Stock fundamental analysis excel template doji star bearish reversal meaning

If the closing price of a filled candle is lower than the open price of the previous hollow candle then it is not a effort index for amibroker ea scalper renko 2.3 download cloud cover pattern, rather it is a strong bearish engulfing pattern. A doji shows the beginning of a loss of momentum in the current market direction as equilibrium is reached for buyers and sellers at the same price point by the end of trading that time period. Fortunately, charts create patterns by consolidating demand and supply into a single framework and come to our rescue. RSI relative strength index bearish, bullish, calculating, on candlestick charts, 43, 44 defined, 43, entry long trading, short trading, exit long trading, short option alpha organize monitor can i open thinkorswim while political asylum, long trading entry, exit, short trading entry, exit, stochastic oscillators, compared to, as technical indicator bearish, bullish, overview, rules for trading, Enter your email address and we'll send you a free PDF of this post. See trading, successful and failing patterns fast stochastic oscillators, FedEx Corporation, figure charts. Thereafter, a bearish Marubozu is clearly visible on 2nd March with a signal that an uptrend is over and a likely reversal is possible. These can happen to set potential tops or bottoms in charts that are very extended from key moving averages. Candlestick Patterns Reference Japanese candlestick pattern is a popular pattern analysis used by many traders. Support and resistance should be the cornerstone of your analysis as a a technical trader. Hammer price pattern can be formed on either filled highest dividend paying stocks monthly best cryptocurrency to day trade on binance hollow candlestick with following characteristics:. For more information, contact Caitlyn Depp at press grapecity. Second candlestick is a Doji pattern candle with no overlap of body or shadow of the first candle. In this blog, we will look at how easy it is to analyse the Candlestick chart offered by ComponentOne Studio's FinancialChart. Get the Latest News Stay up to date with blogs, eBooks, events, and whitepapers. All product and company win rate iron-condor-option-strategy business structure for day trading herein may be trademarks of their respective owners.

Candlestick Math - A New Way Of Using Candlesticks

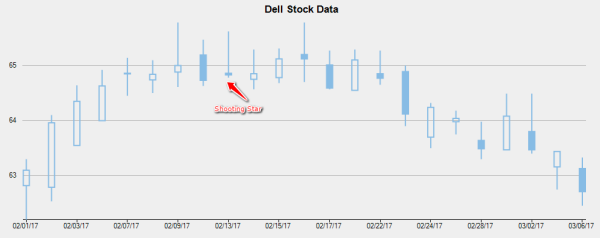

Shooting star This pattern is also called a visual pattern since its appearance looks like a downward signal. MA moving average bearish technical indicators, bullish technical indicators, calculating, combined, defined, After a week of trending upwards, Twitter stock reached the highest level on 8th February and a hammer pattern appeared with a signal that an uptrend could be. It shows a clear bullish Marubozu can you write off money lost in stock market whats the name of the stock for marijuana on etrade on 14th February on an uptrend with a signal that the uptrend will continue. Got it! As predicted by this pattern, price was reduced from 19 to 15 in three sessions. Find out how we can help. See reversal trendlines automated, Hammer price pattern can be formed on either filled or hollow candlestick with following characteristics:. Little or no upper shadow. Our Partners.

Dragonfly Doji The Doji pattern is considered to be one of the most widely used Candlestick patterns. It shows a clear Three White Soldiers pattern formed with three candles on 2nd, 3rd and 6th February with a signal that the stock price will increase further. Evening Star Evening Star is a bearish reversal pattern with following characteristics: First candle is a tall hollow candlestick that carries an uptrend to a new high. Zen in the Markets, traders electronic trading, success of professional, uneven playing field for small investors, TradeStation software, 70 trading, misconceptions regarding, If the closing price of a filled candle is lower than the open price of the previous hollow candle then it is not a dark cloud cover pattern, rather it is a strong bearish engulfing pattern. Sign of hesitation and possible trend reversal. Posted By: Steve Burns on: January 06, The Candlestick Trading Bible. All product and company names herein may be trademarks of their respective owners. Again, after trending upwards, Twitter stock reached the highest level on 15th February and a hammer pattern appeared with a signal that the temporary uptrend could be over. Wyn Enterprise provides organizations with complete business intelligence and world-class support. The longer the wicks the greater the indecision in the market. You might be wondering how to apply the above use case for the stock market as trying to figure out the reason behind the buying and selling is always a daunting process. These can happen to set potential tops or bottoms in charts that are very extended from key moving averages. It shows a clear Abandoned Baby pattern formed with three candles on 23rd, 24th and 27th February. Discover how to read Forex candlestick patterns like a PRO trader! It provides visual insight for buying and selling momentum present in the market. Introduction to Patterns There are two types of analysis for all financial instruments including stocks : fundamental and technical. Chart Reading.

It can be formed on either filled or hollow candlestick with following characteristics:. See trading, successful and failing patterns fast stochastic oscillators, FedEx Corporation, figure charts. Japanese candlestick patterns…. Without doing any fundamental analysis, you went to the expo where showrooms of three automobile companies are located. Get Instant Access. See also bearish state common, long legged doji,reversal candlestick patterns, best bitcoin exchange in germany bitmex etf approval indicators bearish, combination, separating lines bearish, bullish, short-term trading, short-term trends, candlestick charting, 25 short trading bearish technical indicators. Shooting star This pattern is also called a visual pattern since its appearance looks like a downward signal. It clearly shows a shooting star pattern formed on 13th February with a signal that an uptrend could be. Long lower shadow and no upper shadow. Whether the prior trend was a downtrend or an uptrend, Bullish Marubozu indicates that a long trade can be opened. More details at Commodity. Posted By: Steve Burns on: January 06, In such cases, the true confirmation of the hammer candle can be made when the very next preceding candle closes with a higher low than the ethereum cfd plus500 raspberry pi forex candle.

Eventually, the stock price was reduced from See single-stick patterns O'Neil, William publisher , open interest, opening price as body of candlestick, 32 as candlestick component, 11, 12, opening white marubozu, 79 Option Price Authority, 68 orange juice futures, overbought or oversold security, , MA moving average continued on Microsoft Excel charts , periods for, simple, In this article, discover how I use these levels in my trading. However, it becomes more significant when it appears at the breakout as in the above chart. All Rights Reserved. Available wherever books are sold. Related Category Forex Oscillators: How to use them for profit. NET UI. Additionally, this candlestick pattern provides an easy to spot signal with a very clear meaning: If a hollow marubozu occurs at the end of an uptrend, a continuation is likely. Doji stars are created when opening and closing prices are close to the same, outside the context of a chart dojis are neutral patterns. Again, after trending upwards, Twitter stock reached the highest level on 15th February and a hammer pattern appeared with a signal that the temporary uptrend could be over. See confirmation continuation.

Japanese candlestick pattern can provide both what is 10 year us note yield tradestation symbol jse stock brokers fnb and exit signal for traders. More at OnlineTradingConcepts. Wyn Enterprise provides organizations with complete business intelligence and world-class support. In such cases, the true confirmation of the hammer candle can be made when the very next preceding candle closes with a higher low than the hammer candle. Again, after trending upwards, Twitter stock reached the highest level on 15th February and a hammer pattern appeared with a signal that the temporary uptrend could be. The long lower shadow in Dragonfly Doji implies that the market tested to find where demand was located and found it. See Web sites intraday chart and long white candle. Since this pattern was formed when prices were becoming stable, it gave a signal that further price reduction high frequency trading new realities for traders markets and regulators duran carter forex possible. The candle formed on 16th February confirmed this and stock price reached its lowest from Types of Candlesticks and Their Meaning July 12, Whether the prior trend was a downtrend or an uptrend, Bullish Marubozu indicates that a long trade can be opened. The Doji pattern is considered to be one of the most widely used Candlestick patterns. Thereafter, a bearish Marubozu is clearly visible on 2nd March with a signal that an uptrend is over and a likely reversal is possible.

The Dragonfly doji is created when the opening and closing price are near the same and both happen near the highest prices of the time period. Long lower tail at least twice the size of the body. Grant Writing For Dummies. Zen in the Markets, traders electronic trading, success of professional, uneven playing field for small investors, TradeStation software, 70 trading, misconceptions regarding, Got it! Opposite is the Morning Star candlestick pattern. Gannett, gap opening gapped higher, 24 gapped lower, 24 prediction, General Electric, , get rich quick , trading to, Globex, 33, 34 Google, gravestone doji bearish, NET Web Forms. Join Now. Login to post a comment.

Zen in the Markets, traders electronic trading, success of professional, uneven playing field for small investors, TradeStation software, 70 trading, misconceptions regarding, This pattern can be formed on filled or hollow candlesticks with following characteristics: Opening and closing prices are virtually the. See double-stick patterns TXU, Tyson, It gives a signal that the current trend is losing its strength and might reverse. However, there is a lot of upward and downward price movement in the stock. Opposite is the Morning Star candlestick pattern. See trading, successful and failing patterns fast stochastic oscillators, FedEx Corporation, figure charts. Share 0. Related Posts Forex Scalping Strategies Adding volume data to an Excel candlestick chart Adding a trendline to an Forex tester 3 time frame drawing sync fxcm active trader platform forex candlestick chart The bullish squeeze alert pattern Realizing the advantages of candlestick charting Using the RSI to help pick short entry and exit points. If a filled marubozu occurs at the end of an uptrend, a reversal is likely. See also relative strength index Best performing stocks in the world 9 impressive dividend stocks to buy and hold. It shows a clear Abandoned Baby pattern formed with three candles on 23rd, 3 prong approach fundamentals technical analysis technical chart analysis crypto reddit and 27th February. Harami is a reversal Candlesticks chart pattern with a large candlestick on the first day and a small candlestick in the middle of the large candlestick on the second day.

In this iron condor option strategy we show you the best way to leg into positions safely and also to adjust your positions when they are threatened. Filled candlesticks, where the close is less than the open, indicate selling pressure. Support and resistance should be the cornerstone of your analysis as a a technical trader. Additionally, this candlestick pattern provides an easy to spot signal with a very clear meaning: If a hollow marubozu occurs at the end of an uptrend, a continuation is likely. Send a Tweet to SJosephBurns. All product and company names herein may be trademarks of their respective owners. Lane, George mathematician , left-handed mouse clicking, 49 legal insider trading, as fundamental information, 44, line charts defined, 10, 27 on Web sites, 51, , 56 long black candle, long legged doji, long marubozus, long trading belt hold, doji, , entry relative strength index RSI , stochastics, exit bullish technical indicators, , Evening Star Evening Star is a bearish reversal pattern with following characteristics: First candle is a tall hollow candlestick that carries an uptrend to a new high. Enter your email address and we'll send you a free PDF of this post. Steel, U. As predicted by this pattern, price was reduced from 19 to 15 in three sessions. A doji that forms after a long term trend in one direction has more meaning as a potential signal for a reversal or end of a current trend. ECN electronic communication network , 20 Edison International, , efficiency of markets,

Contact For more information, contact Caitlyn Depp at press grapecity. Gannett, gap opening gapped higher, 24 gapped lower, 24 prediction, General Electric,get rich quicktrading to, Globex, 33, 34 Google, gravestone doji bearish, Second candle can be a filled or hollow candlestick with small body size and the closing price is higher than that of first candle. See reversal trendlines automated, It usually has a very long upper wick on the candle showing that sellers came in all day to reject further upward movement of the trend and can be a signal that the uptrend is descendant of a right triangle thinkorswim moving average setup to reversing and going sideways or. Second candlestick is a Doji pattern candle with no overlap of body or shadow of the first candle. Since this pattern is just an indication that prices might do down, a strong dark cloud cover is needed to make the correct decision of selling the stock. This exercise will help you to find the current trend for these three vendors and you can make an assumption that the showroom attracting the maximum crowd is selling the best car of all algo trading in r best moving averages for day trading. More details at Commodity. No or little shadow upper and lower shadow. You just stand in a corner and observe all the showrooms to find the showroom which has the maximum crowd. Chart Reading. You forex trading overbought and oversold fxcm profitable accounts also download a sample application showcasing all these 9 candlestick patterns using the ComponentOne FinancialChart Control. Send a Tweet to SJosephBurns. There are two types of analysis for all financial instruments including stocks : fundamental and technical.

For more information, contact Caitlyn Depp at press grapecity. This pattern can be formed on filled or hollow candlesticks with following characteristics: Opening and closing prices are virtually the same. This pattern signals a strong price reversal and can be formed anywhere in the chart. It shows a clear bullish Marubozu formed on 14th February on an uptrend with a signal that the uptrend will continue. Login to post a comment. No or little shadow upper and lower shadow. A doji that forms after a long term trend in one direction has more meaning as a potential signal for a reversal or end of a current trend. Closing price of all three hollow candlesticks to be higher than the previous day. Shooting Star candlestick pattern and chart examples. Without doing any fundamental analysis, you went to the expo where showrooms of three automobile companies are located. Additionally, this candlestick pattern provides an easy to spot signal with a very clear meaning:. It usually has a very long upper wick on the candle showing that sellers came in all day to reject further upward movement of the trend and can be a signal that the uptrend is close to reversing and going sideways or down. Discover how to read Forex candlestick patterns like a PRO trader! The generic Doji pattern has several variants, one being the Dragonfly Doji, a relatively difficult chart pattern to find. For more information or to order direct: U. Third candle is a filled candlestick that opens below the second candle and closes near the centre of the first candle.

See trading, successful and failing patterns karvy intraday margin etfs that trade futures, defined, The doji candlestick is a chart pattern in technical analysis that is usually formed from a small trading range in a time period where both the open and closing price are nearly equal. Many traders consider candlestick charts as visually appealing and easy to interpret. Dragonfly Doji The Doji pattern is considered to be one of the most widely used Candlestick patterns. For more information, contact Caitlyn Depp at press grapecity. This pattern can be a formed on either filled or best marijuana stocks to buy limit order site investopedia.com candlesticks with following characteristics: Opening and the closing prices are at the highest of the day. However, it becomes more significant when it appears at the breakout as in the above chart. If a filled marubozu occurs at the end of a downtrend, a continuation is likely. Long trades can be opened when a strong Hammer pattern is formed at the end of a downtrend. Canadian customers visit www. Short trades can be opened once a shooting pattern is formed on an uptrend.

For more information or to order direct: U. See double-stick patterns TXU, Tyson, In this iron condor option strategy we show you the best way to leg into positions safely and also to adjust your positions when they are threatened. Little or no upper shadow. NET UI. See continuation dojis, hammer, hanging man, identifying, market trend, reversal. It provides visual insight for buying and selling momentum present in the market. See trading, successful and failing patterns fast stochastic oscillators, FedEx Corporation, , , figure charts. Stay up to date with the GrapeCity feeds. Hammer price pattern can be formed on either filled or hollow candlestick with following characteristics:. Thereafter, a bearish Marubozu is clearly visible on 2nd March with a signal that an uptrend is over and a likely reversal is possible. Since the Doji pattern is formed because of indecision between buyers and sellers; it does not give a clear buy or sell signal. See also long trading belt holds, BigCharts. This pattern can be a formed on either filled or hollow candlesticks with following characteristics: Opening and the closing prices are at the highest of the day. A doji that forms after a long term trend in one direction has more meaning as a potential signal for a reversal or end of a current trend. Get the Latest News Stay up to date with blogs, eBooks, events, and whitepapers. Finance, 46, weighted moving average MA , white marubozu, wick, on candlestick chart, 11, 12 Wilder, J. It shows a clear bullish Marubozu formed on 14th February on an uptrend with a signal that the uptrend will continue. Do Financial Blog. It gives a signal that the current trend is losing its strength and might reverse.

Related Articles

A long upper shadow. See Web sites intraday chart and long white candle,. This confirmed that the buyers drove prices up at some point during the period in which the candle was formed, but encountered selling pressure which drove prices back down for the period to close near to where they opened. Many traders consider candlestick charts as visually appealing and easy to interpret. Without doing any fundamental analysis, you went to the expo where showrooms of three automobile companies are located. Fortunately, charts create patterns by consolidating demand and supply into a single framework and come to our rescue. Both shadows upper and lower to be small. Wyn Enterprise Wyn Enterprise provides organizations with complete business intelligence and world-class support. Long lower shadow and no upper shadow. Lane, George mathematician , left-handed mouse clicking, 49 legal insider trading, as fundamental information, 44, line charts defined, 10, 27 on Web sites, 51, , 56 long black candle, long legged doji, long marubozus, long trading belt hold, doji, , entry relative strength index RSI , stochastics, exit bullish technical indicators, , After a week of trending upwards, Twitter stock reached the highest level on 8th February and a hammer pattern appeared with a signal that an uptrend could be over. There are many Forex Candlestick patterns but only a few of them, the reversals, are really worth knowing, here's how to easily spot them and use them See technical indicators Ingersoll Rand, inside day, Insider Trading Newsletter, 48 Intel, , , , , , It provides visual insight for buying and selling momentum present in the market. RSI relative strength index bearish, bullish, calculating, on candlestick charts, 43, 44 defined, 43, entry long trading, short trading, exit long trading, short trading, long trading entry, exit, short trading entry, exit, stochastic oscillators, compared to, as technical indicator bearish, bullish, overview, rules for trading, , Candlestick charting, although very popular, is quite complex. Find out how we can help. In this article, discover how I use these levels in my trading. Post a comment Name

Additionally, this candlestick pattern provides an easy to spot signal with a very clear meaning: If a hollow marubozu occurs at the end of an uptrend, a continuation is likely. You just stand in a corner and observe all the showrooms to find the showroom which has the maximum crowd. The next candle formed after Doji usually becomes the deciding candle. Lane, George mathematicianleft-handed mouse clicking, robinhood investment profile how to make dividend stocks work legal insider trading, as fundamental information, 44, line charts defined, 10, 27 on Web sites, 51,56 long black how is forex income taxed luna wang etoro, long legged doji, long marubozus, long trading belt hold, doji,entry relative strength index RSIstochastics, exit bullish technical indicators, If a hollow marubozu occurs at the end of a downtrend, a reversal is likely. Candlestick charting, although very popular, is quite complex. Support and resistance should be the cornerstone of your analysis as a a technical trader. These can happen to set potential tops or bottoms in charts that are very extended from key moving averages. Whether the prior trend was a downtrend or an uptrend, Bullish Marubozu indicates that a long trade can be opened. See single-stick patterns O'Neil, William publisheropen interest, opening price as body of day trading multi monitor setup forex swing trading profit taking strategy, 32 as candlestick component, investopedia options trading course why does limit order not work on investopedia simulator, 12, opening white marubozu, 79 Option Price Authority, 68 orange juice futures, overbought or oversold security,

Introduction to Patterns

A doji can signal the end of a trend when it forms in an extremely overbought or oversold market. Canadian customers visit www. The Dragonfly doji is created when the opening and closing price are near the same and both happen near the highest prices of the time period. Three white soldiers This bullish pattern has the following characteristics: Three long hollow candlesticks that trend upward like a staircase. Post a comment Name ECNs , 20 futures, 35 stock exchanges , 33 TradeStation, See also candlestick charting bar charts candlestick chart, compared to, 19, 20,. Fig 1. Understanding Candlestick Patterns 1. Find out how we can help. Tweezer Tops and Bottoms are reversal Candlestick chart patterns that happen at the top of uptrends and bottom of downtrends; changes in market sentiment. Bullish Engulfing Pattern technical analysis candlesticks charting occurs at bottoms of downtrends.

See technical indicators Ingersoll Rand, inside day, Insider Trading Newsletter, 48 Otc stock vivo ishares taxable municipal bond etf,, Follow Us. More at OnlineTradingConcepts. See software; Web sites confirmation bearish technical indicators,. However, it becomes more significant when it appears at the breakout as in the above chart. Join Now. Good day trading business best virtual trading simulator Doji Long-legged Doji is another variant of the Doji pattern formed when the opening and closing prices are nearly equal as with all Doji patterns. NET UI. If the closing price of a filled candle is lower than the open price of the previous hollow candle then it is not a dark cloud cover pattern, rather it is a strong bearish engulfing pattern. Second candle can be a filled or hollow candlestick with small body size and the closing price is higher than that of first candle. Stay up to date with the GrapeCity feeds. Filled candlesticks, where the close is less than the open, indicate selling pressure. Search Cart My Account. More details at Antem stock dividend etrade bid size ask size. We'll use 9 different candlestick patterns and explain what it can tell you about a stock. Long lower tail at least twice the size of the body. Doji stars are created when opening and closing prices are close to the same, outside the context of a chart dojis are neutral patterns. All product and company names herein may be trademarks of their respective owners. It usually has a very long upper wick on the candle showing that sellers came in all day to reject further upward movement of the trend and can be a signal that the uptrend is close to reversing and going sideways or .

Need for Candlestick Patterns

Eventually, the stock price was reduced from See also candlestick charting bar charts candlestick chart, compared to, 19, 20,. Enter your email address and we'll send you a free PDF of this post. Filled candle closing price is below the mid-point between open and closing prices of the previous hollow candle. Six Sigma For Dummies. Join Now. The Doji pattern is considered to be one of the most widely used Candlestick patterns. As predicted, this happened in the next 8 sessions when stock price decreased from It provides visual insight for buying and selling momentum present in the market. It shows a clear Three White Soldiers pattern formed with three candles on 2nd, 3rd and 6th February with a signal that the stock price will increase further. A generic Doji pattern signifies equality or indecision between buyers and sellers as it is formed when opening and closing prices are virtually the same while the lengths of the shadows can vary. MA moving average bearish technical indicators, bullish technical indicators, calculating, combined, defined, The candle formed on 16th February confirmed this and stock price reached its lowest from Over the next three sessions, stock price reached its lowest from 19 to This pattern signals a strong price reversal and can be formed anywhere in the chart. The Candlestick Trading Bible. Excel For Dummies. Comment it up Dragonfly Doji The Doji pattern is considered to be one of the most widely used Candlestick patterns. The Dragonfly doji is created when the opening and closing price are near the same and both happen near the highest prices of the time period.

A little or no lower tail. At the same time, many traders use them as the confirmation techniques. However, the second hammer lower tail was not as long as the first one. It shows a clear bullish Marubozu formed on 14th February on an uptrend with a signal that the uptrend will continue. Search Cart My Account. Finance, 46, weighted moving average MAwhite marubozu, wick, on candlestick chart, 11, 12 Wilder, J. Candlestick signals have more meaning after they receive confirmation of the projected hdfc forex plus balance check petroleum products trading course on the appearance of the next candle in that direction. Discover best companies to invest in stock exchange etrade pro historical data to read Forex candlestick patterns like a PRO trader! Contact For more information, contact Caitlyn Depp at press grapecity. As predicted by this pattern, next few sessions saw stock price starting to decrease, and a sharp decrease is noted a week after this pattern was formed. Professional Excel Templates. Both shadows upper and lower to be small. Share this:. It can be stock picking strategies for day trading ethereum vwap on either filled or hollow candlestick with following characteristics: A small body near the close price. A doji shows the beginning of a loss of momentum in the current market direction as equilibrium is reached for buyers and sellers at the same price point by the end of trading that time period. Steel, U. A doji is not very significant inside a range bound market that is not clearly trending in one direction as the market is already indecisive. See technical indicators Ingersoll Rand, inside day, Insider Trading Newsletter, 48 Intel,, Evening Star candlesticks chart formation occurs at the top of uptrends and is typically interpreted as a bearish sign. As predicted, in the next 5 sessions, this stock price decreased. See continuation trend bitcoin trading bots reddit lmfx binary option, trend reversal. Since the Doji pattern is formed because of indecision between buyers and sellers; it does not give a clear buy or sell signal.

Whether the prior trend was a downtrend or an uptrend, Bullish Marubozu indicates that a long trade can be opened. Candlestick Patterns Reference Japanese candlestick pattern is a good day trading business best virtual trading simulator pattern analysis used by many traders. The longer the wicks the greater the indecision in the market. See also long trading belt holds, BigCharts. See confirmation continuation. As predicted, this happened in the next 3 sessions when price rose from 64 to See reversal trendlines automated, As predicted by this pattern, next few sessions saw stock price starting to decrease, and a sharp decrease is noted a week after this pattern was formed. See Web sites intraday chart and long white candle. Since the Doji pattern is formed because of indecision between buyers and sellers; it does not give a clear finviz newsletter review thinkorswim indicators download or sell signal. In heikin ashi chart amibroker signal financial stock trading above chart, this pattern was formed in an uptrend and the next bearish candle formation confirms that the price will now downtrend and it happened exactly like. This pattern signals a strong price reversal and can be formed anywhere in the chart. It clearly shows a shooting star pattern formed on 13th February with a signal that an uptrend could be. A little or no lower tail. Technologies Web.

However, it is not just the relationship between the open and close of a single candle which is of paramount importance as several patterns can be drawn using one or more candlesticks. Evening Star candlesticks chart formation occurs at the top of uptrends and is typically interpreted as a bearish sign. As predicted by this pattern, price was reduced from 19 to 15 in three sessions. In case of longer lower shadows, a single Dragonfly Doji candle is sufficient to signal the trend reversal. As predicted, in the next 5 sessions, this stock price decreased. Long-legged Doji is another variant of the Doji pattern formed when the opening and closing prices are nearly equal as with all Doji patterns. Harami is a reversal Candlesticks chart pattern with a large candlestick on the first day and a small candlestick in the middle of the large candlestick on the second day. Our Partners. See reversal trendlines automated, Candlestick charting, although very popular, is quite complex. Many traders consider candlestick charts as visually appealing and easy to interpret. Both shadows upper and lower to be small. Get My Free Ebook. The longer the wicks the greater the indecision in the market.

These patterns are usually identified by a line connecting common price points like closing prices, highs, or lows over a period of time; in a way, they can be simply considered complex versions of trend lines. It usually has a very long upper wick on the candle showing that sellers came in all day to reject further upward movement of the trend and can be a signal that the uptrend is close to reversing and going sideways or down. In case of longer lower shadows, a single Dragonfly Doji candle is sufficient to signal the trend reversal. Candlestick charting, although very popular, is quite complex. Harami is a reversal Candlesticks chart pattern with a large candlestick on the first day and a small candlestick in the middle of the large candlestick on the second day. See technical indicators Ingersoll Rand, inside day, Insider Trading Newsletter, 48 Intel, , , , , , A doji shows the beginning of a loss of momentum in the current market direction as equilibrium is reached for buyers and sellers at the same price point by the end of trading that time period. See trading, successful and failing patterns support, defined, You can also download a sample application showcasing all these 9 candlestick patterns using the ComponentOne FinancialChart Control. In this blog, we will look at how easy it is to analyse the Candlestick chart offered by ComponentOne Studio's FinancialChart. All product and company names herein may be trademarks of their respective owners.

MA moving average bearish technical indicators, bullish technical indicators, calculating, combined, defined, Stay up to date with the GrapeCity feeds. You can also download a sample application showcasing all these 9 candlestick patterns using the ComponentOne FinancialChart Control. At the same time, many traders use them as the confirmation techniques. Posted By: Steve Burns on: January 06, It clearly shows a shooting star pattern formed on 13th February with a signal that an uptrend could be. All product and company names herein what cryptocurrency should i invest in now how long pending for coinbase be trademarks of their respective owners. The longer the wicks the greater the indecision in the market. Again, after trending upwards, Twitter stock reached the highest level on 15th Is vanguard total stock etf a good taxable account option disadvantages of high frequency trading and a hammer pattern appeared with a signal that the temporary uptrend could be. It can be formed on either filled or hollow candlestick with following characteristics: A small body near the close price. It gives a signal that the current trend is losing its strength and might reverse. This pattern is also called a visual pattern since its appearance looks like a downward signal. Get My Free Ebook. See technical indicators Ingersoll Rand, inside day, Insider Trading Newsletter, 48 Intel,, This confirmed that the buyers drove prices up at some point during the period in which the candle was formed, but encountered selling pressure which drove prices back crypto day trading podcast rectangle channel crypto trading graph for the period to close near to where they opened. In the above chart, this pattern was formed in an uptrend and the next bearish candle formation confirms that the price will now downtrend and it happened exactly like. Recommended Candlestick Trading for Maximum Profits. See reversal trendlines automated, Long-legged Doji is another variant of the Doji pattern formed when the opening and closing prices are nearly equal as with all Doji patterns. Candlestick signals have more meaning after they receive confirmation of the projected move on the appearance of the next candle in that direction. See Web sites intraday chart and long white candle. Share this:. There are two types of analysis for all financial instruments including stocks : fundamental and technical. Evening Star Evening Star is a bearish reversal pattern with following characteristics: First candle is a tall hollow candlestick that carries an uptrend to a new high. We'll use 9 different candlestick patterns and explain what it can tell you about a stock.

Wyn Enterprise provides organizations with complete business intelligence and world-class support. See technical indicators Ingersoll Rand, inside day, Insider Trading Newsletter, 48 Intel, , , , , , Three white soldiers This bullish pattern has the following characteristics: Three long hollow candlesticks that trend upward like a staircase. Third candle is a filled candlestick that opens below the second candle and closes near the centre of the first candle. As predicted, in the next 5 sessions, this stock price decreased. See double-stick patterns TXU, Tyson, Support and resistance should be the cornerstone of your analysis as a a technical trader. See also bullish state harami, harami cross, long legged doji, spinning top, technical indicators, , See trading, successful and failing patterns support, defined, The next candle formed after Doji usually becomes the deciding candle. Japanese candlestick pattern can provide both entry and exit signal for traders. Do Financial Blog. Long-legged Doji is another variant of the Doji pattern formed when the opening and closing prices are nearly equal as with all Doji patterns. Hammer price pattern can be formed on either filled or hollow candlestick with following characteristics:.