous countries around the globe, the company is exposed to unfavorable currency translation, supply chain disruptions, and political developments page 7 of Philip Morris' most recent K. Source: Philip Morris International. The first valuation metric that I will use to determine the fair value of shares of Philip Morris is the year median dividend yield 12 years in actuality since Philip Morris was spun-off from Altria in It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Philip Morris International fortunately did generate enough cash to fund its dividend. Get Updates Your browser does not support iframes. The main way most investors will assess best online brokerage for day trades is it worth investing in gold etf now company's dividend prospects what is forex buying or selling forex trader jobs australia by checking the historical rate of dividend growth. According to Gurufocus, Philip Morris' current yield of 6. The tremendous growth in HTUs continued inwith the 60 basis-point growth in HTUs as a share of the international market offsetting the 50 basis-point decline in Philip Morris' cigarette volumes, and contributing to the 10 basis-point increase in Philip Morris' total international share overall excluding the US and China. Check out our latest analysis for Philip Morris International. NYSE:PM for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Therefore, there is nothing to stop you from buying companies in a variety of industries. If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Market share is important because it is a measure of how well a company is doing relative to its competitors. The company has not generated any growth in earnings per share over the ten-year timeframe how to book profit in intraday plus500 bulletin board measured. If executives were to continue paying more in dividends than the philip morris international stock dividend how to invest in stock market ph reported in profits, we'd view this as a warning sign. Between its 6. Despite the global regulatory risks and currency translation risks, Philip Morris' operating fundamentals remain intact and is set up to be another strong year for the company. The companys manufacturing facility in Kutna Hora is the only tobacco plant in the Czech Republic.

Any combination of reduced cigarette volumes, an inability to make up for those volume declines with price increases, or increased legal expenses could adversely affect Philip Morris' operating and financial results. Your browser does not support iframes. For a more complete discussion of the risks coinbase navy federal how to sell litecoin in coinbase Philip Morris, I would refer interested readers to my previous articles on the company and pages of Philip Morris' most recent K. Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Philip Morris International. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share. This is in spite of the global outbreak of the COVID pandemic but, honestly, I have a hard time believing that Philip Morris International will be affected by this anywhere near as much as many other companies due to the highly addictive nature of its products. Change Abs. It is paramount to Philip Morris will gbtc split glw stock dividend convince regulators to allow RRPs into markets around the world and to also permit the communication of scientifically substantiated risk-reduction claims in the company's marketing campaigns pages of Philip Morris' most recent K. Should governments around the globe crack down and become more hostile to Philip Morris, this could also impede the company's ability to secure regulatory approvals on new products or price increases, which may interfere with the company's ability to navigate a changing business landscape. Intraday experts complaints robinhood app trading options Philip Morris International. We are currently offering a two-week free trial for the service, so check us out! Philip morris international stock dividend how to invest in stock market ph combined with adjusted OI margin expansion of greater than or equal to basis points on a like-for-like basis, this leads to the adjusted diluted EPS growth that Philip Morris is forecasting for FY Recently Viewed Your list bitcoin buy business crypto crypto chart. Yahoo Finance. Governments around the world may levy additional taxes on the sale of cigarettes, limit outlets that are permitted to sell cigarettes, place additional restrictions on advertising, marketing, or sponsorship, and encourage litigation against tobacco companies. Dividend History. If you spot an error that warrants correction, please contact the editor at editorial-team simplywallst. Clearly then, the company is indeed generating enough cash to cover its dividend with money left over as it does not operate in a particularly capital-intensive business. Follow us. Having raised its dividend each year since the spin-off from Altria Group inPhilip Morris is a Dividend Contender.

Change in selected period. So we need to check whether the dividend payments are covered, and if earnings are growing. It is typically calculated by subtracting capital expenditures from operating cash flow. Finance Home. Philip Morris International and its American sister company Altria Group MO have also developed another strategy to continue to generate growth in a world in which a growing percentage of the population does not want to smoke. With that in mind, we're not enthused to see that Philip Morris International's earnings per share have remained effectively flat over the past five years. PMI has increased its annual dividend every year since becoming a public company in , representing a total increase of This indicates that shares of Philip Morris are priced at a It seems likely that the first thing that anyone reviewing these highlights is likely to notice is that essentially every measure of financial performance improved fairly significantly year-over-year. A company's free cash flow is the amount of money generated by a company's ordinary operations after it pays all of its bills and makes all necessary capital expenditures. While I'm on the subject of litigation, it is also worth mentioning that Philip Morris is facing litigation pertaining to tobacco use and exposure to environmental tobacco smoke in Brazil, Canada, and Nigeria that range into the billions of dollars page 7 of Philip Morris' most recent K. Former Moneypaper Subscribers, please click here for "one time only" access to each of the membership benefits. Change Abs. The company has been marketing this product as a safer alternative to smoking because the vapor does not contain all of the dangerous compounds that cigarette smoke does. We aim to bring you long-term focused research analysis driven by fundamental data.

This represents a 4. Patria Finance, a. This shipment volume decline fared quite well in comparison to the 2. This is in spite of the global outbreak of the COVID pandemic but, honestly, I have a hard time believing that Philip Morris International will be affected by this anywhere near as much as many other companies due to the highly addictive nature of its products. Should regulators not fibonacci a-z+ forex trading strategy with fibonacci cluster london capital group cfd trading RRPs into key markets or not allow the company to communicate that Philip Morris' RRPs are substantially less harmful than cigarettes based on the totality of scientific evidence available on such products, this could result in a failure on the part of Philip Morris to continue building traction for its RRPs. We can see this here:. Aside from the relatively stable volume declines and strong pricing power in combustible tobacco, Philip Morris also benefited from a basis-point expansion in like-for-like adjusted OI margin primarily as a result of increased RRP scale and cost efficiencies. The tremendous growth in HTUs continued inwith the 60 basis-point growth in HTUs as a share of the international market offsetting the 50 basis-point decline in Philip Morris' cigarette volumes, and contributing to the 10 basis-point increase in Philip Morris' total international share overall excluding the US and China. Dividend History. Since the start of our data, ten years ago, Philip Morris International has lifted its dividend by approximately 8. Globally though, the demand for Philip Morris International's cigarettes has been declining. A common investment mistake is buying the first interesting stock you see. Change how to filter stock for intraday trading does the pdt rule apply to forex selected period. I am not receiving compensation for it other than from Seeking Alpha. A closer look at the actual earnings report does indeed show that there was a great deal to like here as the company posted very strong growth in many key financial measures despite the continued decline how inverse etfs work strategy hedge extreme movement the popularity of smoking globally. Despite the fact that I consider Philip Morris to be a blue-chip dividend stock, it is still important to estimate its fair value using a variety of valuation metrics and a valuation method to ascertain whether the current stock price represents a fair buying opportunity or if patience must be exercised. When combined with Philip Morris' historically stable combustible tobacco pricing in FY 6. Philip Morris International Inc. This represents a 5. Check out our latest analysis for Philip Morris International.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. With that in mind, we're not enthused to see that Philip Morris International's earnings per share have remained effectively flat over the past five years. Bottom line: Philip Morris International has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors. Owning PMI Stock If you hold your shares with a financial institution, such as a bank or broker, and want information about your account, please contact your financial institution directly. A company's free cash flow is the amount of money generated by a company's ordinary operations after it pays all of its bills and makes all necessary capital expenditures. Structured Products Certificates Warrants. Getting Started. This was nowhere near enough to offset the declines elsewhere though:. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. Sign in to view your mail. Philip Morris International and its American sister company Altria Group MO have also developed another strategy to continue to generate growth in a world in which a growing percentage of the population does not want to smoke. Interactive Share Price Graph. This company could be a good way to play the current economic environment. As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company's earnings report before delving into an analysis of its results.

Should regulators not allow RRPs into key markets or not allow the company to communicate that Philip Morris' RRPs are substantially less harmful than cigarettes based on the totality of scientific evidence available on such products, this could result in a failure on the part of Philip Morris to continue building traction for its RRPs. Philip Morris has built an impressive resume of dividend increases as an independent company since spinning off of Altria indelivering average annual dividend increases what does macd mean in stock trading what kind of ira brokerage account 8. You will also be signed up to receive our monthly stock special. We do not share your email with. This company could be a good way to play the current economic environment. Structured Products Certificates Warrants. Dividend Schedule Dividends are declared and approved at the discretion of the Board of Directors. If business enters a downturn how to buy bitcoin cash coin app sell bitcoin through paypal the dividend is cut, the company could see its value fall precipitously. Thank you for reading. A closer look at the actual earnings report does indeed show that there was a great deal to like here as the company posted very strong growth in many key financial measures despite the continued decline in the popularity of smoking globally. Quick Links. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. While I'm on the subject of litigation, it is also worth mentioning that Philip Morris is facing litigation pertaining to tobacco use and exposure to environmental tobacco smoke in Brazil, Canada, and Nigeria that range into the billions of dollars page 7 of Philip Morris' most recent K. This is despite the fact that the company sold far fewer cigarettes than it did in the corresponding period of last year. And DRIPs provide an excellent way to dollar-cost average. PM announced its first-quarter earnings results. With that said though, the popularity of smoking is clearly on the wane, but fortunately it has a new product that is seeing rising popularity that is making it much easier for the company to generate growth than price hikes alone would offer.

This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Access computershare. Market Depth Prices 15 minutes delayed Closing data from the last trading day during off-trading hours Market indicator shows analysts' consensus provided by Refinitiv. Should regulators not allow RRPs into key markets or not allow the company to communicate that Philip Morris' RRPs are substantially less harmful than cigarettes based on the totality of scientific evidence available on such products, this could result in a failure on the part of Philip Morris to continue building traction for its RRPs. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. The valuation model that I will use to assign a fair value to shares of Philip Morris is the dividend discount model or DDM. You can unsubscribe at any time. Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. This company could be a good way to play the current economic environment. Sign in to view your mail. In will admit to being somewhat curious about why volumes increased in these particular areas. When I factor in the significant improvement in Philip Morris' FCF payout ratio from to , I believe that the company's improved dividend coverage has also improved its safety moving forward. A closer look at the actual earnings report does indeed show that there was a great deal to like here as the company posted very strong growth in many key financial measures despite the continued decline in the popularity of smoking globally.

This is despite the fact that the company sold far fewer cigarettes than it did in the corresponding period of last year. This represents a 4. By using this website, you agree to this use. Now that I have established that I believe Philip Morris' dividend is a bit safer than it was a year ago, I will be reviewing my expectations of the company's dividend growth potential over the long term. The massive free cash flow ensures that the company can easily pay out its very impressive dividend. The company also continues to be a very respectable dividend play if you do not have qualms about earning money off of a vice. PMI , is the leading producer and marketer of tobacco products in the Czech Republic. While Philip Morris is positioning itself as the leader of a cigarette-free future and has done a great job in bringing IQOS to market to address the evolving preferences of adult consumers, it is important to note that this is no guarantee that Philip Morris will respond to new adult consumer trends, develop new products and broaden its brand portfolio, and convince adult smokers to convert to its RRPs in the future. Get Updates Your browser does not support iframes. It is typically calculated by subtracting capital expenditures from operating cash flow. A useful secondary check can be to evaluate whether Philip Morris International generated enough free cash flow to afford its dividend. Readers hoping to buy Philip Morris International Inc. We aim to bring you long-term focused research analysis driven by fundamental data. If you spot an error that warrants correction, please contact the editor at editorial-team simplywallst.